Supply Shortage Continues... Annual Growth Expected to Exceed 14%

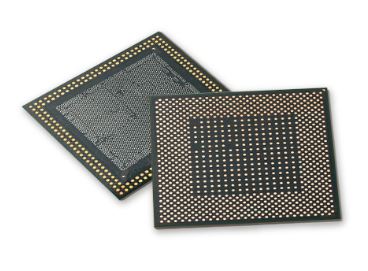

Product photo of Samsung Electro-Mechanics semiconductor package substrate (for CPU).

Product photo of Samsung Electro-Mechanics semiconductor package substrate (for CPU). [Photo by Samsung Electro-Mechanics]

[Asia Economy Reporter Han Yeju] The domestic component industry is fiercely competing in investments for flip chip (FC)-ball grid array (BGA), known as an advanced semiconductor package substrate. Although package substrates are gaining attention due to increased semiconductor demand, only about 10 companies currently produce them because of the high level of technical expertise required. With supply shortages expected to continue for the time being, the growth of FC-BGA is highly anticipated.

According to the industry on the 25th, recently, domestic component companies such as Samsung Electro-Mechanics and LG Innotek have accelerated investments by unveiling new substrate materials.

FC-BGA, which connects semiconductor chips and main substrates using the flip chip method, is a highly integrated package substrate that improves electrical and thermal characteristics. It is a high-spec product mainly used in CPUs (central processing units) and GPUs (graphics processing units), which exchange many electrical signals. Recently, it has been utilized mainly in AI, automotive electronics, and 5G, and is expected to experience rapid growth in the future.

Samsung Electro-Mechanics, which succeeded in the first mass production of FC-BGA in 2002, began investing about 1 trillion won in its Vietnam subsidiary in December last year and continued investing several hundred billion won this year. Samsung Electro-Mechanics, which started mass production of network FC-BGA this year, has begun mass production of server FC-BGA domestically for the first time in the second half of the year.

LG Innotek also took a step forward by deciding to invest 413 billion won in FC-BGA facilities and equipment earlier this year. LG Innotek's FC-BGA-related sales are expected to begin from 2024. LG Innotek is expected to expand FC-BGA application fields from mobile to communication/network, server/PC, digital TV, and vehicles.

Daeduck Electronics, which started supplying FC-BGA from the third quarter of last year, announced that it will invest 270 billion won in production facilities in the first quarter to respond to market demand for large-area FC-BGA for high-end non-memory semiconductors. The company plans to continue advancing its business portfolio by reducing flexible printed circuit boards (FPCB) and multilayer printed circuit boards (MLB) and converting to high value-added package substrate lines.

The package substrate market is expected to reach $11.3 billion (approximately 15.763 trillion won) this year, growing at an average annual rate of about 10% including mobile and computer uses, and is estimated to expand to $17 billion (approximately 23.7 trillion won) by 2026.

Although concerns about an industry peak-out arise as the smartphone and PC markets slow down, the supply shortage phenomenon of FC-BGA is expected to continue for the time being because there are very few companies worldwide capable of producing FC-BGA. The industry forecasts that the FC-BGA supply shortage will persist until 2027.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.