Approved for trading by 24 Securities Firms, Available from the 26th... No Expectation of Effectiveness

Only 6 Stocks Over 500,000 Won "Defeats the Purpose of Easy Investment in High-Priced Blue Chips"

[Asia Economy Reporter Lee Seon-ae] Finally, the domestic stock market will also begin fractional share trading. However, the atmosphere is cold as expectations grow that it will be difficult to achieve the initial goal of revitalizing trading. Although investors can buy desired stocks for as little as 1,000 won, the sluggish domestic stock market has led investors to turn away from the market, and there are few stocks priced above 500,000 won, let alone the so-called "emperor stocks" priced over 1 million won, leading to a judgment that demand will be lacking. Securities firms also seem to be taking a cautious approach. The mood, which initially raised strong voices demanding the allowance of fractional share trading, has completely reversed, and it is expected that there will not be many securities firms launching the actual service for the time being.

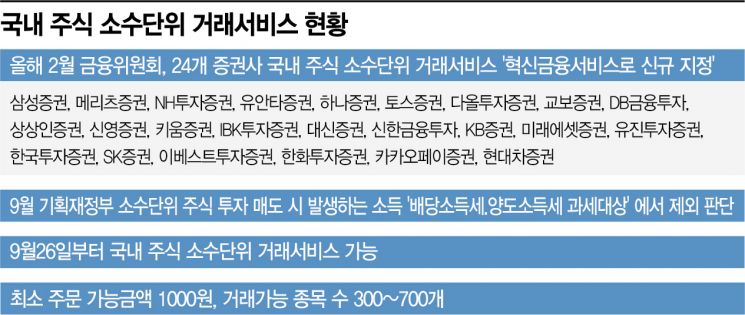

According to the financial investment industry on the 22nd, a total of 24 securities firms, including Mirae Asset Securities, Korea Investment & Securities, NH Investment & Securities, Samsung Securities, KB Securities, and Kiwoom Securities, have received approval for fractional share trading, and the service can officially begin from the 26th. KB Securities will take the first step by starting the service on the 26th. Samsung Securities has decided to implement it from October. However, others have not yet decided on a specific timeline. Some securities firms are reportedly considering introducing it by the end of the year or early next year. It is interpreted that they believe it is not too late to implement the service after observing market reactions.

The lukewarm atmosphere is mainly due to investor withdrawal caused by the sluggish stock market. The reason securities firms initially raised their voices for allowing fractional share trading was to expand the stock market base, as the MZ generation (Millennials + Generation Z) had entered the market after COVID-19 but faced limitations in purchasing high-priced blue-chip stocks. Fractional share trading was seen by the financial investment industry as having the effect of increasing liquidity and activating trading without changing the company's value or profits, similar to a stock split.

However, now the market is stagnant due to sluggish stock performance, and investor withdrawal is accelerating. There are no "emperor stocks" priced over 1 million won. Moreover, while there were 10 stocks priced over 500,000 won as of March this year, only six remain as of the previous day. This raises doubts about whether there will be demand to buy fractional shares for 1,000 won. A representative from a major securities firm said, "We are only preparing the IT service from a service perspective, but we do not expect significant effectiveness," adding, "We need to watch the market situation."

Another representative from a small to medium-sized securities firm also said, "There are about 60 stocks with a domestic market capitalization of 1 trillion won, daily trading volume of 200,000 shares, and stock price above 50,000 won, and only about half of these have prices above 100,000 won. It is doubtful whether investors will engage in fractional share trading," adding, "It will not be as active as the U.S. market." For comparison, currently in the U.S., there are about 950 stocks with a market capitalization of 2 billion dollars, trading volume of 200,000 shares, and stock price above 50 dollars, and about 460 stocks priced above 100 dollars.

One reason fractional share trading is seen as having low contribution to market revitalization is that it is difficult to respond immediately to market conditions. Additionally, since voting rights are prohibited and shareholder rights are restricted, there are opinions that the institutional effect will be minimal. The Fair Trade Act is also an obstacle. The Korea Fair Trade Commission issued an official interpretation stating that if securities firms belonging to business groups restricted from cross-shareholding introduce fractional share trading services for affiliate stocks, it may violate the prohibition on mutual and circular shareholding. The securities firms concerned are Samsung Securities, Hyundai Motor Securities, Kakao Pay Securities, Korea Investment & Securities, and Hanwha Investment & Securities. Fractional share trading is prohibited for Samsung Securities on ▲Samsung C&T and ▲Samsung Life Insurance; for Hyundai Motor Securities on ▲Hyundai Motor, ▲Kia, ▲Hyundai Glovis, ▲Hyundai Mobis, and ▲Hyundai Steel; for Kakao Pay Securities on ▲Kakao and ▲Kakao Pay. Korea Investment & Securities cannot offer fractional share trading for Korea Investment Holdings, and Hanwha Investment & Securities cannot for ▲Hanwha Solutions and ▲Hanwha Life Insurance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.