Korea Housing Finance Corporation logo.

Korea Housing Finance Corporation logo.

[Asia Economy Yeongnam Reporting Headquarters Reporter Hwang Du-yeol] As of the 6th day of applications, on the 23rd, a total of 16,964 applications for the preferential Anshim Conversion Loan have been received, amounting to approximately 1.5658 trillion KRW.

Applications submitted via the Korea Housing Finance Corporation website and the Smart Housing Finance app totaled 8,848, reaching an application amount of about 846.4 billion KRW. Applications received at the branches of Kookmin, Industrial, Nonghyup, Shinhan, Woori, and Hana banks totaled 8,116, with an application amount of approximately 719.4 billion KRW.

The cumulative application amount is about 1.5658 trillion KRW, which is approximately 6.26% of the Anshim Conversion Loan supply scale of 25 trillion KRW.

The preferential Anshim Conversion Loan is a product that refinances variable or quasi-fixed rate mortgage loans secured by homes valued at 400 million KRW or less from the first and second-tier financial institutions into long-term, fixed-rate policy mortgages.

Eligible borrowers are single individuals or married couples with a combined annual income of 70 million KRW or less, owning one home priced at 400 million KRW or less.

Eligible applicants can convert up to 250 million KRW of their existing mortgage loans into fixed-rate products without prepayment penalties.

The preferential Anshim Conversion Loan interest rates range from 3.80% to 4.00% annually depending on the loan term of 10 to 30 years, while low-income youth aged 39 or younger with an income of 60 million KRW or less can receive rates from 3.70% to 3.90% annually.

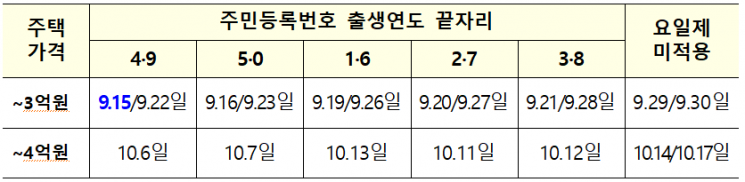

The preferential Anshim Conversion Loan is being smoothly processed by applying a phased application schedule based on housing prices and a weekday system according to the last digit of the applicant's birth year.

The application period varies by housing price: owners of homes priced at 300 million KRW or less can apply during the first phase from September 15 to 28, and applications for homes priced up to 400 million KRW can be submitted during the second phase from October 6 to 13.

Applications can be submitted online via the Korea Housing Finance Corporation website or the Smart Housing Finance app, and offline applications are also accepted at the branches of Kookmin, Industrial, Nonghyup, Shinhan, Woori, and Hana banks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.