Only 200 Anti-Money Laundering Personnel in Virtual Asset Industry

FIU "High Money Laundering Risks, Insufficient Prevention Efforts"

Suspicious Transactions Surge Tens of Thousands as Bitcoin Drops 30%

Industry "Dedicated Teams Exist, No Money Laundering Incidents"

[Asia Economy Reporters Song Seung-seop, Lee Myung-hwan] Illegal money laundering, once involved, leads to a decline in trust across the domestic financial sector and sanctions. Virtual assets, which offer high anonymity, are particularly at high risk of being involved in money laundering and financing of public threats. In South Korea, a surge in suspicious transaction reports in the financial sector has been observed whenever Bitcoin prices plummet. There are calls for special countermeasures from related agencies and the market.

The apparent reason for the increase in suspected money laundering transactions in the domestic financial sector lies in the system. The FIU completed the next-generation anti-money laundering information system project over 22 months in March last year. The number of institutions linked to suspicious transaction information was increased, and functions such as enhanced information search capabilities and dedicated account and individual programs were introduced for analysis. As the financial sector improved its systems, it detected suspicious financial transactions that were previously unnoticed, leading to an increase in suspicious transaction reports. [Related article: Korea is no longer a safe zone for money laundering]

High Risk of Virtual Currency Money Laundering Involvement... "Insufficient Prevention Efforts"

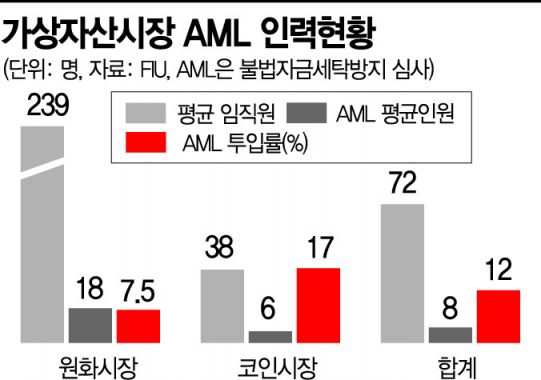

However, the fundamental background involves virtual assets. According to a survey conducted by the FIU at the end of last year targeting 29 virtual asset service providers, the total number of anti-money laundering (AML) personnel in the virtual asset market was 200. The average was 18 for the Korean won market and 6 for the coin market. This represents 12% of the 1,717 people working in the virtual asset market. Among them, 31% were employees who did not exclusively handle AML but performed it alongside other duties.

The FIU holds the view that virtual asset service providers’ preparations are insufficient. Despite increasing concerns about money laundering through virtual assets, the FIU criticized the lack of anti-money laundering efforts by virtual asset service providers. The FIU stated, "(Virtual asset service providers) were found not to have secured sufficient dedicated personnel for anti-money laundering," adding, "Efforts to prevent money laundering, such as securing dedicated AML personnel, are required."

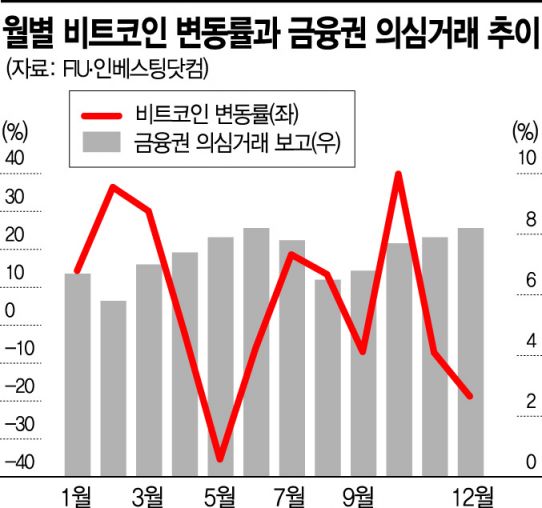

Due to anonymity, virtual assets have a high potential for misuse in illegal financial transactions. In South Korea last year, a pattern was observed where suspicious transaction reports from financial companies increased whenever Bitcoin prices fell. From January to March last year, Bitcoin prices surged by about 15-35% each month. During that time, suspicious transaction reports in the financial sector were around 50,000 to 60,000 cases. However, when prices plummeted by more than 30% starting in April, suspicious transactions surged to 80,000 cases in June. When prices rose again in July and August, suspicious transactions decreased, but they increased again in November and December as prices fell.

There were actual cases where attempts to launder money using virtual assets were detected. Last year, virtual asset exchange A was caught after receiving funds from multiple individuals, transferring them to a specific individual's account, purchasing virtual assets through another exchange, and then moving the proceeds to the account of CEO A. This is a typical money laundering method where assets are bought when prices are low, and profits are siphoned off to desired accounts using exchanges.

Severe Sanctions if Wrongly Involved... "Substantial Money Laundering Prevention Needed"

The problem is that even if only one exchange is involved in money laundering, it causes significant damage to the entire domestic financial market. The situation worsens if linked to international financial transactions. The U.S. regulations on money laundering are known to be strict and demanding. If linked to terrorist organizations or sanctioned countries, U.S. financial authorities hold institutions responsible for failing to prevent money laundering, regardless of intent. In severe cases, normal financial services may be disrupted both overseas and domestically.

Virtual asset exchanges are also connected to banks. According to the Specific Financial Information Act enforced on March 25 last year, financial companies must verify basic information, segregation of deposits and proprietary assets, and certification of information security management systems when dealing with virtual asset service providers. If a virtual asset service provider has not reported to the FIU or is judged to pose a high risk of money laundering, financial transactions must be refused.

Nevertheless, stakeholders in the virtual asset market claim that current preparations are sufficient. A representative from a virtual asset exchange explained, "Two to three years ago, exchanges lacked personnel before entering the legal system, but recently, they have organized anti-money laundering teams and increased staff, resulting in almost no incidents," adding, "Although exchanges have an image of being vulnerable to money laundering, we want to emphasize that we are working hard."

Experts advise that since exchanges are passive in measures such as real-name account verification and building anti-money laundering systems, efforts and regulations to prevent money laundering should be strengthened. A representative from academia related to virtual assets said, "Exchanges tend to neglect the efforts required for real-name account systems," and added, "It is necessary to sufficiently reinforce personnel and ensure they fulfill their roles so that substantial money laundering prevention is effectively implemented."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.