Inversion of Closing Yields on 3-10 Year Treasury Bonds

Reflecting Economic Recession

[Asia Economy Reporter Yoonju Hwang] Daishin Securities has set the spread target for 3- to 10-year government bonds at -15bp (1bp=0.01%P). This indicates an inversion of short- and long-term interest rates, reflecting concerns about an economic recession.

On the 26th, Gong Dong-rak, a researcher at Daishin Securities, stated, "As the Federal Reserve (Fed) announced an upward revision of the dot plot exceeding expectations, uncertainty across the financial markets, including bonds, has significantly increased."

The Fed presented the median target interest rate at 4.4% by the end of this year and 4.6% next year. This is higher than the market's forecast range (4.0~4.25%). It can be interpreted as a continuation of a high-intensity tightening policy.

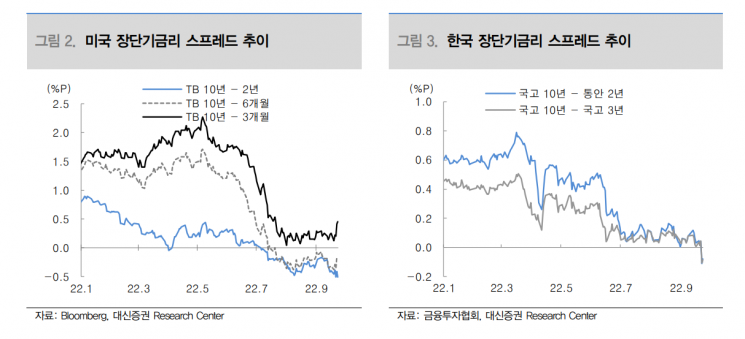

The bond market is also reflecting the possibility of an economic recession. After the September FOMC, short-term bonds such as the 3-year government bond and 2-year Monetary Stabilization Bond tend to show a deepening inversion with the 10-year government bond yield.

According to the Bond Information Center of the Korea Financial Investment Association, as of the closing price on the 22nd, the yield spread between the 3-year government bond (4.104%) and the 10-year government bond (3.997%) recorded -10.7bp, marking the first inversion in about 14 years. The next day (23rd), the spread between the 3-year bond (4.199%) and the 10-year bond (4.112%) was -8.7bp, closing in an inverted state for two consecutive trading days.

Although intermittent inversions occurred between the 5-year and 10-year bonds and between the 3-year and 30-year bonds, the inversion between the 3-year and 10-year bonds carries a different significance. The 3-year government bond, which has the most abundant liquidity, is considered an indicator reflecting the base interest rate, while the 10-year government bond reflects economic outlook. In the bond market, the 3-year government bond generally moves in line with market consensus on the base interest rate, whereas the 10-year bond can be considered based solely on the fundamentals of the Korean economy, independent of monetary policy effects.

Generally, short-term bond yields are lower than long-term bond yields because short-term bonds are preferred over long-term bonds. High demand for short-term bonds lowers their yields. However, if the base interest rate rises faster than expected and recession concerns grow, the yield gap between short- and long-term bonds narrows (yield curve flattening), or an inversion occurs. This is because, during a recession, monetary policy lowers interest rates to facilitate liquidity. As a result, long-term bond yields become more attractive, increasing demand and narrowing the yield difference with short-term bonds.

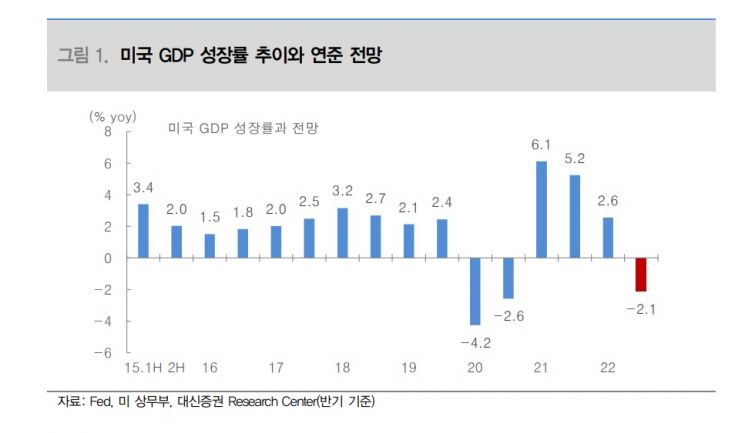

The GDP growth rate presented by the Fed is also interpreted as assuming a recession in the second half of the year. At the September FOMC regular meeting, the Fed lowered the GDP growth rate forecast to 0.2% for 2022 and 1.2% for 2023. The previous forecasts were 1.7% for each year.

Researcher Gong explained, "Although the US GDP growth rates for the first and second quarters were 3.5% and 1.7% year-over-year, respectively, an annual GDP growth forecast of 0.2% means that negative growth in the second half of the year is inevitable," adding, "Looking at the forecast range of 0 to 0.5%, most Fed officials expect a recession this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.