Lifting of Regulation Zones Across All Provinces Except Sejong City

"Limited Impact on Market... Continued Interest Rate Hikes"

Although the government has implemented 'regulatory zone removals' measures that respond to demands for real estate deregulation, the market itself appears to be wandering. There is no noticeable movement of investors seeking areas benefiting from deregulation. For now, they are cautious and on alert to the effects of deregulation. Some even lament that this deregulation essentially confirms the government's acknowledgment of the long-term slump in local real estate markets.

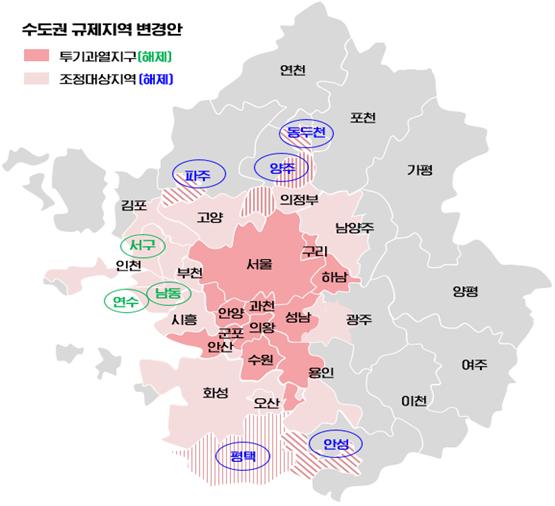

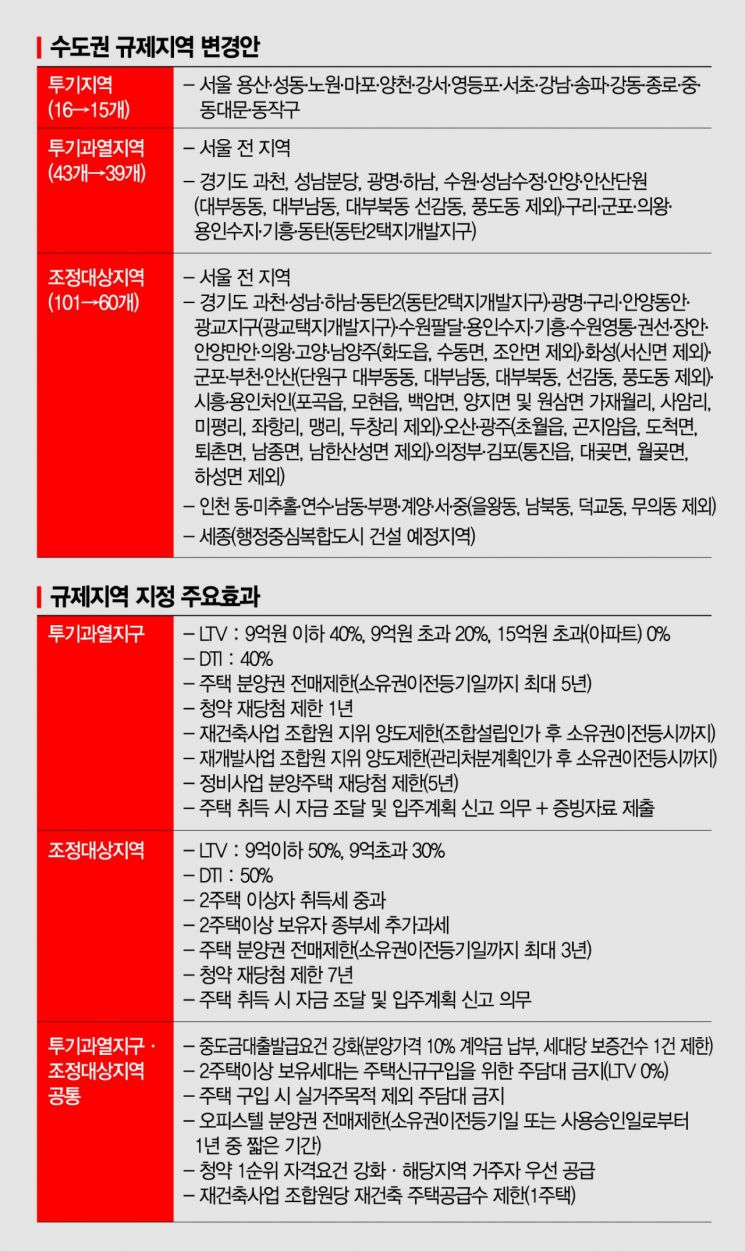

◇Visible Deregulation Measures Under the New Government= Amid a nationwide decline in housing prices, the government has decided to lift the designation of 'adjustment target areas' for all local regions except Sejong City. In the Seoul metropolitan area, the speculative overheating zone in Incheon, where the decline is steep, will be lifted, but the adjustment target area status will remain. Additionally, five areas?Dongducheon, Yangju, Paju, Pyeongtaek, and Anseong?will be removed from the adjustment target areas. Seoul's current regulated zones will remain unchanged.

On the 21st, the government held the 3rd Residential Policy Deliberation Committee (Jujeongshim) and the 61st Real Estate Price Stabilization Committee to review and approve the 'Adjustment of Speculative Overheating Zones and Adjustment Target Areas (Draft)' and the 'September 2022 Housing Speculative Areas (Designated Areas) Removal (Draft).' The approved measures will take effect from 0:00 on Monday, September 26, upon publication in the official gazette.

Local governments previously designated as regulated zones, such as Yangju, Dongducheon, Paju in Gyeonggi Province, and Busan and Changwon in Gyeongnam Province, had requested deregulation ahead of the 3rd Jujeongshim meeting. The deregulation of all local areas except Sejong is considered a more extensive measure than expected. Eunhyung Lee, a research fellow at the Korea Construction Policy Research Institute, said, "This adjustment of regulated zones is the most visible scale of deregulation implemented under the new government," adding, "It can be seen as part of the government's declared effort to normalize the market."

◇"Well..." Expectations for Housing Price Rebound Are Missing= The market appears relatively quiet. Mr. G, a representative of a real estate agency in Yadang-dong (Unjeong New Town), Paju, said, "While transactions might increase somewhat after deregulation, I don't have high expectations," adding, "Since the overall housing market has been subdued recently, it's uncertain whether this will act as a significant positive factor."

Experts also agree that the impact of this deregulation on the market will be limited. Byungchul Lim, senior researcher at Real Estate R114, said, "Although many areas, including parts of the metropolitan area and most local regions, have been deregulated in this review, the burden of rapid housing price increases, sharp interest rate hikes, and economic downturn effects make it difficult for buying demand to recover, so the housing price weakness is expected to continue."

Concerns about interest rates and economic recession, expected to persist for some time, also forecast dark clouds over the real estate market. The September nationwide apartment occupancy outlook index released by the Housing Industry Research Institute dropped sharply by 21.9 points to 47.7 from 69.6 in the previous month. The institute explained, "Both nationwide and regional occupancy outlook indices are at their lowest since the survey began," adding, "This is likely due to concerns about economic recession caused by rapid interest rate hikes in a short period, increased loan cost burdens, and falling housing prices, which are expected to deepen the real estate transaction freeze."

◇Government Dismisses Claims That Deregulation Will Lead to Housing Price Rebound= The government's calculations seem to be somewhat reflected in this bold deregulation. While publicly announcing deregulation, they believe it is possible to control the current downward trend in housing prices without reversing it. Hyukjin Kwon, Director of the Housing and Land Office at the Ministry of Land, Infrastructure and Transport, said, "We previously lifted regulations on some local areas in June, and continuous monitoring of those areas shows that both prices and trends remain stable."

This is also confirmed by private statistics. In the 2nd Jujeongshim held in June, the government lifted the speculative overheating zone designation for six areas, including Suseong-gu in Daegu, Yuseong-gu in Daejeon, and Uichang-gu in Changwon, Gyeongnam. According to the KB Real Estate Weekly Housing Price Trend Survey, housing prices in these areas either declined or remained flat over approximately three months following the 2nd Jujeongshim. Daegu's Suseong-gu fell by 0.88%, Daejeon's Yuseong-gu by 2.19%, and Uichang-gu rose slightly by 0.16%. Dalseo-gu in Daegu, which was removed from the adjustment target area, dropped by 2.25%, and Suncheon City in Jeonnam fell by 0.67%. In reality, deregulation did not immediately lead to housing price increases.

The results of this 3rd deregulation are also expected to be similar to the situation after the 2nd removal. Youngjin Ham, head of the Zigbang Big Data Lab, said, "From the buyer's perspective, the willingness to purchase due to deregulation is not expected to be high," adding, "Since the removal of adjustment target areas is concentrated more in local regions than in the metropolitan area, and housing prices have stagnated, it will be difficult to purchase homes without considering the high mortgage interest burden."

There are also concerns that deregulation could act as a negative factor. Seunghyun Song, CEO of Urban and Economy, said, "Areas where regulations were lifted during a housing price adjustment period could be interpreted as signals that price rebounds will be difficult," adding, "Even if transactions become active in those areas, if they are mainly driven by urgent sales, it is highly likely to lead to further price declines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.