Largest US-Korea Interest Rate Inversion... Interest Rate Levels Unpredictable

"Temporary Slowdown in Buying Demand, Recovery Expected Around January-February Next Year"

[Asia Economy Reporter Minji Lee] After the September U.S. FOMC (Federal Open Market Committee) caused market interest rates to surge, institutional investors in the corporate bond market appear to be closing their books early without fully exhausting their funds. This is because the financial market has been highly volatile, with the interest rate inversion between Korea and the U.S. widening to an unprecedented level, pushing interest rate levels into an unpredictable situation.

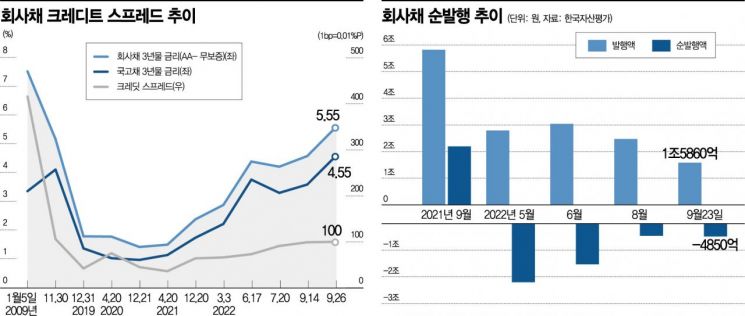

According to the bond industry on the 27th, the credit spread (the difference between the 3-year corporate bond yield with a credit rating of ‘AA-’ and the 3-year government bond yield), which indicates bond issuance sentiment, stood at 100 basis points (1bp = 0.01%) as of the previous day. This is the first time since the 2008 global financial crisis that the credit spread has entered the 100bp range. After the June FOMC, which caused a shock to the global financial market this year, the credit spread was around 80bp, but it has risen by 20bp in just three months. A larger credit spread indicates unstable supply and demand, meaning bond issuance is not proceeding smoothly. The absolute interest rate level also surged significantly; as of the previous day, the 3-year corporate bond with a high credit rating of AA reached 5.5%, similar to levels seen in 2008-2009, while AA- was at 5.55%, and A- at 7.08%.

Market participants had expected interest rate uncertainty to ease after the September FOMC, but reality was different. When the U.S. CPI (Consumer Price Index) rose by 8.3% in August, exceeding market expectations, opinions gained traction that even if a ‘giant step’ (a 75bp rate hike at once) was taken at the September FOMC, concerns over interest rates might not dissipate. Furthermore, Federal Reserve Chair Jerome Powell’s statement that “interest rates will not be cut until inflation is firmly under control” erased any hopes for a soft landing in interest rates. Shin Eol, a researcher at SK Securities, predicted, “The Bank of Korea will align its rate hike pace with major countries eager to quickly curb inflation,” and revised the year-end base rate forecast upward from 3% to around 3.5%. He added, “This is based on Bank of Korea Governor Lee Chang-yong’s remarks about considering policy responses to inflation stabilization and the impact of won depreciation.”

As the difficult market environment prolongs, institutional investors are turning their attention to next year, effectively ending this year’s business early. For example, Hanwha General Insurance, which issued new hybrid capital securities worth 85 billion KRW in mid-September, received only one order of 1 billion KRW from an investment brokerage, with no orders from institutions. Doosan Enerbility (formerly Doosan Heavy Industries & Construction), despite being rated BBB, confirmed a corporate bond issuance of 50 billion KRW after receiving 70 billion KRW in subscriptions plus an additional 10 billion KRW. However, this was driven more by individuals interested in high-yield bonds than by institutions. During the demand forecast, 67% (47 billion KRW) of the total 70 billion KRW orders came through investment brokerage firms (including securities companies). Recently, individuals have been increasing their off-market bond purchases through securities firms.

Bond experts say that for the corporate bond issuance environment to improve, it is necessary to confirm whether the December FOMC will reduce the rate hike magnitude to a ‘big step’ (a 50bp hike at once). Kim Eun-gi, a researcher at Samsung Securities, explained, “For the credit spread to reverse, it is important that uncertainty over monetary policy is resolved.” He added, “For the time being, bond-related fund outflows will continue, leading to redemption responses and a slowdown in buying demand due to book closings. It will likely be around January or February next year before bond-related fund inflows can be expected.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.