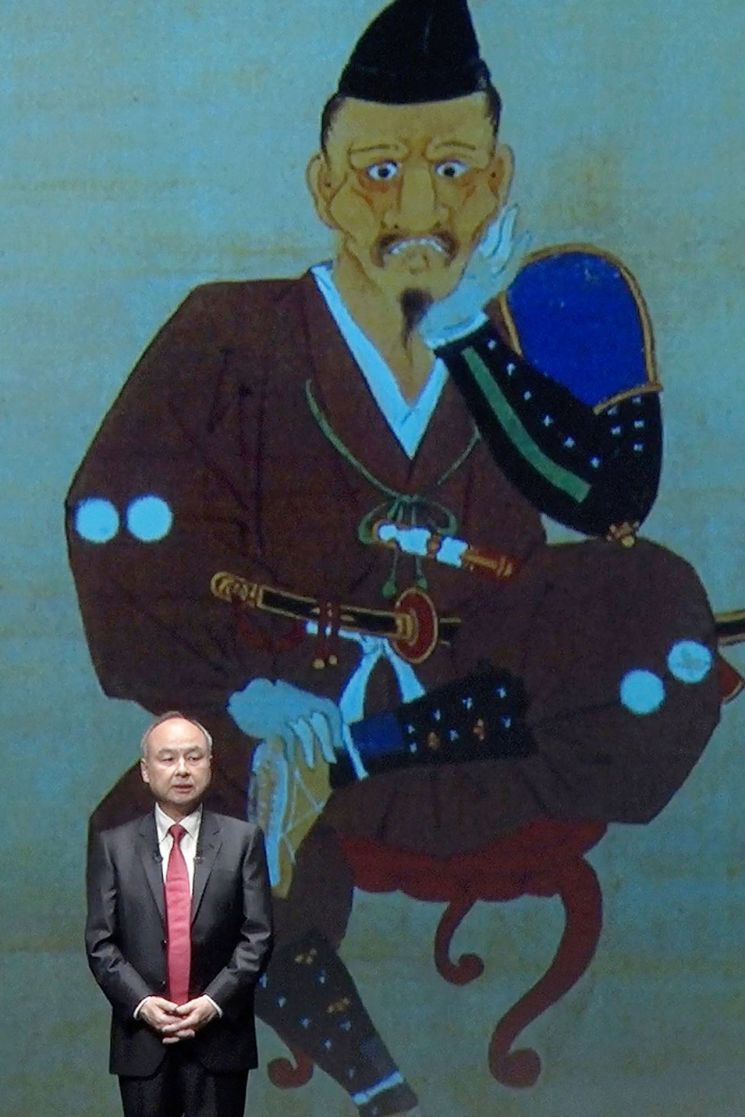

[Asia Economy Intern Reporter Song Hyundo] As Samsung's plan to acquire ARM Holdings (hereafter ARM) comes into view, attention is also focused on the background of SoftBank's decision to sell ARM. Masayoshi Son (Son Masayoshi·孫正義), chairman of SoftBank Group, is known for aggressive investments through the company's IT investment fund, the 'SoftBank Vision Fund,' including investing $3 billion in Coupang by 2018. So why did Chairman Son decide to sell ARM, a golden goose and a valuable company?

The sale of ARM is largely intended to offset losses from the Vision Fund. According to Japanese foreign media, SoftBank recorded losses of 3.1627 trillion yen (about 30.5 trillion won) for two consecutive quarters as of June this year. In particular, the Vision Fund's value, which was 7 trillion yen (about 69.384 trillion won), has virtually returned to zero, resulting in record losses.

Foreign media evaluated that the consecutive deficits of companies invested in by the Vision Fund, such as Alibaba and Coupang, led to SoftBank's losses. Among the companies invested in by the Vision Fund, 35 listed companies suffered losses of 1.7253 trillion yen (about 17.1011 trillion won) due to stock price declines, and among unlisted companies, the value of 175 companies fell by a total of about 1.0436 trillion yen (about 10.3441 trillion won). In particular, the fact that Alibaba's stock price dropped by two-thirds was considered decisive. Accordingly, Chairman Son stated at the annual financial results meeting held in May this year that he was "ashamed and reflecting on his overconfidence" and would adopt a defensive management approach.

Another reason for the sale is that ARM's revenue does not contribute to offsetting SoftBank Group's losses. When ARM was acquired in 2016 for $32 billion, some argued that buying the company at more than 20 times ARM's average annual revenue at the time was an overestimation of its potential. Last year, ARM recorded revenue of $2.7 billion (about 3.8 trillion won), achieving its highest-ever performance, but this is small considering the group's overall losses.

In this situation, opinions suggest that the sale of ARM is an inevitable step. The Japanese economic magazine Business Insider Japan commented, "The future of SoftBank Group lies in ARM," predicting that this sale will open a lifeline for SoftBank. SoftBank holds a 75% stake in ARM, with the remaining 25% owned by the Vision Fund. If the sale proceeds, the transaction size is estimated to approach 100 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.