Jusan-yeon, 'September Housing Business Outlook Index'

September Housing Business Sentiment Index Trends / Data provided by Korea Housing Industry Research Institute

September Housing Business Sentiment Index Trends / Data provided by Korea Housing Industry Research Institute

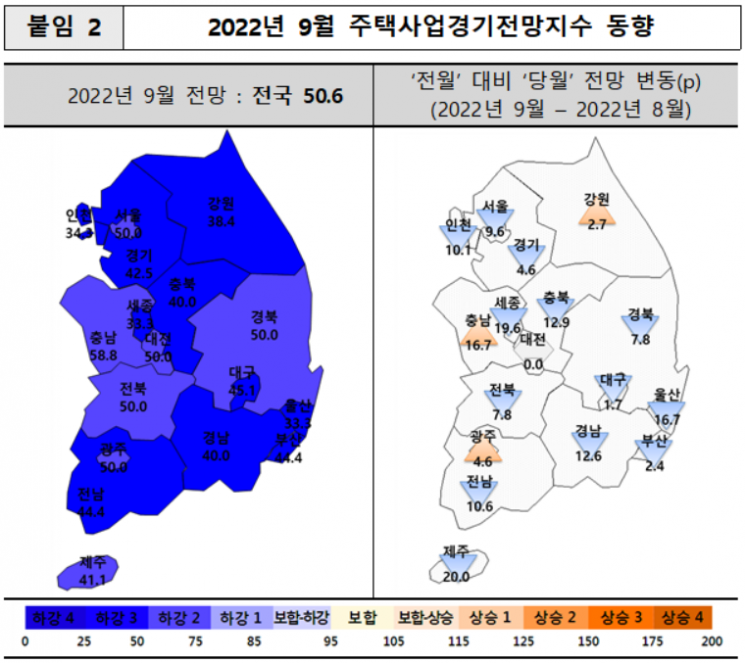

[Asia Economy Reporter Hwang Seoyul] The nationwide housing business outlook for September is predicted to improve slightly compared to last month. However, the overall downward trend remains unchanged, with the metropolitan area and provincial major cities continuing to decline.

According to the 'September Housing Business Outlook Index' released on the 22nd by the Housing Industry Research Institute (hereafter HIRI), the national outlook index for this month stands at 50.6, a slight increase of 1.3 points compared to August.

The Housing Business Outlook Index is calculated monthly through surveys of housing business operators regarding their business performance and outlook. It is a supply market indicator that comprehensively assesses the housing business from the supplier's perspective. The survey targets members of the Korea Housing Association and the Korea Housing Builders Association. The index baseline is 100, with values below 85 indicating a downturn phase, 85 to less than 115 indicating a stable phase, and 115 or above indicating an upturn phase.

Despite the slight improvement in the national index, the metropolitan area and large cities maintained a downward trend. This month, the housing business outlook index for the metropolitan area was 42.3, down 8.1 points from the previous month. Seoul (50.0), Incheon (34.3), and Gyeonggi (42.5) each fell by 9.6 points, 10.1 points, and 4.6 points respectively.

Regions outside the metropolitan area (44.2) are also expected to decline by 6.3 points compared to the previous month. However, Gwangju (45.4→50.0), Gangwon (35.7→38.4), and Chungnam (42.1→58.8) are predicted to rise compared to last month, while Daejeon is expected to maintain a stable trend at 50.0.

The material supply index (77.1), financing index (52.7), and labor supply index (75.0) for September each fell by 2.6 points, 13.9 points, and 2.0 points respectively compared to the previous month. HIRI stated, “Due to the base interest rate hike and reluctance toward real estate PF loans, many development projects are being halted or delayed,” adding, “It is expected that the construction industry and housing market downturn will continue for a considerable period, necessitating government-level countermeasures.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.