Mirae Asset Securities Report

[Asia Economy Reporter Myunghwan Lee] As the leading altcoin Ethereum has successfully completed the Merge upgrade, an analysis suggests that this update is also positive for the United States' largest cryptocurrency exchange, Coinbase. However, it also emphasizes that the recovery of cryptocurrency trading volume is crucial.

Mirae Asset Securities analyzed on the 25th, "Ethereum's Merge is positive for Coinbase, but the recovery of trading volume is most important."

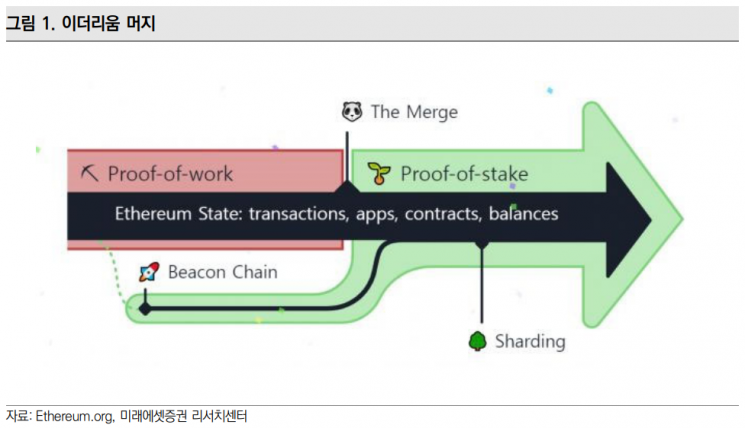

Ethereum completed the Merge upgrade on the 15th. The Merge upgrade primarily involves transitioning the Ethereum blockchain algorithm from the existing Proof of Work (PoW) method to Proof of Stake (PoS). Proof of Work means participating in the blockchain through computer computational processing and receiving coins as rewards. In contrast, Proof of Stake means delegating held cryptocurrencies to the blockchain and receiving coins as compensation for participating in verification and creation.

Mirae Asset Securities' analysis expects effects such as reduced power consumption and lowered security costs due to this Merge upgrade. It also pointed out that an increase in 'staking' rewards, where users can earn returns by delegating cryptocurrencies, and improvements in decentralization can be anticipated.

According to Mirae Asset Securities, several more procedures remain before Ethereum's performance improvements are fully realized. Additional upgrade steps are needed, such as enabling the withdrawal of staked Ethereum six months later. Mirae Asset Securities forecasts that it will take at least more than two years until all stages are completed.

Mirae Asset Securities also assessed that the Ethereum Merge upgrade is positive for the stock price of Coinbase, the largest cryptocurrency exchange in the U.S. Coinbase was listed on the Nasdaq market in April last year. It is expected that Coinbase's staking revenue and overall operating profit will improve with the increase in Ethereum staking. As of the second quarter, Coinbase's staking revenue was $68 million, accounting for about 8.5% of total revenue.

However, it noted that the growing risk-averse sentiment could reduce trading volume, which is a negative factor. While the Ethereum Merge upgrade is positive amid forecasts of continued operating losses, it is insufficient to restore investor sentiment. Trading fees account for more than 90% of Coinbase's total revenue.

Mirae Asset Securities predicts that Coinbase's revenue growth slowdown will continue for the time being due to shrinking trading volume. This is because the risk-averse trend is expected to persist amid interest rate hikes and the possibility of an economic recession. Researcher Yongdae Park of Mirae Asset Securities said, "Coinbase's stock is trading at a 12-month forward price-to-sales ratio (PSR) of 4 times, which is a historical low," but added, "New entries are burdensome."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.