Last Year, Fried Noodle Production Value Reached 2.492 Trillion KRW, Up 10.9% YoY

Ramen Prices Saw Largest Increase in 13 Years, Production Value Also Rose Double Digits

Gradual Increase in Cup Noodle Share... Influenced by Single-Person Households and Convenience Store Channels

Bagged Ramen Preferred as Meal, Cup Ramen Popular as Snack

[Asia Economy Reporter Koo Eun-mo] Last year, the production value of fried noodles such as bagged ramen and cup ramen approached 2.5 trillion KRW, showing that the ramen industry is steadily expanding. The steady increase in ramen consumption is attributed to its familiar taste and convenient cooking methods, as well as recent price hikes across the industry, which are believed to have contributed to the rise in production value.

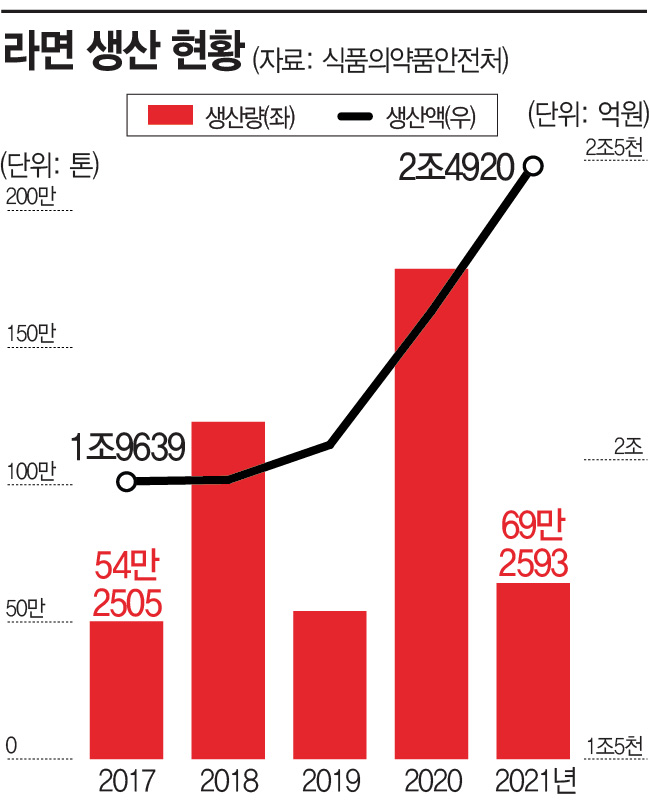

According to the Ministry of Food and Drug Safety on the 27th, the production value of fried noodles, including bagged and cup ramen, reached 2.492 trillion KRW last year, marking a 10.9% increase compared to the previous year (2.2479 trillion KRW). The production value of ramen, which was 1.9663 trillion KRW in 2018, surpassed the 2 trillion KRW mark in 2019 with 2.0248 trillion KRW and has continued to grow steadily since then. Over the past five years, ramen production value has shown continuous growth, especially last year when ramen prices rose by about 11% compared to 2020, marking the largest increase in 13 years, resulting in a double-digit growth rate in production value. According to the Food Code, ramen mainly refers to fried noodles. However, with increasing health awareness and product diversification, the release of non-fried dried noodle products has also been on the rise recently.

Looking at production value by type, the share of cup ramen, known as container noodles, has been gradually increasing. The production value of container noodles, which was 28.7% (652.6 billion KRW) in 2017, exceeded 30% in 2019 at 31.0% (728.5 billion KRW) and steadily increased to 31.4% (783 billion KRW) last year. The rise in the share of cup ramen is attributed to the increase in single-person households and solo diners, as well as the rapid emergence of convenience stores as major consumption channels for ready-to-eat meals, reflecting changes in food consumption trends. The demand for foods that can be easily prepared and eaten alone aligns with the advantages of container noodles, and the expansion of convenience stores even into neighborhood markets has influenced the growth of the container noodle market.

During the same period, production volume was 692,593 tons, a 64.1% decrease compared to 1,930,686 tons in 2020. This is because production volume surged in 2020 due to strong exports driven by the Korean Wave, such as the foreign interest in "Jjapaguri" featured in the movie "Parasite." Additionally, the prolonged COVID-19 pandemic increased the frequency of home cooking, which also influenced production. Therefore, the decrease is seen as a correction following the exceptional export surge in 2020, and it is difficult to interpret this as a long-term decline in production volume.

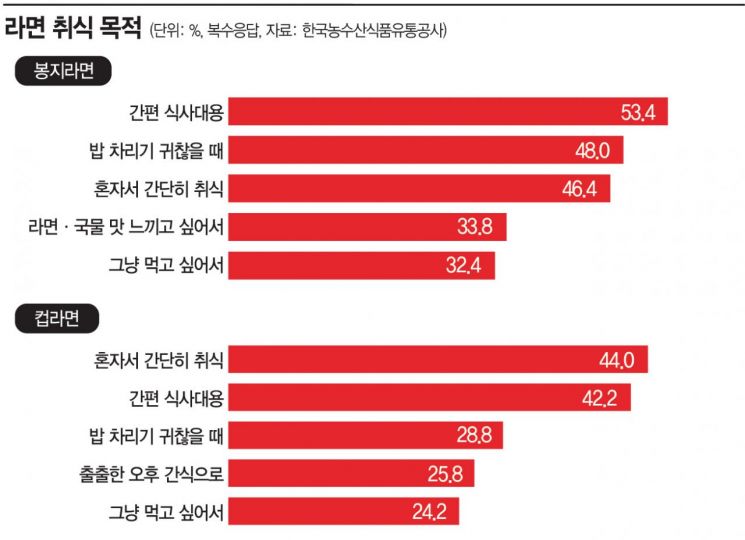

Meanwhile, bagged ramen and cup ramen showed similar but slightly different consumption purposes. According to a consumer survey (multiple responses allowed) by the Korea Agro-Fisheries & Food Trade Corporation (aT), the primary reason for consuming bagged ramen was "a convenient meal substitute" at 53.4%, followed by "because I am too lazy to prepare a meal" at 48.0%. In contrast, the top reason for consuming cup ramen was "to eat simply alone" at 44.0%, with "as a light afternoon snack" also being significant at 25.8%.

While both bagged and cup ramen are consumed as meal substitutes, cup ramen tends to be consumed more as a snack compared to bagged ramen. Since cup ramen allows consumers to choose portion sizes and offers the convenience of adding water for easy preparation, consumers are interpreted to choose cup ramen for its convenience and lightness, enjoying it alone or as a snack when feeling a bit hungry.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.