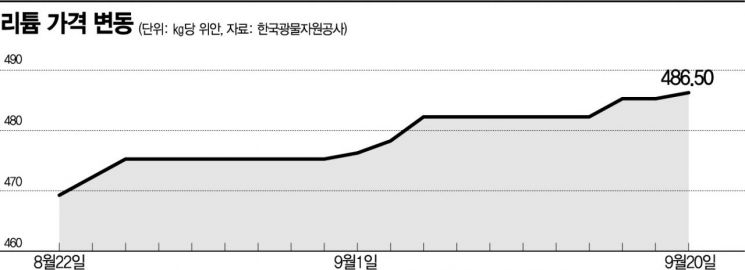

486.5 Yuan per kg on the 20th

South Korea's Dependence on China at 58%

Battery Industry Struggles to Diversify Imports

The price of lithium, a key mineral used in electric vehicle battery manufacturing, has hit a record high again in just four days. This comes as global demand for lithium surges due to the increased use of renewable energy, while major producing and refining countries are limiting supply. If the lithium price surge continues long-term, it is expected that the cost burden for domestic battery manufacturers producing finished products will also rise significantly.

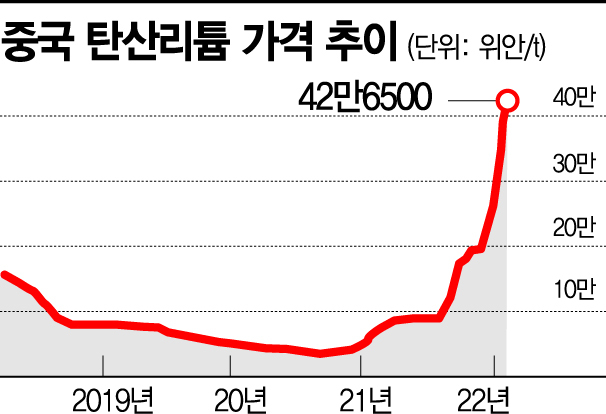

According to the Korea Resources Corporation on the 22nd, the price of lithium reached a record high of 486.5 yuan per kilogram (approximately 96,200 KRW) as of the 20th. This marks the fifth time this month alone that the record has been broken, following 485.5 yuan on the 16th. Compared to a year ago (154 yuan), the price has increased by 3.2 times.

The main factors affecting lithium prices are production volume and processing. As of last year, the global lithium reserves amounted to approximately 19.73 million tons. Annual lithium production is 104,800 tons, with over 90% produced by four countries: Australia (55%), Chile (26%), China (14%), and Argentina (6.2%).

In particular, key raw materials used in batteries such as lithium carbonate and lithium hydroxide are concentrated in South American countries and China. The problem is that these countries have recently strengthened production controls as part of a ‘resource weaponization’ policy for rare minerals. This strategy aims to maximize profits by controlling production to drive up lithium prices. In fact, Chile and Argentina ranked first and third worldwide in lithium carbonate export value in 2020. The Chilean government is also recently pushing for the nationalization of lithium mines.

China, which accounts for 60% of global lithium refining, is also facing supply shortages. This summer, some lithium refining plants in Sichuan Province, responsible for 30% of China’s lithium production, halted operations due to power usage restrictions. China’s lithium production is 14,000 tons, ranking third in the world, and its export value of battery-grade lithium hydroxide was $544 million in 2020, ranking first globally.

According to KOTRA, global lithium demand is expected to increase from 677,000 tons in lithium carbonate equivalent (LCE) this year to 947,000 tons in 2024. Especially for South Korea, which depends on imports from China for more than half (58%) of its lithium, the burden of rising refined lithium prices is growing.

This is why the Korean battery industry has recently focused on diversifying import sources by strengthening partnerships with Australian companies. Last year, POSCO Group signed a memorandum of understanding (MOU) with Australian resource development company Hancock for the development of lithium, nickel, and other mines to secure stable resources. As Chinese lithium refining prices surged, LG Energy Solution is considering converting the production line at its Nanjing plant in China to produce lithium iron phosphate (LFP) batteries next year.

Experts point out that it is urgent for the domestic battery industry to diversify the lithium supply chain, which is currently dominated by China. There are concerns that if the lithium price surge continues long-term, the cost burden could increase exponentially at the time of contract renewals.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.