Subscription Savings Account Appeal Declines, Subscribers Plummet

Nationwide Apartment Winning Bid Rate Lowest in 3 Years

Buying Momentum Broken Long Ago... "Decline Continues"

[Asia Economy Reporters Kyungjo Noh, Seoyul Hwang] The real estate market is showing a deepening wait-and-see attitude across subscription, sales, and auctions. This is because housing demanders have become passive about purchasing their own homes or investing amid falling house prices and a transaction freeze.

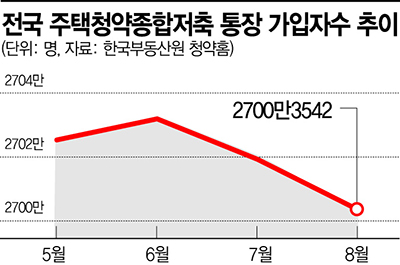

According to the Korea Real Estate Board's Subscription Home as of the end of August, the total number of nationwide housing subscription savings account holders was 27,003,542, a decrease of 15,711 from the previous month (27,019,253). This follows a decrease of 12,658 in June and July, with the decline widening. Currently, among the four major types of subscription accounts (Housing Subscription Savings, Subscription Savings, Subscription Deposit, and Installment Savings), only the Housing Subscription Savings account is available for new subscriptions.

By region, the five major metropolitan cities (5,297,724) saw the largest drop of 7,451 in one month. Seoul (6,238,313) and Incheon·Gyeonggi (8,813,062) decreased by 5,722 and 3,765 respectively during the same period. Other provinces (6,654,443) increased by 1,137, but the growth rate has been shrinking for five consecutive months.

It is analyzed that this is because prospective subscribers with shorter subscription periods left due to the downward trend in house prices. The number of second-priority subscription account holders, classified as new subscribers, decreased by 94,538 compared to the previous month. On the other hand, the number of first-priority subscribers, who generally need to subscribe for a relatively long period depending on regional conditions, increased by 78,827. Yoon Jihae, Senior Researcher at Real Estate R114, said, "Since it is a period when buyers can reasonably select properties in the sales market, the incentive to maintain subscription accounts seems to have diminished."

The sales market has long seen a decline in buying demand. Last month, the nationwide comprehensive housing (apartments, detached houses, multi-family houses, row houses, etc.) sales supply-demand index fell to 89.7, dropping below the 90 mark for the first time since October 2019. The sales supply-demand index ranges from 0 to 200, where values closer to 0 indicate more supply, and values closer to 200 indicate more demand. This index, which was 119.5 in August last year, fell to the 90s from December (96.6) and has continued to decline this year.

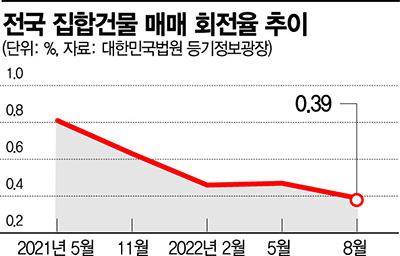

Various real estate transaction indicators have also contracted. According to the Korea Court Registry Information Plaza, the nationwide turnover rate for collective buildings (officetels, apartments, row houses, multi-family houses, etc.) last month was 0.39%. This is the lowest in 9 years and 7 months since January 2013. A turnover rate of 0.39% means that out of 10,000 tradable real estate units, only 39 were sold. By region, the rates were lowest in the following order: ▲Daejeon (0.21%) ▲Seoul (0.26%) ▲Ulsan (0.29%) ▲Busan, Gwangju, Gyeongbuk, Gyeongnam (each 0.33%) ▲Jeju (0.38%).

Auction market indicators also showed the lowest levels in three years. According to the 'August Auction Trend Report' by Gigi Auction, a specialized court auction company, the nationwide apartment winning bid rate was 85.9%, the lowest in about three years since September 2019 (84.8%). The winning bid rate also dropped 1.8 percentage points from the previous month (43.3%) to 41.5%. The average number of bidders was 5.6, marking a decline for four consecutive months since April (8.0).

Ham Youngjin, Head of the Big Data Lab at Zigbang, said, "With additional interest rate hikes expected, the real estate market is likely to remain in a lull until the first half of next year. Ultimately, the question is when the peak of inflation will occur. Until then, the real estate market will continue its downward trend centered on urgent sales along with subscription polarization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)