Launch of New Start Fund on October 4 with On-site Applications

Beware of Voice Phishing

[Asia Economy Reporter Sim Nayoung] The New Start Fund, aimed at alleviating the repayment burden of self-employed individuals and small business owners struggling to repay loans due to difficulties in business operations after COVID-19, will launch on October 4.

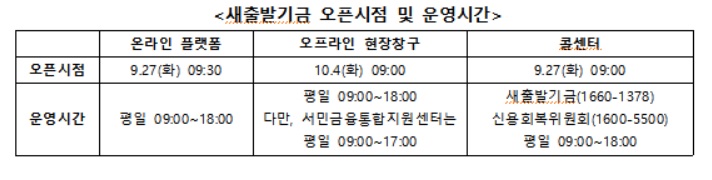

According to the Financial Services Commission on the 23rd, self-employed individuals and small business owners who wish to apply for debt adjustment can do so through the New Start Fund online platform and offline service counters (a total of 76 locations including 26 offices of Korea Asset Management Corporation and 50 centers of the Integrated Financial Support Center for the Underprivileged). By calling the New Start Fund call center or the Credit Recovery Committee call center, applicants can receive guidance on visiting the service counters.

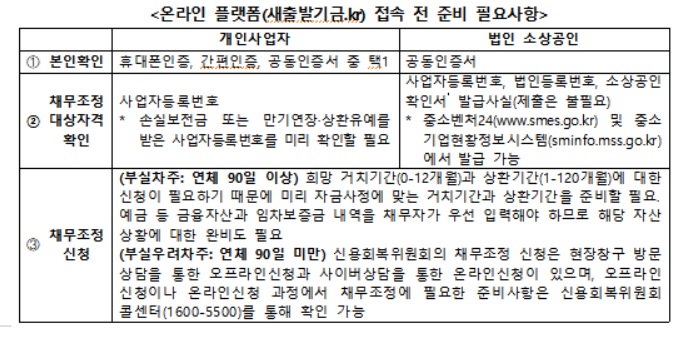

When applying at the service counters, applicants must first contact the New Start Fund call center or the Credit Recovery Committee call center to reserve a visit date and time, then bring their ID to apply. For corporations, the representative’s ID, corporate seal certificate, corporate seal, corporate registration certificate, and small business confirmation (based on the criteria of Small and Medium Venture 24 or the Small and Medium Enterprise Status Information System) are required.

A Financial Services Commission official stated, "At the beginning of the application period, congestion at the counters is expected, so we ask that applicants use the New Start Fund internet site as much as possible." The official added, "The online platform will operate a pre-application period for four days from the 27th to the 30th." Offline service counters will operate starting from the 4th.

Pre-application through the internet site will be operated on an odd-even basis. Those born in odd-numbered years can apply on the 27th and 29th, while those born in even-numbered years can apply on the 28th and 30th. The application process on the internet site proceeds in the order of identity verification → qualification check for debt adjustment → debt adjustment application. Applicants should prepare the necessary information for identity verification, qualification check, and debt adjustment application before accessing the site.

The Financial Services Commission official emphasized, "Many illegal cases such as voice phishing or loan scams impersonating the New Start Fund are expected, so caution is required." The official stressed, "Any internet access or phone calls other than the New Start Fund internet site, the New Start Fund call center, and the Credit Recovery Committee call center are not related to the New Start Fund."

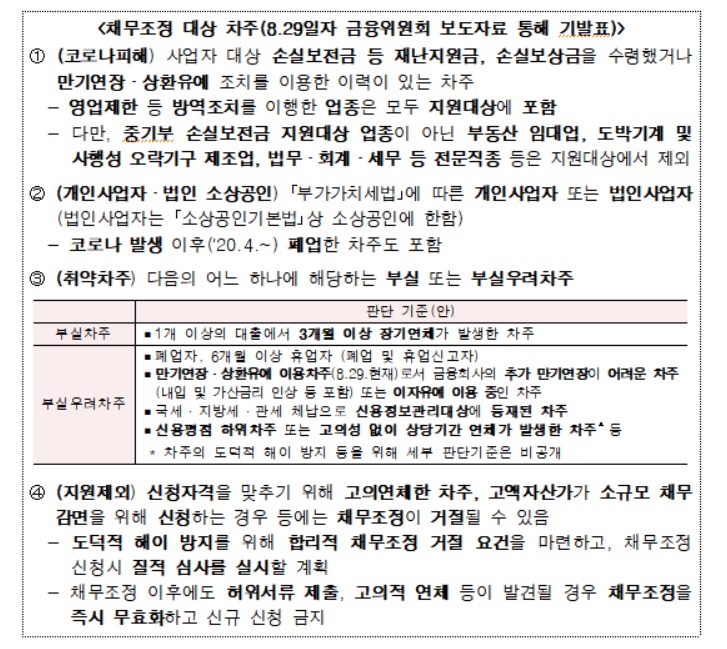

The New Start Fund allows individual business owners or small business owners affected by COVID-19 who are either delinquent borrowers (overdue for 3 months or more) or borrowers at risk of delinquency (overdue less than 3 months) to apply for debt adjustment through the fund.

The New Start Fund targets all loans held by financial institutions that have signed the 'New Start Fund Agreement' (regardless of whether the loan is secured, guaranteed, or unsecured for business or household purposes). Since corporate small business owners have separate legal entities and representatives, household loans of the representative are not supported.

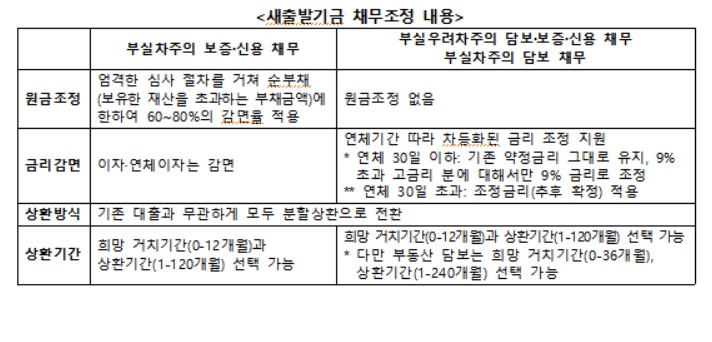

In debt adjustment, the principal of guarantees and unsecured debts of delinquent borrowers is adjusted, while interest rates and repayment periods are adjusted for secured, guaranteed, and unsecured debts of borrowers at risk of delinquency and secured debts of delinquent borrowers. For delinquent borrowers, after a strict screening process, a reduction rate of 60-80% is applied only to the debt amount exceeding the value of owned assets.

For delinquent borrowers, collection on guarantee and unsecured debts is immediately suspended (within 1-2 days) after applying for debt adjustment through the New Start Fund internet site. For borrowers at risk of delinquency, collection is immediately suspended (within 1-2 days) after qualification verification through the New Start Fund internet site and counseling with the Credit Recovery Committee, followed by debt adjustment application.

The adjustment limit is KRW 1 billion for secured loans and KRW 500 million for unsecured loans, totaling KRW 1.5 billion. Only one debt adjustment application can be made during the application period. However, if a borrower at risk of delinquency fails to comply with the debt adjustment plan for more than 90 days during the use of the New Start Fund and becomes a delinquent borrower, debt adjustment according to the delinquent borrower category is possible.

A Financial Services Commission official stated, "We will first accept debt adjustment applications for one year, but considering the possibility of COVID-19 resurgence, economic conditions, and trends in potential delinquency among self-employed individuals and small business owners, we plan to operate the program for up to three years if necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.