[Asia Economy Reporter Hwang Yoon-joo] Korea Asset Investment Securities forecasted that the peak of monetary tightening will occur in the fourth quarter of this year or early next year. Accordingly, it presented the KOSPI band for the fourth quarter as 2300p to 2700p.

On the 24th, Korea Asset Investment Securities stated in a market report, "Below 2300p, the perception of undervaluation based on the price-earnings ratio (PER) and price-to-book ratio (PBR) is strengthening, the recession period is generally much shorter than the boom period, and interest rates are expected to peak in the fourth quarter of this year or early next year."

The report explained, "Whether the market breaks below the previous low is important for the fourth quarter market outlook, but as of September 22, the S&P 500 has not broken below its previous low, and indices that have broken below previous lows are rare both domestically and internationally."

It continued, "Neither the KOSPI nor the KOSDAQ has broken below previous lows, and Japan, which is experiencing a rising exchange rate similar to Korea, has a resilient Nikkei 225 that is consecutively raising its lows." It added, "Only Samsung Electronics renewed its low in the third quarter, so it is worth waiting to see if it rebounds in the fourth quarter."

One reason for the weakening downward momentum of the KOSPI in the third quarter was the shift to net buying by foreigners. The report analyzed, "Although individual investors’ net buying amount rapidly shrank to 1.3 trillion KRW in the third quarter, foreigners absorbed domestic institutional selling by net buying 4.7 trillion KRW." It explained that the simultaneous selling by institutions and foreigners was broken.

Korea Asset Investment Securities emphasized, "The upper limit of 2700p in the fourth quarter has significant meaning as a box range." The report explained, "If a bull market is defined as the KOSPI rebounding more than 20% from its low, then based on 2276p on July 4, surpassing 2731p, which is a 20% increase, can be judged as a transition to a bull market."

Additionally, the report stated, "Using another criterion where recovering 50% of the drop from the highest point to the lowest point (from 3316p to 2276p) is the condition for a bull market transition, the index must once reach above 2794p."

Korea Asset Investment Securities noted, "There is a significant divergence of opinions on whether stock prices will fall further after the fourth quarter, with pessimism somewhat prevailing," and added, "The U.S. market is similarly divided into two views: whether it will fall sharply again or enter a box range."

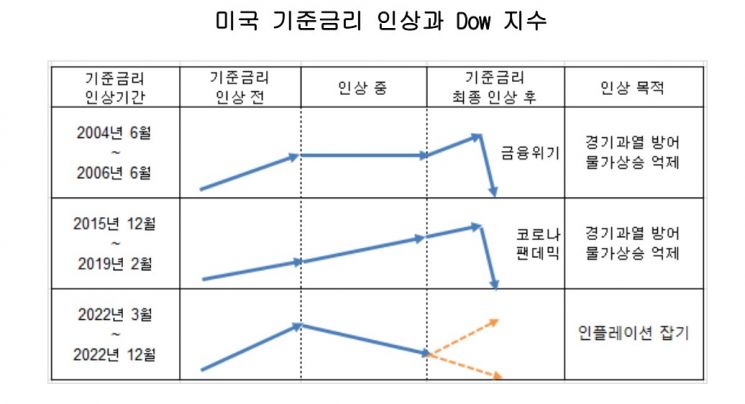

Meanwhile, regarding the tightening stance, it predicted that 2023 will be a turning point for the base interest rate. Korea Asset Investment Securities emphasized, "Whether interest rate cuts begin in the second half of 2023 or in 2024 is important," and added, "Stock prices move 6 to 12 months ahead."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.