Direct Acquisition of Related Companies Including Yuhan, CJ, hy, and Genome & Company

Market Size Expected to Reach 151 Trillion KRW in 2023

No Commercialized Drugs Yet

US-based Ceres Recently Completed Phase 3 and Applied for FDA Approval

Domestic Competition Among Gobio Lab, CJ, and Genome & Company in Development

[Asia Economy Reporter Lee Chun-hee] Can diseases be cured with microorganisms? Recently, the domestic pharmaceutical and bio industries have been fiercely competing to secure the microbiome market as a future growth engine by curing diseases with microorganisms.

According to the industry on the 19th, Yuhan Corporation recently acquired AtoGen, a microbiome therapeutic company. AtoGen, a subsidiary of cosmetics company TonyMoly, has been developing microbiome therapeutics for various diseases such as metabolic diseases, immune diseases, and muscular diseases based on its independently developed platform.

Yuhan Corporation plans to first secure the position of the largest shareholder of AtoGen through an existing stock acquisition and then acquire additional shares through a separate paid-in capital increase early next year. Through this, it aims to expand the development of microbiome-based therapeutics and the functional probiotics business.

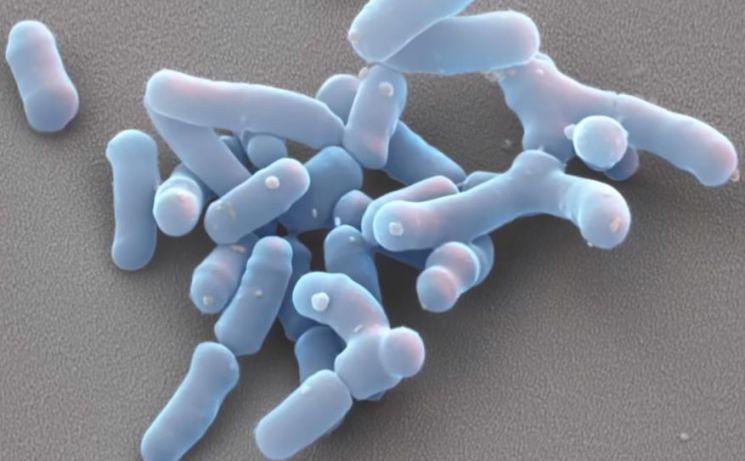

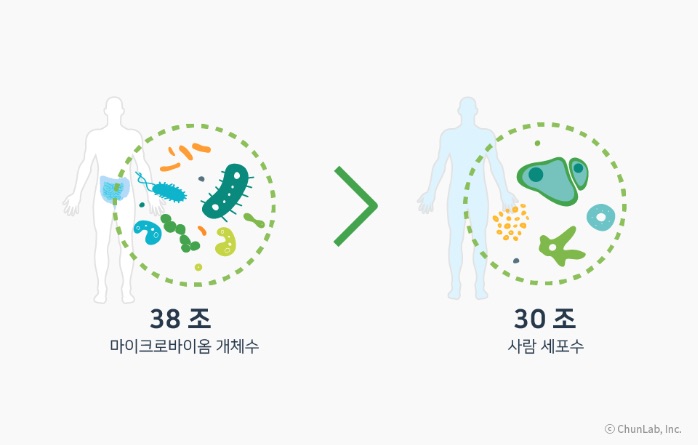

Microbiome is a compound word of micro (microorganism) and biome (ecosystem). It refers to the tens of trillions of microorganisms and their genes existing inside the human body. It is generally known that an adult weighing 70 kg has about 38 trillion microorganisms. As it has been revealed that various diseases such as psoriasis, gastroesophageal reflux disease, obesity, colitis, and cardiovascular diseases are associated with each individual's microbiome, a new approach to curing diseases through this is being pursued.

According to the Ministry of Science and ICT, the global microbiome market size is estimated to grow from $87.2 billion (approximately 121.5 trillion KRW) in 2020 to $108.7 billion (approximately 151.5 trillion KRW) next year, gaining attention as a new modality (therapeutic approach).

Accordingly, cases of large corporations or pharmaceutical and bio companies directly acquiring microbiome-related companies to enter the industry are also increasing. Besides Yuhan Corporation, the market is rapidly growing with companies such as CJ CheilJedang, hy, and Genome & Company.

CJ CheilJedang re-entered the pharmaceutical and bio industry, which seemed to have withdrawn after selling CJ Healthcare (now HK Innoen), by acquiring ChunLab (now CJ Bioscience) last year. It is actively conducting research and development (R&D) with the goal of holding 10 candidate substances and achieving 2 technology exports by 2025.

The continuous acquisition rumors surrounding Xenofocus, which is evaluated to have considerable technological capabilities in the microbiome field, are also believed to be related to this situation. Xenofocus was once rumored to be acquired by Harim, but it was soon proven false, and currently, various companies including Lotte Group are reportedly attempting to acquire it.

Genome & Company also entered the microbiome CDMO (Contract Development and Manufacturing Organization) business by acquiring the U.S. microbiome CDMO company ListLab last year. ListLab is a microbiome CDMO company with 44 years of history, equipped with advanced country’s current Good Manufacturing Practice (cGMP) standards and has a track record of producing numerous microbiome pharmaceuticals.

Although not through direct acquisition, companies entering the microbiome business through R&D cooperation with specialized companies are also increasing. Anguk Pharmaceutical signed a business agreement on the 7th with microbiome venture company V-One Bio to develop 'One Health Microbiome-based Immuno-oncology Drugs.' The plan is to combine Anguk Pharmaceutical’s immuno-oncology R&D capabilities with V-One Bio’s microbiome research platform technology to develop immuno-oncology drugs.

Chong Kun Dang Bio signed an agreement in July with Yonsei University Medical Center Industry-Academic Cooperation Foundation to establish a joint clinical research center for microbiome and to jointly research and develop microbiome therapeutics. Through this, a joint clinical research center for microbiome will be established within Severance Hospital, and R&D on microbiome therapeutics will be pursued for diseases with high demand for treatment development such as inflammatory bowel disease, Alzheimer’s dementia, and respiratory infectious diseases.

Hy, a lactic acid bacteria specialist company (formerly Korea Yakult), also started joint development of live biotherapeutic products (LBP) with microbiome new drug developer Immunobiome.

However, no microbiome therapeutics have been commercialized worldwide yet. Attention is focused on whether the first microbiome new drug will emerge as Seres Therapeutics in the U.S., which is leading the field, successfully completed the Phase 3 clinical trial of its Clostridium difficile infection (CDI) therapeutic candidate 'SER-109.' Seres Therapeutics applied for FDA approval for the use of SER-109 in June.

Domestically, Gobio Lab is considered the most advanced. 'KBL697,' being developed as a psoriasis treatment, is undergoing Phase 2 clinical trials, and at the same time, the Phase 2a clinical trial plan (IND) for ulcerative colitis has also been submitted to the FDA.

In addition, Genome & Company’s 'GEN-001,' developed as an immuno-oncology drug, is in Phase 2 clinical trials, with interim results expected next year. CJ Bioscience is also developing anticancer drugs such as 'CLCC1' and 'CJRB-101.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)