Order Reduction → Inventory Increase → Price Decline Vicious Cycle Continues

TrendForce "Q4 NAND Price Drop Estimated at 15-20%"

[Asia Economy Reporter Park Sun-mi] Amid the ongoing downturn cycle in the memory semiconductor market characterized by the vicious cycle of ‘order reduction → inventory increase → price decline,’ SK Hynix is facing concerns over a sharp rise in inventory due to its merger with Solidigm (formerly Intel’s NAND flash business division). To clear the inventory, the company has no choice but to increase shipments by lowering prices, and the NAND price decline is expected to steepen for the time being.

On the 28th, the semiconductor industry noted that while SK Hynix’s merger with Solidigm helped increase its global NAND market share, the rapidly freezing memory semiconductor market is placing a significant burden on performance recovery.

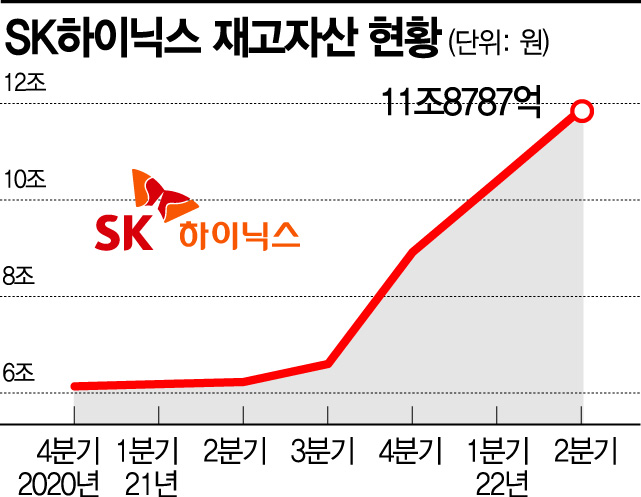

Concerns over the sharp rise in inventory have grown. SK Hynix’s inventory assets at the end of the second quarter stood at 11.9 trillion KRW, and the inventory turnover days (the time it takes for held inventory to be converted into sales) reached 145 days, which is very high. Especially, the surge in inventory assets has become more evident since the Solidigm merger at the end of 2021. Inventory assets, which were around 6 trillion KRW at the end of the third quarter last year, exceeded 8 trillion KRW by the end of last year and even surpassed 10 trillion KRW in the first quarter of this year. By the end of the second quarter this year, the inventory asset scale increased by more than 90% compared to 6.2267 trillion KRW a year ago.

Although the sales growth rate has slowed since the Solidigm merger, the inventory growth rate is increasing, which is a more worrying factor. Lee Seung-woo, a researcher at Eugene Investment & Securities, said, "Inventory surged after the Solidigm merger," adding, "If there is no dramatic improvement in the NAND market, it is expected to pose a significant burden on future performance recovery."

The semiconductor industry expects that it will take more time for the current memory semiconductor market to improve. Accordingly, SK Hynix’s inventory asset scale and inventory turnover days are also expected to increase and rise further in the third and fourth quarters. Due to the nature of the semiconductor industry, where it is not easy to stop production lines once they are running, it is difficult to lower the operating rate that has been raised to 100%.

A realistic way to respond to the accumulating inventory is to lower prices. The semiconductor industry is currently responding by lowering semiconductor prices to clear inventory. The common view in the industry is that the phenomenon of lowering memory semiconductor prices to supply will inevitably continue at least until early next year.

Accordingly, further declines in NAND prices, which have already fallen significantly, are anticipated. Market research firm TrendForce forecasted a 13-18% price drop in the third quarter NAND market and expects the decline to widen to around 15-20% in the fourth quarter. It explained, "NAND buyers are focusing on reducing purchases to cut inventory, while suppliers have started supplying NAND at the lowest prices," adding, "The wafer prices necessary for making NAND have already dropped 30-35% in the third quarter."

Some analysts suggest that semiconductor companies like SK Hynix, which have maintained a 100% operating rate, may eventually have to consider production cuts to reduce inventory. Choi Do-yeon, a semiconductor research fellow at Shinhan Financial Investment, said, "In the case of NAND, not only reducing capital expenditures (CAPEX) but also production cuts (lowering operating rates) need to be considered," adding, "A stronger supply reduction strategy than in the past is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.