Gyeonggi Dongducheon, Yangju, Paju, Pyeongtaek, Anseong 5 Areas Selected for Deregulation

Incheon and Sejong Removed from Speculative Overheated Zones, Retain Adjustment Areas

"Considering Recent Housing Market Conditions... No Sharp Price Rise Expected Even After Deregulation"

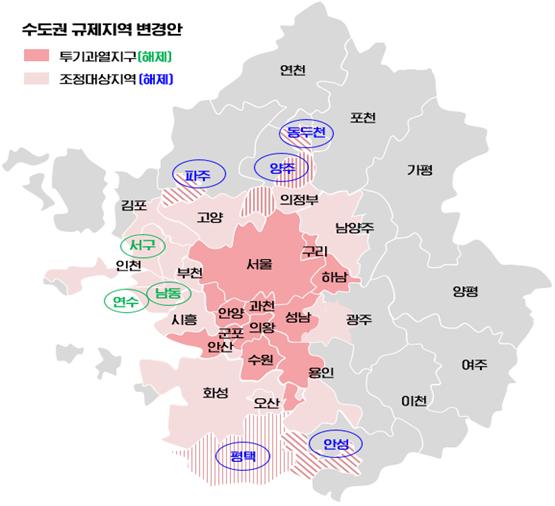

Amid a nationwide decline in housing prices, the government has decided to lift the designation of ‘adjustment target areas’ for all regions except Sejong City. In the Seoul metropolitan area, the speculative overheated district designation for Incheon, where the decline has been steep, will be lifted, but the adjustment target area status will be maintained. Additionally, five areas including Dongducheon, Yangju, Paju, Pyeongtaek, and Anseong will have their adjustment target area status lifted. However, the current regulatory status in Seoul will remain unchanged.

Although there are concerns that this deregulation could reverse the recent downward trend in housing prices, the government explained that the decision was made after comprehensively considering factors such as interest rate hikes and the macroeconomic environment. Some regulations were lifted in certain areas in June, but no signs of a housing price rebound have appeared since then.

◆Speculative Overheated Districts Reduced from 43 to 39, Adjustment Target Areas from 101 to 60

On the 21st, the government held the 3rd Residential Policy Deliberation Committee (Jujeongshim) and the 61st Real Estate Price Stabilization Deliberation Committee, where they reviewed and approved the 'Adjustment Plan for Speculative Overheated Districts and Adjustment Target Areas' and the 'Plan to Lift Housing Speculative Districts (Designated Areas) in September 2022.'

First, the Ministry of Land, Infrastructure and Transport (MOLIT) made significant adjustments to regulatory areas at the Jujeongshim by comprehensively considering market conditions such as housing prices.

Adjustment target areas in local regions (excluding Sejong) and some outer areas of the Seoul metropolitan area were lifted, and speculative overheated district designations in Incheon and Sejong, excluding Seoul and Gyeonggi Province, were removed.

In local areas, all currently designated adjustment target areas will be lifted, including the entire Busan area such as Haeundae, Suyeong, and Yeonje districts; Suseong District in Daegu; Gwangju; Daejeon; Ulsan; Chungbuk; Cheongju; Cheonan, Gongju, and Nonsan in Chungnam; Wansan and Deokjin in Jeonbuk Jeonju; Nam-gu in Pohang, Gyeongbuk; and Changwon and Seongsan districts in Gyeongnam.

Jujeongshim members judged that "considering the recent price declines, reduced transaction volumes, increased unsold housing, and the effects of lifting regulations in the first half of the year, it is necessary to lift all adjustment target areas in local regions."

In the case of Sejong City, the speculative overheated district designation will be lifted considering the recent continuous expansion of housing price declines, but the adjustment target area status will be maintained due to the relatively low unsold housing and high subscription competition rates.

With this decision, the number of speculative overheated districts will decrease from 43 to 39, and adjustment target areas will be reduced from 101 to 60.

However, most areas in Seoul and the metropolitan area still have relatively few unsold houses, and there remains a possibility of market instability due to expectations of deregulation, so regulatory areas will be maintained.

In Gyeonggi Province, some adjustment target areas located in border and outer regions will be lifted. Five areas including Anseong, Pyeongtaek, Yangju, Paju, and Dongducheon are included in the deregulation targets.

Although the Seoul metropolitan area generally continues to experience a downward trend, Seoul and adjacent areas will maintain regulatory status and continue to monitor market conditions. This is due to the relatively low number of unsold houses and the potential for market instability stemming from deregulation expectations.

In Incheon, considering the significant price decline, the speculative overheated district designation will be lifted first. In Gyeonggi Province, some adjustment target areas located in border and outer regions will be lifted.

Kwon Hyuk-jin, Director of the Housing and Land Office at MOLIT, said, "The Residential Policy Deliberation Committee decided to lift regulatory areas after comprehensively considering factors such as the recent downward stabilization of housing prices, decreased housing transaction volumes, and continuous interest rate hikes. The prevailing opinion was that the Seoul metropolitan area should be monitored for market conditions for the time being."

The government expects the impact on housing prices from this deregulation to be minimal.

Director Kwon said, "Regulations were previously lifted in some local areas in June, and monitoring since then shows that prices and trends have remained stable." This means that deregulation does not immediately lead to housing price increases.

The government rather holds the position that the recent downward stabilization of housing prices should continue. Director Kwon added, "Since housing prices have risen sharply mainly in the Seoul metropolitan area until recently, the downward stabilization should be maintained a bit longer."

The approved measures will take effect from 0:00 on Monday, September 26, after publication in the official gazette.

◆Regulatory Intensity Order: Speculative District > Speculative Overheated District > Adjustment Target Area

The government classifies and regulates areas according to the degree of housing market overheating, in the order of adjustment target areas, speculative overheated districts, and speculative districts.

Among these, speculative overheated districts have the highest regulatory intensity and the most types of regulations. Twenty regulations are applied simultaneously, mainly focusing on redevelopment projects such as reconstruction. In particular, regulations on reconstruction and redevelopment projects are strong. When acquiring housing, submission of a financing plan and supporting documents is required.

Regarding the loan-to-value ratio (LTV), for houses priced at 900 million KRW or less, 40% applies; for the 900 million to 1.5 billion KRW range, 20% applies. Loans are prohibited for apartments priced above 1.5 billion KRW. The debt-to-income ratio (DTI) is also set at 40%.

Adjustment target areas apply the subscription-related regulations extracted from those of speculative overheated districts. This time, the designation was lifted for all local areas except Sejong. However, all of Seoul and most of Gyeonggi Province remain designated as adjustment target areas.

When designated as an adjustment target area, tax measures are strengthened, including imposing acquisition tax and capital gains tax surcharges on multi-homeowners and additional comprehensive real estate tax.

For LTV, 50% applies to houses priced at 900 million KRW or less, and 30% applies to houses priced above 900 million KRW. The DTI is set at 50%. These are all 10 percentage points lower than those for speculative overheated districts.

Speculative districts designated by the Ministry of Economy and Finance have loan regulations such as LTV and DTI similar to those of speculative overheated districts. In fact, they do not have tax regulations that adjustment target areas have. Initially, speculative districts were classified as the most strictly regulated areas, but now they are operated similarly to speculative overheated districts. Due to overlapping regulations, the government plans to review the system.

With MOLIT lifting Sejong City from the speculative district designation, only 15 districts remain as speculative districts in Seoul. These 15 areas include the 'Gangnam 3 districts' (Gangnam, Seocho, Songpa), the 'Mayongseong' area (Mapo, Yongsan, Seongdong), districts with many reconstruction sites such as Yangcheon, Yeongdeungpo, Nowon, Gangdong, Gangseo, and central districts including Jongno, Dongdaemun, and Jung-gu.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.