US Largest Cable Operator

Comcast Wins Equipment Order

President Jeon Kyung-hoon "Will Realize Next-Generation

Communication Vision"

Benefiting Until Next Year Due to Market Growth

[Asia Economy Reporter Cha Min-young] As the global 5G market, including the United States, enters full bloom, Samsung Electronics is securing orders by leveraging its advanced technology. In addition to technological competitiveness, the fact that Huawei has been virtually excluded from the U.S. telecommunications equipment market is also seen as working in Samsung's favor.

Equipment Orders from the Largest U.S. Cable Operator

On the 22nd, Samsung Electronics announced that it had succeeded in securing an order for 5G network equipment from Comcast, the largest cable operator in the United States. Jeon Kyung-hoon, President of Samsung Electronics’ Network Business Division, said, "This Comcast order is the result of Samsung Electronics' advanced 5G technology and relentless challenges and efforts toward innovation," adding, "We will present a blueprint for the future brought by the advancement of mobile communication technology and realize the vision of next-generation communications."

Comcast has the widest Wi-Fi coverage across the United States. In 2017, it entered the mobile communication business by utilizing Wi-Fi hotspots and the Mobile Virtual Network Operator (MVNO) method of leasing wireless networks from existing mobile carriers.

Samsung Electronics plans to supply communication equipment such as 5G mid-band (3.5GHz~3.7GHz, CBRS) base stations, 5G low-band (600MHz) base stations, and wired small cell base stations for Comcast’s 5G commercial network deployment in the U.S. Among these, the wired small cell base station product being supplied this time is an integrated solution that provides the base station, radio, and antenna in a single form factor. Equipped with Samsung’s latest self-developed 2nd generation 5G modem chip, the base station is made smaller and lighter while doubling the data processing capacity compared to previous products.

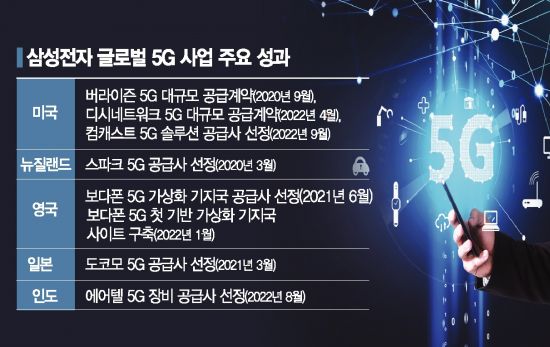

Since 2019, Samsung has been achieving equipment order successes in line with the global 5G market expansion. Previously, Samsung signed large-scale 5G equipment supply contracts with global telecom operators such as Verizon in the U.S., DISH Network in the U.S., Vodafone in the U.K., KDDI in the U.K., and Airtel in India. In addition, Samsung has secured supply contracts with many major telecom companies in Canada, New Zealand, Japan, and other countries.

Global 5G Market, Including the U.S., Enters Full Bloom

As the global 5G market enters full bloom, benefits are expected in the network equipment market through next year. The U.S. government is driving efforts to secure 5G leadership, expanding frequency supply since 2020 as part of this initiative. Verizon, the largest telecom operator in the U.S., announced at its ‘Analyst & Investor Day’ event in March last year that it plans to spend $10 billion (approximately 14 trillion KRW) over the next three years on C-band investments. According to Meritz Securities, U.S. telecom operators’ CAPEX in 2021 was forecast to increase by 15.2% year-on-year to $50.8 billion (approximately 71 trillion KRW).

Samsung’s gains are also expected to be significant. The scale of Samsung’s 5G equipment orders from Verizon in 2020 was $6.64 billion (approximately 7.9 trillion KRW). For DISH Network, which signed a contract this year, it announced plans to invest about $2.5 billion (approximately 3.51 trillion KRW) in 5G facilities this year alone, so even securing one-third of that would generate sales exceeding 1 trillion KRW.

Samsung Electronics explained that the background for its 5G equipment orders was largely due to the equipment technology accumulated since previous wireless communication standards such as 2G, 3G, and 4G (LTE). Samsung also contributed to Korea’s world-first 5G commercialization achievement on December 1, 2018, in cooperation with the country’s three telecom operators and the government.

On the other hand, it is also observed that Samsung has benefited indirectly from the U.S.-China dispute that began during former President Donald Trump’s administration in 2019. According to foreign media such as Reuters, Canada recently finalized a policy to exclude Chinese companies from its 5G business. In the West, including the U.S., concerns about ‘backdoors’ (unauthorized access to networks) have led to a trend of banning the use of 5G equipment from Chinese telecom equipment manufacturers such as Huawei.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.