Defensive Stocks in Gyeonggi 'Food & Telecom' Rise

Secondary Battery Stocks Also Hold Up Amid Expectations of Inflation Reduction Act Benefits

Rising War Tensions... Defense Stocks Also Up

[Asia Economy Reporter Myunghwan Lee] Despite fears of high-intensity tightening, there are still pockets of growth.

Inflation and tightening fears have pressured the domestic stock market, but defensive stocks, secondary battery, and defense industry stocks have instead risen. Defensive stocks avoided stock market volatility, while secondary battery and defense stocks overcame the market downturn with individual positive factors. Securities firms have advised increasing the weight of these stocks, given the possibility of increased stock market volatility going forward.

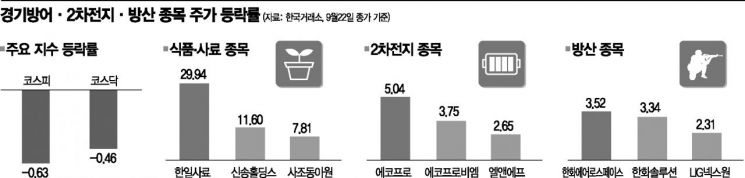

According to the Korea Exchange as of 9:40 a.m. on the 23rd, telecommunications (0.39%) and food and beverage (0.10%) sectors showed slight gains despite the KOSPI declining. On the previous day, the food and beverage index rose 1.69% compared to the previous trading day, showing an upward trend. On this day, the electricity and gas index closed at 768.90, up 2.37% from the previous trading day, marking the largest increase among all KOSPI indices. In the KOSDAQ market, food and tobacco (3.46%) and telecommunication services (0.66%) indices also closed higher the previous day.

Looking at individual stock price trends, defensive stocks are on the rise. At the same time, food and feed stocks such as Hanil Feed (12.45%), Hantop (5.23%), and Daehan Flour Mills (3.51%) are increasing. On the previous day, food and beverage stocks such as Shinsong Holdings (11.60%), Sajo Dongawon (7.81%), Sempio (6.61%), SPC Samlip (6.61%), and Daehan Sugar (6.45%) also stood out.

Although the domestic stock market is showing a downward trend in the morning session on the 23rd following the U.S. Federal Reserve's third consecutive giant step (a 0.75 percentage point increase in the benchmark interest rate), defensive stocks, classified as less sensitive to economic cycles, have shown consecutive gains. As of 10 a.m., the KOSPI was at 2309.15, down 0.99% (23.16 points) from the previous trading day, and the KOSDAQ index was at 741.90, down 1.27% (9.51 points) from the previous day.

Defense stocks have overcome market volatility with individual positive factors. The Russia-Ukraine war crisis has escalated again, driving an upward trend. This is due to Russian President Vladimir Putin's partial mobilization order for reservists and even hints at the possible use of nuclear weapons. At the same time, Hanwha Aerospace, the parent company of Hanwha Defense, is trading 1.05% higher than the previous day, along with major defense stocks such as Hyundai Rotem (1.38%) and Korea Aerospace Industries (0.97%) all rising.

Secondary battery stocks have been highlighted due to solid earnings forecasts and expected benefits from the Inflation Reduction Act (IRA). On the previous day in the KOSPI market, secondary battery manufacturers such as LG Energy Solution (1.88%) and Samsung SDI (1.62%) saw their stock prices rise, while in KOSDAQ, EcoPro (5.04%) and EcoPro BM (3.75%) also closed higher.

Securities firms advised considering increasing the weight of these stocks for the time being. Daijun Kim, a researcher at Korea Investment & Securities, said, "We have entered a risk-off environment with weak risk asset preference," adding, "We should respond with defensive stocks such as food and beverage, telecommunications, utilities, which have low market sensitivity, and sectors less affected by high exchange rate shocks such as automobiles, secondary batteries, and defense."

There is also a forecast that increasing the weight of these stocks could be a breakthrough. Yonggu Kim, a researcher at Samsung Securities, said, "In the current situation, holding rather than joining a herd-like panic sell-off, and a strategy of buying at low prices followed by selling on rebounds rather than aimless waiting, is advantageous," suggesting, "The response centered on automobiles, secondary batteries, commercial services (defense), food and beverage, and distribution leading stocks is the way to break through the current market."

Kyungmin Lee, a researcher at Daishin Securities, also said, "The downward trend in the stock market is expected to continue, so strategically, we maintain a reduction in stock weight and an increase in cash weight," but advised, "From a portfolio investment perspective, we recommend increasing the weight of dividend stocks (telecommunications, non-life insurance, etc.) and defensive stocks (telecommunications, food and beverage, etc.)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)