$238 Million Deficit Last Month

Increased Tesla Imports from US Factory Production

Korean Products Not Eligible for Tax Credits

US Deficit Expected to Widen Further

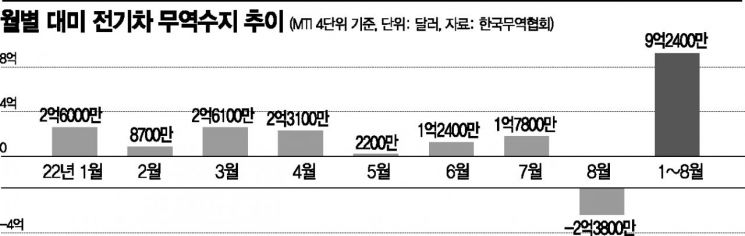

[Asia Economy Reporter Choi Dae-yeol] It has been revealed that South Korea recorded a trade deficit in electric vehicles (EVs) with the United States last month. This is the first time in a year since August last year. Due to the U.S. Inflation Reduction Act (IRA), which eliminated tax credit benefits for foreign-made EVs, South Korea's EV exports to the U.S. are expected to sharply decline, making it difficult to recover the deficit going forward.

According to export-import statistics from the Korea International Trade Association on the 26th, South Korea's EV exports to the U.S. last month amounted to $157 million, while imports were $395 million, resulting in a deficit of $238 million. The import amount last month was the highest ever on a monthly basis. Even in 2019, just before the COVID-19 outbreak, the total annual import value of U.S.-made EVs was just over $300 million. In terms of deficit size, it is the second largest monthly deficit since May last year ($331 million deficit).

The increase in imports is attributed to the large-scale inflow of Tesla vehicles and the full-scale import of Chevrolet EVs produced in the U.S. Tesla, despite production disruptions due to parts supply shortages, has been steadily increasing the volume of vehicles imported into South Korea. However, there is considerable monthly variation. While imports increased significantly, exports slightly decreased compared to July. This is due to reduced production as Hyundai Motor and Kia's factories halted operations during the vacation season.

The U.S. is considered South Korea's largest automobile export market. Until two or three years ago, due to low demand for EVs in the U.S., South Korea mainly exported EVs to Europe rather than the U.S., but the situation changed last year. Since the Biden administration took office and began expanding EV adoption, and other manufacturers besides Tesla have been releasing new models and focusing on the U.S. market, Hyundai Motor and Kia have also significantly increased exports to the U.S. by launching dedicated EVs (Ioniq 5 and EV6) from the second half of last year.

The problem lies ahead. Demand has increased as countries worldwide actively promote EV adoption, and South Korea has steadily increased EV exports to major overseas markets. The share of EVs in total automobile exports was about 1% five years ago (by value), but this year it is approaching 15%. Hyundai Motor and Kia, responsible for all domestic EV production, have also focused on the U.S. as a key target and have been dedicated to EV exports. However, EV exports to the U.S. are inevitably facing setbacks due to the Inflation Reduction Act that took effect last month.

Currently, a tax credit of $7,500 (about 10 million KRW) is provided only for EVs produced in the North American region, significantly reducing the price competitiveness of Korean-made EVs. Hyundai Motor plans to build a dedicated EV factory in Georgia, U.S., to respond to the local market situation. However, since the factory is expected to be completed around 2025, a gap of 2 to 3 years is unavoidable. Given that Tesla, the world's largest EV manufacturer, is based in the U.S. and global automakers are localizing production, it is expected to be difficult for Hyundai Motor and Kia to secure market dominance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.