Sweeping 80% of Global Orders

Price Exceeds 330 Billion Won Per Unit

[Asia Economy Reporter Donghoon Jung] Korea's shipbuilding industry is capturing more than 80% of the global orders for liquefied natural gas (LNG) carriers amid the energy crisis and rising demand for eco-friendly vessels. There is a rosy outlook that Korea's shipbuilding industry can enter another boom period by leading with eco-friendly ships.

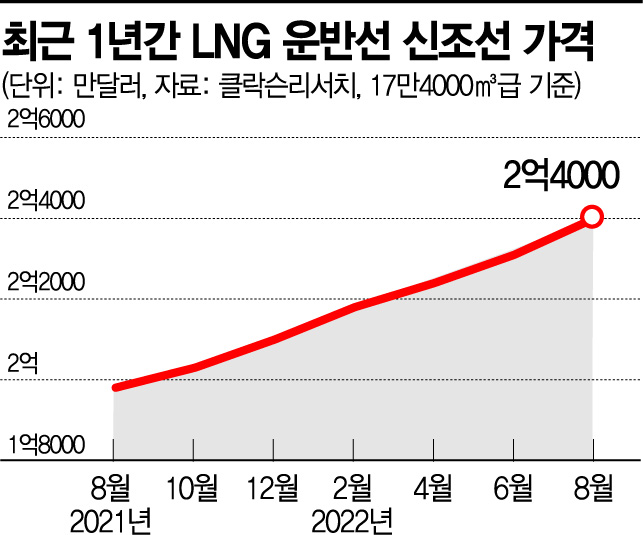

According to Clarkson Research, a UK-based shipbuilding and shipping market analysis firm, on the 18th, the price of LNG carriers with a capacity of 174,000 cubic meters or more reached a record high of $240 million (approximately 332 billion KRW). This is double the price of ultra-large crude carriers (VLCCs), which have suffered due to falling prices and demand as renewable energy becomes mainstream, priced at $120 million (approximately 164.9 billion KRW).

LNG carriers are the most expensive among all ship types, and their recent price increases are the most prominent. The popularity of these LNG carriers is largely due to the global decarbonization trend and the impact of the Russia-Ukraine war. These two factors have increased demand for eco-friendly energy such as LNG, leading to more shipowners seeking LNG carriers.

The number of LNG carriers ordered worldwide from January to last month is the largest ever. A total of 115 vessels (9.61948 million CGT) were ordered, with Korea securing 94 of them, representing a high market share of 82%. The global average annual order volume for LNG carriers over the past 20 years has been only 39 vessels. Notably, this year's order volume accounts for 20% of the LNG carriers currently in operation worldwide (658 vessels).

Although not included in last month's statistics, Korean shipbuilders have continued to secure trillion-KRW scale contracts this month alone. On the 6th, Daewoo Shipbuilding & Marine Engineering announced that it had secured an order for seven LNG carriers from an African shipowner for 2.0368 trillion KRW. These vessels are scheduled to be delivered to the shipowner by February 2026. Daewoo Shipbuilding & Marine Engineering has secured orders worth $8.17 billion (approximately 11.2165 trillion KRW) so far, achieving 92% of its annual target.

On the same day, Samsung Heavy Industries also announced orders for four LNG carriers?two each from shipowners in Bermuda and Africa. The total order value for these four vessels is 1.1651 trillion KRW. The ships are scheduled to be delivered sequentially by September 2025. With this contract, Samsung Heavy Industries has secured a total of 37 vessels worth $7.2 billion (approximately 9.8892 trillion KRW) this year, achieving 82% of its annual target.

Korea Shipbuilding & Offshore Engineering recently signed a construction contract for two LNG-powered Pure Car and Truck Carriers (PCTCs) with a Middle Eastern shipowner. The total order amount is 331.8 billion KRW. These PCTCs will be built at Hyundai Samho Heavy Industries in Yeongam, Jeollanam-do, and will be delivered sequentially to the shipowner by the second half of 2025. Korea Shipbuilding & Offshore Engineering has secured a total of 168 vessels worth $19.97 billion in the shipbuilding and offshore sectors so far, achieving 114.5% of its annual order target of $17.44 billion.

Professor Janghyun Lee of Inha University's Department of Naval Architecture and Ocean Engineering said, "The prices of ships that Korea's shipbuilding industry focuses on, such as LNG carriers, are continuously rising, so profitability improvement is expected." He added, "During this boom, it is an opportunity to solve structural problems by improving technology development and wage structures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.