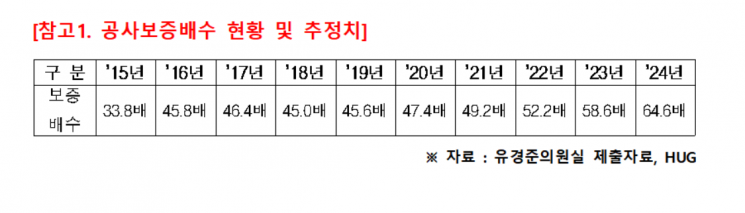

Capital-to-Guarantee Amount Ratio Expected to Reach 64.6 Times in 2024

Under Current Law, Guarantee Supply Halts if Corporation’s Guarantee Amount Exceeds 60 Times Capital

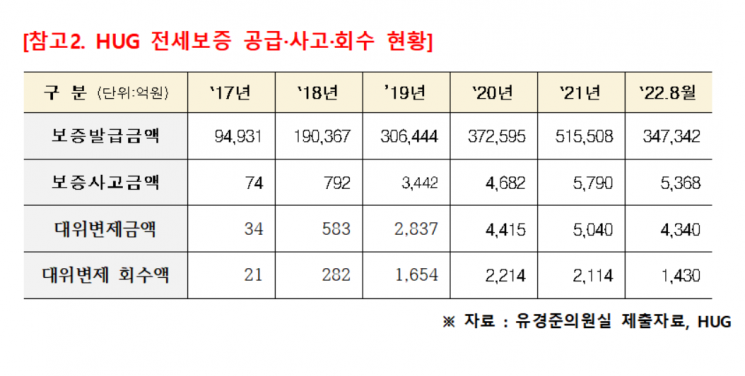

Approximately 720 Billion KRW Losses in Last 6 Years Due to Jeonse Deposit Return Guarantees

[Asia Economy Reporter Kim Min-young] There is a diagnosis that the Housing Guarantee Corporation (HUG)'s 'Jeonse Deposit Return Guarantee' may be suspended.

According to an analysis of the 'Corporation Guarantee Multiple Status and Estimates' data submitted by HUG to People Power Party lawmaker Yoo Kyung-jun, the Housing Guarantee Corporation’s guarantee operation multiple, which indicates financial soundness, is expected to reach 64.6 times in 2024, putting the 'Jeonse Deposit Return Guarantee' subscription at risk of suspension. The corporation’s guarantee multiple was 33.8 times in 2015, increased to 45.0 times in 2018, and rose from 49.2 times last year to 52.2 times this year.

According to the current 'Housing and Urban Fund Act,' the corporation’s total limit must not exceed 60 times its own capital, and if it exceeds 60 times, the corporation cannot supply any guarantee products. If the guarantee multiple exceeds 60 times in 2024, HUG’s Jeonse Deposit Return Guarantee may be suspended. On the 1st of this month, the government promised to support guarantee fees to expand subscriptions to the 'Jeonse Deposit Return Guarantee' system, which currently has only an 18% subscription rate due to the burden of guarantee fees, as a measure to prevent Jeonse fraud. If subscriptions increase, the guarantee multiple will inevitably grow accordingly.

However, concerns are rising that if the number of subscribers increases amid the current surge in Jeonse guarantee accidents and the deterioration of HUG’s financial structure, the financial deterioration could accelerate.

The amount of guarantee accidents at HUG has sharply increased every year from 7.4 billion KRW in 2017 to nearly 580 billion KRW last year, with approximately 540 billion KRW in guarantee accidents as of August this year. The scale of deposits repaid by HUG due to the surge in guarantee accidents is also increasing. The amount of subrogation payments made by HUG rose from 3.4 billion KRW in 2017 to 500 billion KRW in 2021. As of August this year, subrogation payments reached 430 billion KRW, and if this trend continues, it is expected to surpass last year’s repayment amount.

The surge in Jeonse guarantee accidents also raises concerns about HUG’s financial deterioration. HUG realized guarantee income of about 13.2 billion KRW in 2017, but from 2018, guarantee losses sharply increased, totaling 720 billion KRW over the past six years.

As losses grew, HUG’s 'solvency ratio,' which was 524% in September 2019, was halved to 216% in less than a year.

Lawmaker Yoo Kyung-jun emphasized, "To prevent the suspension of subscriptions to the 'Jeonse Deposit Return Guarantee,' which is a direct means of protecting citizens from Jeonse fraud, increasing government capital injection into HUG must be prioritized." He added, "Subsequently, the Ministry of Land, Infrastructure and Transport needs to not only increase support for guarantee fees to expand subscriptions but also present alternatives to handle the increased demand for Jeonse guarantees."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.