[Asia Economy New York=Special Correspondent Joselgina] The U.S. central bank, the Federal Reserve (Fed), which has implemented three consecutive giant steps (0.75 percentage point rate hikes), indicated through its dot plot that the benchmark interest rate will reach the high 4% range next year. This suggests a more aggressive tightening than the market had expected.

On the 21st (local time), the Fed announced after the Federal Open Market Committee (FOMC) regular meeting that it would raise the federal funds rate by 0.75 percentage points from the previous 2.25-2.50% to 3.0-3.25%. This is the highest level since January 2008. Despite the high-intensity tightening, inflation has been stubborn, leading to three consecutive giant steps. The interest rate gap between Korea and the U.S. has widened again.

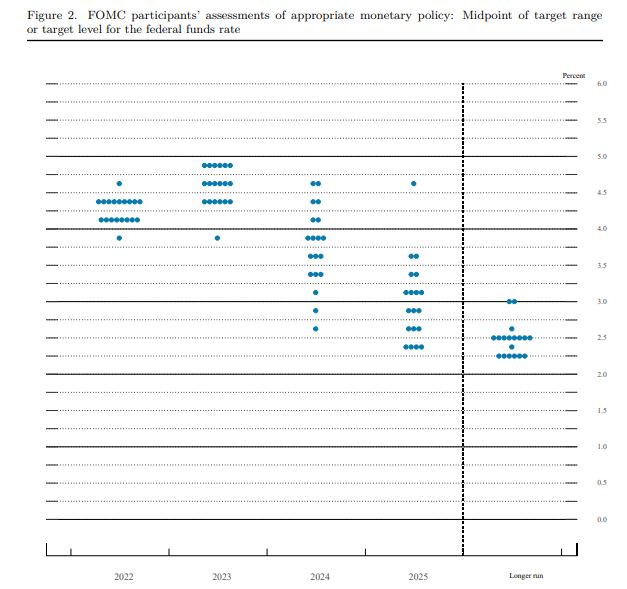

The released dot plot confirmed that FOMC members’ rate forecasts have been revised upward. The median rate for the end of this year rose by 1 percentage point from June to 4.4%. Among the 19 FOMC members, 9 projected 4.25-4.50%, and 8 projected 4.00-4.25%. Even excluding today’s giant step, this signals large rate hikes in the remaining two meetings this year.

By the end of next year, the rate is expected to rise to 4.6%, then fall to 3.9% by the end of 2024, and 2.9% by the end of 2025. Notably, 6 of the 19 FOMC members forecast rates will increase to 4.75-5.00% next year, leaving open the possibility of reaching the 5% range. This exceeds the 4.4% level presented in the economic outlook.

Following the announcement of high-intensity tightening, the New York stock market immediately gave up gains and turned downward. In the New York bond market, the yield on the U.S. 2-year Treasury note, sensitive to monetary policy, surpassed 4.1% immediately after the Fed’s rate hike announcement. This is the highest since 2007. The 10-year yield also rose to around 3.614%.

Fed Chair Jerome Powell is currently holding a press conference starting at 2:30 p.m.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.