[Asia Economy Reporter Song Hwajeong] An analysis has emerged that during periods of rising interest rates, loans linked to the outstanding balance COFIX are more advantageous than loans linked to the newly contracted COFIX. This is because the outstanding balance COFIX interest rate rises more gradually compared to the newly contracted COFIX interest rate.

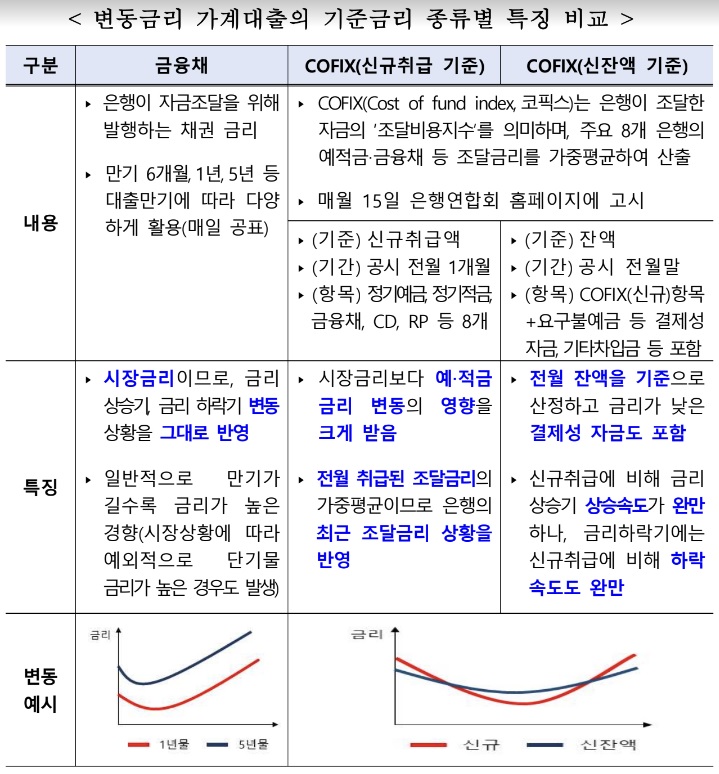

On the 26th, the Financial Supervisory Service (FSS) announced that starting from the 17th of next month, banks will strengthen comparative explanations to help consumers more easily understand the characteristics and interest rate levels of different loan benchmark interest rate types when handling variable interest rate loans. Currently, loan product descriptions simply list types of benchmark interest rates such as bank bonds and COFIX, but the revised loan product descriptions will categorize benchmark interest rates into bank bonds, newly contracted COFIX, and outstanding balance COFIX, detailing their characteristics, interest rate reflection structures, and impacts.

The FSS explained, "When selecting a loan product, consumers should carefully choose the interest rate conditions (variable interest rate, fixed interest rate, hybrid interest rate) that suit them, considering future interest rate forecasts and expected repayment timing." They added, "If a variable interest rate is chosen, during periods of rising interest rates, loans linked to the outstanding balance COFIX may be more advantageous than those linked to the newly contracted COFIX, so it is necessary to carefully compare the respective interest rate levels before making a choice."

Variable interest rate household loans increase in interest rate as market interest rates rise, but the extent of the increase may vary depending on the type of benchmark interest rate. According to the FSS, as of the end of July, among variable interest rate household loans, loans based on bank bonds, newly contracted COFIX, and outstanding balance COFIX accounted for 32.9%, 37.5%, and 12.3%, respectively. Loans linked to bank bond rates reflect market interest rate increases directly in the loan interest rate. Loans linked to newly contracted COFIX reflect increases in recent new funding costs (such as newly contracted deposits, financial bonds, CDs from the previous month) more than market interest rates. Loans linked to outstanding balance COFIX reflect the average interest rate increase of the bank’s funding balance (including deposits, financial bonds, CDs, and low-interest demand deposits such as settlement funds) in the loan interest rate.

Considering this interest rate structure, during periods of rising interest rates, the outstanding balance COFIX interest rate rises more gradually than the newly contracted COFIX interest rate. Assuming the same loan spread, loans linked to the outstanding balance COFIX may be more advantageous than those linked to the newly contracted COFIX. However, during periods of falling interest rates, the outstanding balance COFIX interest rate also declines more slowly, which may be disadvantageous compared to newly contracted COFIX loans.

An FSS official advised, "If the upward trend in interest rates is expected to continue, consumers may also consider using interest rate cap-type mortgage loans (adding special clauses to existing loans) that limit the extent of interest rate increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.