[Asia Economy Reporter Park Sun-mi] The semiconductor industry, which is currently passing through a recession tunnel amid a slowdown in global IT consumption in the second half of the year, is expected to endure double-digit declines in memory semiconductor prices in the fourth quarter as well. Although the impact of falling semiconductor prices is expected to be fully reflected in the third-quarter earnings to be announced next month, the semiconductor industry maintains its stance to continue investment in expansion for the time being.

According to the industry on the 24th, the slowdown in global IT consumption in the second half of the year is intensifying, making it inevitable to enter a full-fledged memory semiconductor inventory adjustment cycle in the fourth quarter. Dark forecasts suggest that the already declining sales trend is likely to worsen. This is because a vicious cycle is repeating in the market: oversupply of DRAM → increase in customer DRAM inventory → DRAM price decline → increase in supplier inventory.

For this reason, the bit growth (production increase rate converted to bit units) of DRAM demand this year is expected to be a record low of 8%. Considering that both demand and supply bit growth have maintained an average of around 20% for over 10 years since the DRAM market became oligopolistic in 2012, this is a very unusual situation. The semiconductor demand growth rate is also expected to fall short of even half of the 18% forecast presented earlier this year.

In fact, market research firm TrendForce diagnosed that the fixed transaction prices of memory semiconductors DRAM and NAND flash fell by about 1% in August, and the price decline trend is expected to continue in September as well.

They forecast that DRAM prices will drop by 13-18% in the fourth quarter. This follows a predicted 10-15% decline in the third quarter, indicating a continued downward trend in the fourth quarter. Despite price adjustments, IT product sales are not recovering due to high inventory levels. Cha Min-sook, an analyst at Korea Investment & Securities, said, "Since there is no improvement in the Chinese smartphone market to recover DRAM demand, Samsung Electronics and SK Hynix's third-quarter DRAM shipments are likely to shrink compared to the previous quarter," adding, "Following the third quarter, DRAM prices are bound to continue double-digit declines in the fourth quarter."

Expectations for the third-quarter earnings of Samsung Electronics and SK Hynix, which lead the global memory semiconductor market, are also declining. In the third-quarter earnings announcement scheduled for next month, Samsung Electronics' operating profit consensus (average forecast by securities firms) is projected to decrease by 16% year-on-year to 13.2892 trillion won, while SK Hynix's is expected to fall by 35% to 2.7098 trillion won.

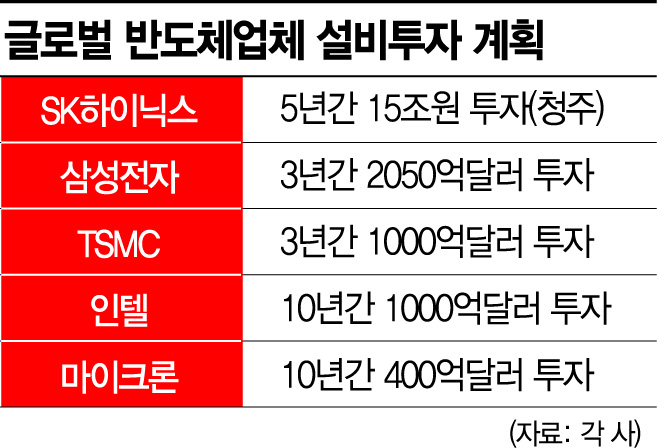

Despite the bleak market situation, the semiconductor industry insists it will not reduce long-term investments immediately. SK Hynix plans to invest 15 trillion won by 2025 to build a new semiconductor plant, M15X, in Cheongju, Chungbuk. Samsung Electronics has only partially started operating its Pyeongtaek Campus Line 3 but has already begun preparations for the construction of Line 4 expansion, and Lines 5 and 6 are also undergoing infrastructure acquisition work. Kyung Kye-hyun, President of Samsung Electronics' DS Division, said, "If we reduce investments during a recession, it leads to poor results during a boom, so rather than relying on market ups and downs, steady investment is the right approach."

The beneficiaries are the affiliated construction companies that continue to receive orders due to semiconductor plant expansions. Samsung C&T, which won a contract worth over $1.9 billion in July for the construction of Samsung Electronics' foundry plant in Taylor, USA, is optimistic about the expanding semiconductor plant expansion plans in Korea.

Because Samsung C&T has mainly been responsible for construction of Samsung Electronics' semiconductor plants due to technology security reasons, the lines scheduled for expansion at the Pyeongtaek Campus are also inevitably structured to be contracted to Samsung C&T.

Choi Nam-gon, an analyst at Yuanta Securities, said, "Samsung C&T's construction orders in the first half of the year reached about 8.6 trillion won, achieving 73% of the annual forecast of 11.7 trillion won, thanks to orders for Samsung Electronics' Pyeongtaek semiconductor Line 3 and the Taylor plant in the U.S.," and added, "This year's new order performance is expected to reach around 15 trillion won, exceeding the annual guidance by about 30% due to strong high-tech and overseas project results."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)