Maximum Interest Rate 6.5% Applied

Support Available for Individual Business Owners or Corporate Small Enterprises Affected by COVID-19

Limit of 50 Million KRW for Individuals, 100 Million KRW for Corporate Small Enterprises

[Asia Economy Reporter Song Hwajeong] Starting from the 30th, an 8.5 trillion KRW refinancing program will be implemented to reduce the financial burden on self-employed individuals and small business owners affected by COVID-19 by converting high-interest business loans with an annual interest rate of 7% or higher into low-interest loans.

On the 25th, the Financial Services Commission announced that from the 30th, applications for the low-interest refinancing program can be submitted through the mobile apps and bank counters of 14 banks including Kookmin, Shinhan, Woori, Hana, IBK, Nonghyup, Suhyup, Busan, Daegu, Gwangju, Gyeongnam, Jeonbuk, Jeju, and Toss.

Who is eligible for low-interest refinancing support?

The support target for this high-interest loan refinancing program is borrowers in good standing who have been affected by COVID-19 and are individual business owners or small corporate businesses. Applicants must have received disaster relief funds (including quarantine support funds), loss compensation, or have had maturity extensions or repayment deferrals from financial institutions, and currently be conducting normal business operations with the ability to repay the low-interest refinancing funds.

However, borrowers who have suspended or closed their businesses, have overdue national or local taxes, are delinquent with financial institutions, or are otherwise considered at risk of default (borrowers with low credit scores) and thus unlikely to be considered normal borrowers in terms of repayment ability after refinancing will be supported through the debt adjustment program called the New Start Fund, which will be implemented from next month.

Industries difficult to consider as COVID-19 affected, such as gambling and entertainment-related businesses, nightclubs, real estate leasing and sales, finance, legal, accounting, tax, and healthcare sectors excluded from small business policy funds, will continue to be excluded from support.

The debts eligible for support are business loans (corporate credit extended to individual business owners or corporate small businesses holding a business registration certificate) received from financial institutions for facilities or working capital, with an interest rate of 7% or higher at the time of refinancing application. Financial institution loans include business credit and secured loans handled by banks, savings banks, specialized credit finance companies (cards, capital), mutual finance institutions (credit unions, Nonghyup, Suhyup, Forestry Cooperatives, Saemaeul Geumgo), and insurance companies. Considering the purpose of supporting businesses affected by COVID-19, loans issued up to the end of May this year are included. Loans received before the end of May this year that were renewed after June are also eligible.

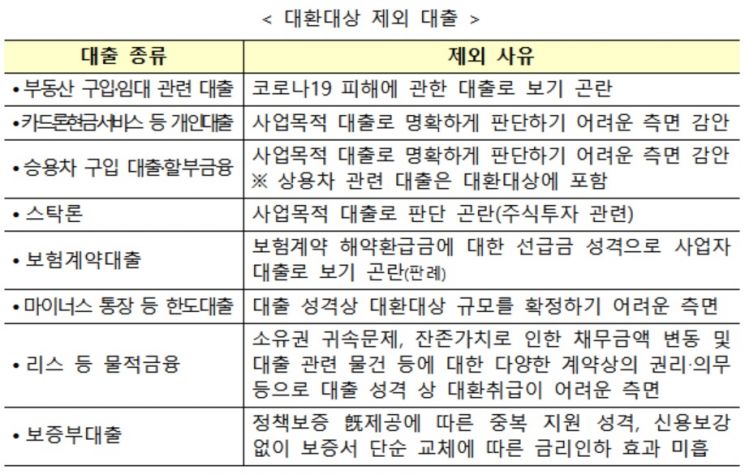

Since this program aims to reduce the burden of business-purpose loans, loans that are difficult to classify as business loans or whose nature makes refinancing inappropriate are excluded. Loans for residential or rental real estate, personal vehicle purchases, stock loans, and overdraft accounts are not eligible. However, loans related to commercial vehicles such as freight trucks and construction equipment (including installment loans) are clearly recognized as business-purpose loans and are included in refinancing regardless of the loan nature at the initial issuance.

What kind of support is provided?

The refinancing program will supply a total of 8.5 trillion KRW by the end of next year. The refinancing limit is 50 million KRW per individual business owner and 100 million KRW per small corporate business, and multiple high-interest loans can be refinanced within the limit.

The interest rate and guarantee fee borne by self-employed individuals and small business owners using the refinancing program will be up to 6.5%, with the actual applied rate varying according to the borrower's creditworthiness. For the first and second years, a fixed interest rate of up to 5.5% will be applied based on the initial loan interest rate, and for years three to five, the agreed interest rate (bank bond AAA 1-year rate + 2.0 percentage points) will be the interest rate ceiling. The guarantee fee is fixed at 1% per annum.

Existing loans repaid through this refinancing program and new loans taken out to repay existing loans will be fully exempt from prepayment penalties after consultation with financial institutions.

The repayment structure is a total of five years with a two-year grace period followed by three years of installment repayment. Since prepayment penalties are fully waived, borrowers can repay principal and interest early without additional financial burden according to their individual circumstances.

How to apply?

Eligible self-employed individuals and small business owners can apply for the refinancing program from the 30th through 14 banks either non-face-to-face (via bank mobile apps) or face-to-face (visiting branches). However, in cases such as small corporate businesses or when there are two or more representatives, non-face-to-face applications are difficult, so applicants must visit bank branches in person as an exception.

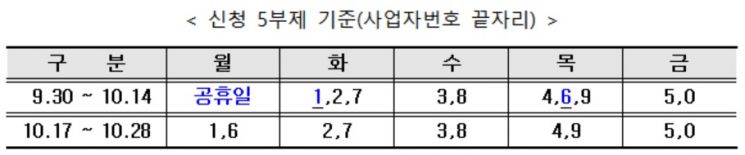

To minimize customer inconvenience such as application difficulties due to simultaneous access at the early stage of implementation, a five-day rotation system based on the last digit of the business registration number will be implemented for one month from the 30th to the 28th of the following month. Since October 3rd and 10th are holidays, self-employed individuals and small business owners whose business registration numbers end with 1 or 6 can apply on the Tuesday (for 1) and Thursday (for 6) of that week, respectively, to facilitate smoother refinancing applications.

After application submission, the refinancing loan execution requires guarantee screening by the applying bank, data verification between the applying bank and existing loan institutions, and remittance procedures, which take about two weeks. However, the actual processing time may vary depending on the volume of refinancing applications by institution and the completeness of required documents provided by customers.

An online refinancing guidance system will also be operated to facilitate smoother low-interest refinancing applications. It provides detailed information on required documents, financial institutions, and other application details, and allows applicants to pre-check whether they are eligible for the refinancing program and whether they hold eligible debts based on the information they input.

This system will be officially operated from the 30th when the refinancing program starts and will be pilot-operated from the 26th for prior guidance. During the pilot operation period (26th to 29th), support target and eligible debt information inquiries will be operated on a two-day rotation basis (even last digit of business registration number on the 26th and 28th, odd last digit on the 27th and 29th) to ensure stable service, and from the 30th, inquiries will be available without restrictions. However, the support target information provided through the online guidance system is reference material for preparing refinancing applications, and the actual refinancing eligibility will be finally determined through bank screening.

A Financial Services Commission official urged, "Since voice phishing (spam) messages impersonating the government, public institutions, and financial institutions to induce phone consultations or clicking on URLs are occurring randomly, special caution is required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.