Despite Global Shipping Market Slump, Car Carrier Charter Rates '↑'

[Asia Economy Reporter Yoo Hyun-seok] Hyundai Glovis is smiling thanks to the booming shipping business. Unlike the global shipping market downturn, the charter rates for Pure Car and Truck Carriers (PCTC) have more than doubled this year. Additionally, recent large-scale transportation contracts have brightened the outlook.

According to FnGuide and related industries on the 28th, securities firms forecast Hyundai Glovis's Q3 revenue and operating profit at KRW 6.6548 trillion and KRW 424.3 billion, respectively. This represents an increase of 23.14% and 34.70% compared to the same period last year.

One reason for the strong performance is the expected boom in the shipping business. Hyundai Glovis's operations are broadly divided into logistics, shipping, and distribution. The shipping business is mainly split into finished car maritime transport and bulk maritime transport, with the former recently showing strong growth. The biggest reason is the sharp rise in charter rates for car carriers (6000 CEU class). The charter rate, which was $17,000 per day on January 1 last year, rose about 2.3 times to $38,500 in January this year. In August, it surged to $80,000.

This trend contrasts with the decline in container ship and bulk ship freight indices (BDI). The Shanghai Containerized Freight Index (SCFI) recorded 2072.04 on the 23rd, marking the lowest point of the year, while the BDI stood at 1816, up from 965 on the 31st of last month but still more than 1500 points below its peak of 3369 on May 23.

The main cause is interpreted as the limited number of PCTCs amid increasing automobile supply. According to the industry, as of January, the global PCTC fleet has remained around 750 vessels: 782 in 2018, 785 in 2019, 776 in 2020, 756 in 2021, and 764 this year. Meanwhile, the automobile market, which was contracted due to parts supply and production disruptions during the early COVID-19 period, has eased since the second half of last year, leading to a surge in purchase demand driven by pent-up consumption. A shipping industry official explained, "Shipping freight rates follow the law of supply and demand. Since ships are limited but finished car transport volumes are increasing, PCTC charter rates have risen."

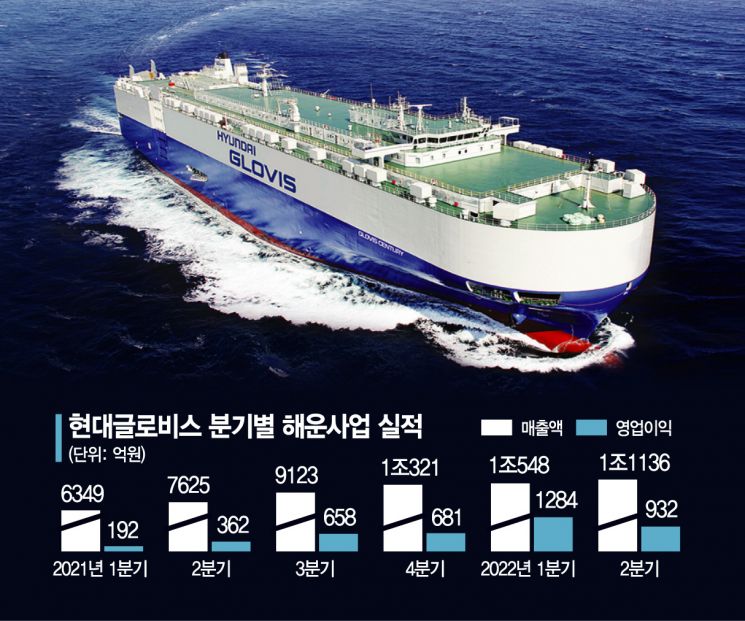

Along with this favorable trend, Hyundai Glovis's strong performance is expected to continue. In Q2, Hyundai Glovis recorded revenue of KRW 6.8629 trillion and operating profit of KRW 448.5 billion, up 25.5% and 62% year-on-year, respectively. Particularly, the shipping business has shown steady growth. In Q2, shipping business revenue and operating profit were KRW 1.1136 trillion and KRW 93.2 billion, up 46% and 157.5% compared to the same period last year.

Choi Go-woon, a researcher at Korea Investment & Securities, emphasized, "Unlike SCFI and BDI, car carrier charter rates have more than doubled this year. Coupled with strong demand in upstream industries and benefits from exchange rate increases, Q3 is expected to set a new record for operating profit."

A recent large-scale finished car maritime transport contract also raises expectations for future performance improvements. Hyundai Glovis signed overseas finished car maritime transport contracts worth a total of KRW 2.1881 trillion over three years from next year through 2025. This is the largest single contract signed by a shipping company competing with automobile manufacturers in the global finished car maritime transport market. Finished cars will be shipped to global demand centers in Europe, the Americas, and Asia. The industry estimates that this contract will result in an annual revenue increase of KRW 720 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.