[Asia Economy Reporter Oh Hyung-gil] Corporate Venture Capital (CVC) is expected to inject vitality into the venture and startup sectors, which have been struggling with dried-up funding amid the economic recession.

With the amendment of the Fair Trade Act at the end of last year allowing general holding companies to establish venture capital firms, CVCs have been gaining attention. The Yoon Seok-yeol administration has emphasized revitalizing the free market economy system and included the activation of CVCs as a national policy task.

Six out of ten domestic startups feel that the business environment this year has worsened compared to last year.

According to the recent survey on 'Startup Difficulties and Policy Tasks' released by the Korea Chamber of Commerce and Industry and the Korea Startup Forum, 59.2% of respondent companies said this year is more difficult than last year. The proportions of those who said it was similar or better were 24.0% and 16.8%, respectively.

The main reasons cited for the worsening business conditions were 'deterioration of investment sentiment toward startups' and 'domestic market slump due to COVID-19, etc.' (multiple responses, each 52.7%). This was followed by 'intensification of the "three highs" phenomenon: high inflation, high interest rates, and high exchange rates' (35.6%) and 'heightened global overseas market instability' (25.3%).

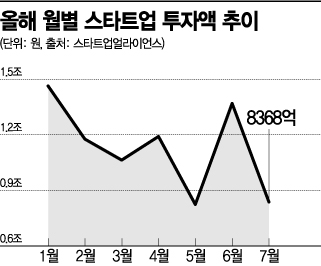

In particular, it was revealed that the investment freeze in startups is becoming full-fledged. Due to rapid interest rate hikes and other domestic and international economic uncertainties, 36% of respondent companies said their investments decreased compared to last year.

Among the companies that reported reduced investments, about half (47.8%) said their investment amounts decreased by more than 50% compared to last year.

The startups' outlook on the future economy was also bleak. When asked when they expect the economy to recover and their businesses to regain momentum, 31.2% of respondents answered 'the second half of next year.'

This was followed by 'the first half of next year' (24.8%), 'the second half of this year' (20%), and 'after 2024' (14%). The proportion of those who answered 'no prospect' reached 10%.

As a task to transform into a private sector-led startup ecosystem like advanced countries, many companies pointed to the activation of the Corporate Venture Capital (CVC) system (34.5%).

CVCs are venture capital firms that large corporations can establish for investment purposes. Although permitted at the end of last year, their activation has been slow due to stringent establishment criteria and various regulations.

Choi Sung-jin, CEO of the Korea Startup Forum, said, "While the damage and pain caused by high inflation, high interest rates, and high exchange rates affect all citizens, many startups are in situations where survival is difficult. It is urgent to prepare measures to prevent capable startups from collapsing due to temporary funding shortages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.