If the USD/KRW exchange rate rises by 10%

Daesang operating profit sensitivity 11%

KT&G operating profit improves by 5%

Strong grain price trend until next year

Food stocks expected to see significant earnings improvement next year

[Asia Economy Reporter Ji Yeon-jin] Recently, as abnormal weather events have been occurring frequently, especially in Europe, concerns have arisen that food stocks may be hit due to the possibility of grain prices rising again. However, the key variable determining the corporate value of food companies is the recently soaring dollar, and an assessment considering the impact of exchange rates is necessary.

According to a report published by Hana Securities on the 19th, global abnormal weather events such as record droughts following this summer's heatwave are attributed to La Ni?a. La Ni?a is a phenomenon where the sea surface temperature near the equator in the eastern Pacific Ocean remains at least 0.5℃ below average for more than five months, and it has occurred five times in the past decade. Among these, La Ni?a has led to grain price increases twice.

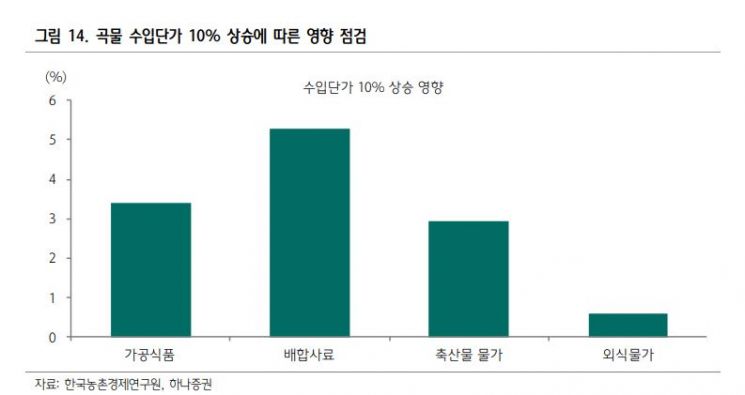

Shim Eun-joo, a researcher at Hana Securities, stated, "With the resumption of Ukrainian grain exports, supply chain issues are easing, and the actual global grain stock-to-use ratio is being maintained at a stable level," adding, "Considering the economic conditions of emerging countries including China and the strength of the dollar comprehensively, the possibility of a short-term sharp rise in grain prices is limited." Hana Securities expects grain prices to maintain a firm trend until the end of the year but forecasts a weakening trend after next year when La Ni?a ends.

The issue lies with the won-dollar exchange rate. The dollar's upward trend is currently pausing just below 1,390 won. If this trend continues, the average exchange rate in the third quarter of this year is estimated to rise by 15.7% compared to the same period last year, and by 14.9% in the fourth quarter. When the won-dollar exchange rate rises by 10%, Daesang's operating profit is expected to decrease by 11.5%, SPC Samlip and CJ CheilJedang are expected to decrease by 7.6% and 2.0%, respectively, whereas KT&G is estimated to see a 5.5% improvement in consolidated operating profit with a 10% rise in the exchange rate.

According to the Korea Rural Economic Institute, this year, the increase rates in raw material costs for food and beverage companies were 3.0% for bread, 3.3% for beverages, 7.5% for snacks, 12.8% for noodles, 17.9% for coffee and cocoa, 23.4% for sugar, 27.8% for edible oils, and 41.5% for flour milling, with significant cost burdens in sugar, edible oils, and flour milling. However, food and beverage companies have already implemented price increases of around 11% over the past two years. Researcher Shim recommended CJ CheilJedang, Nongshim, and Daesang, stating, "Next year, companies with relatively high exposure to grain prices and those that have timely implemented price increases will see performance momentum highlighted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.