Semiconductor Slump... Image Sensor Sales Decline for First Time in 13 Years

Recovery Expected from 2023 with Market Rebound in 2024

Sony Leads Image Sensor Market Share, Samsung Electronics Second

Samsung Narrows Gap with 'ISOCELL HP3'

[Asia Economy Reporter Han Ye-ju] Sales of CMOS image sensors (CIS), known as the "eyes of the industry," are expected to experience negative growth this year. Although considered one of the blue oceans of system semiconductors, it has not escaped the shadow of the global recession, analysts say. With market recovery anticipated from 2024, Samsung Electronics plans to narrow the gap with Sony, the current market leader, as much as possible to achieve the top position in system semiconductors.

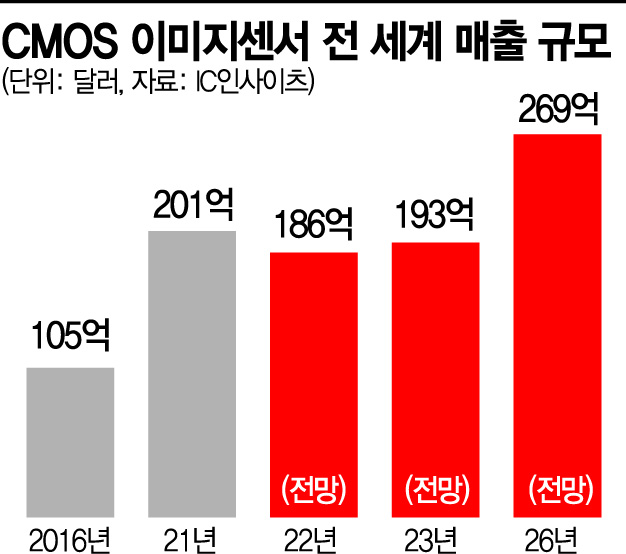

On the 19th, market research firm IC Insights forecasted that the CMOS image sensor market sales this year will decrease by 7% compared to last year, reaching $18.6 billion (25.9786 trillion KRW). Shipments are also expected to decline by 11% to 6.1 billion units compared to last year. This marks the first decline in 13 years. The contraction of the smartphone camera market due to the Ukraine crisis, China's strengthened COVID-19 lockdowns, and the economic downturn naturally led to a reduction in the image sensor market size.

CMOS image sensors are devices that capture images like the retina of the human eye in cameras. As a representative product of non-memory semiconductors, the annual sales growth rate and volume growth rate from 2016 to 2021 were 13.9% and 11.6%, respectively.

The absolute leader in the image sensor market is Japan's Sony. According to market research firm Strategy Analytics (SA), Sony held a 45% market share last year, ranking first in the image sensor market. Samsung Electronics ranked second with a 26% share, followed by China's OmniVision in third place with 11%. The combined market share of these three companies accounts for 82% of the total market.

Samsung Electronics entered the image sensor market in 2002 to foster system semiconductors and surpassed OmniVision in 2015 to become the industry's second largest. Since then, it has steadily narrowed the gap with Sony, reducing the market share difference to 17 percentage points in 2020. Last year, Samsung's market share slightly decreased due to sluggish Galaxy smartphone sales, widening the gap with Sony to 19 percentage points. However, image sensor sales have increased annually, maintaining growth momentum.

Samsung Electronics aims to further increase its market share in image sensors by leading with advanced technology products. Recently, Samsung unveiled the 'ISOCELL HP3,' an image sensor with 200 million pixels and the industry's smallest pixel size of 0.56μm (micrometers, one-millionth of a meter). The ISOCELL HP3 is scheduled for mass production by the end of this year. Although it has not yet been confirmed which smartphone will use it, considering that Xiaomi was the first to adopt the previous 180 million-pixel image sensor, Xiaomi is likely to be the first to introduce this one as well. Some speculate that Samsung may introduce a 200 million-pixel camera in the Galaxy S23 to strengthen hardware specification competitiveness.

Meanwhile, the market predicts that the image sensor market will gradually normalize after the smartphone market stabilizes around early next year. The recent expansion of image sensor applications to robots, autonomous vehicles, augmented reality, and virtual reality devices, in addition to smartphones, is also seen as a positive factor.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.