Real Estate Board August Housing Price Trend Survey Results

Jeonse Prices Also Fall at the Largest Rate in 3 Years and 4 Months

On a monthly basis, nationwide housing prices have fallen at the largest rate since the 2008 global financial crisis. Seoul also recorded a decline in all 25 districts, marking the biggest drop in nine years, indicating a shaky housing market.

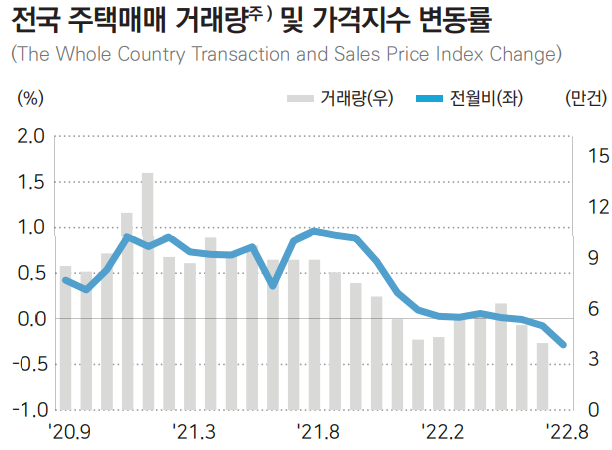

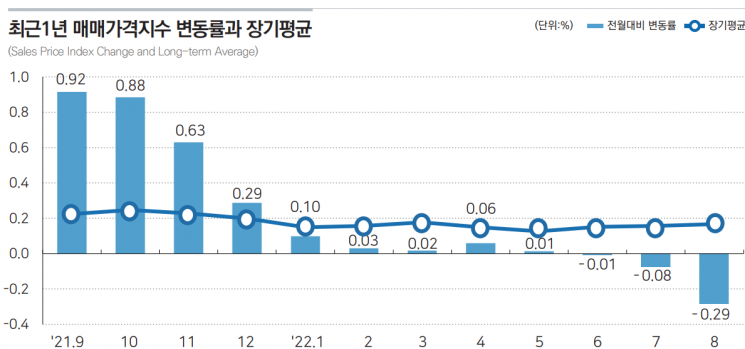

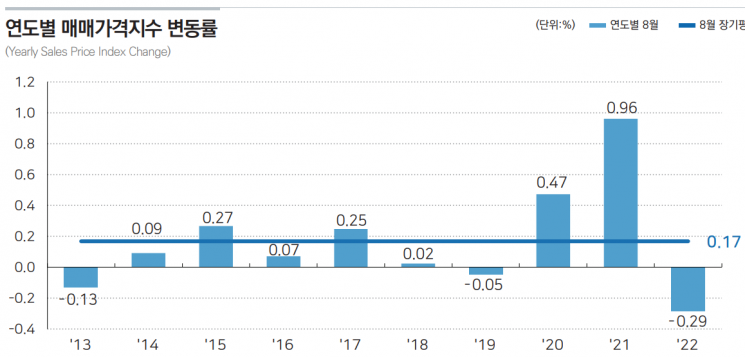

According to the "August Nationwide Housing Price Trend Survey Results" by the Korea Real Estate Board on the 15th, the comprehensive nationwide housing (apartments, detached houses, and row houses) sale prices recorded a decline of -0.29%, a larger drop than the previous month (-0.08%). This is the largest drop in 13 years and 7 months since January 2009 (-0.55%) during the global financial crisis. Both the metropolitan area (-0.14% → -0.40%) and provincial areas (-0.01% → -0.18%) showed declines.

◆Seoul Housing Prices Fall at the Largest Rate in 9 Years and 1 Month

The comprehensive housing sale prices in Seoul fell by 0.24% compared to the previous month, a 0.15% decrease. This is the largest drop since August 2013 (-0.41%), 9 years and 1 month ago.

Seoul housing prices had shown either an increase or remained flat since a slight 0.01% drop in March this year, buoyed by expectations of deregulation following the presidential election. However, due to interest rate hikes and economic recession effects, prices turned downward again last month after four months and have declined for two consecutive months.

By district, Yongsan-gu, which benefited from the presidential office relocation and international business district development, turned to a slight decline (-0.01%). Nowon-gu (-0.84%) saw weakness mainly in aging apartments in Wolgye, Sanggye, and Junggye-dong, while Dobong-gu (-0.59%) experienced declines mainly in Chang, Dobong, and Ssangmun-dong areas.

In the Gangnam area, Seocho-gu also turned to a decline (0.09% → -0.05%), and both Gangnam-gu (-0.02% → -0.14%) and Songpa-gu (-0.07% → -0.36%) saw their declines deepen.

The Real Estate Board analyzed, "Due to concerns over further housing price declines caused by interest rate hikes, transaction sentiment is shrinking and a wait-and-see stance continues," adding, "All 25 districts in Seoul showed declines with an expanding rate of decrease."

Housing prices in Gyeonggi-do fell by 0.45%, significantly expanding the decline from the previous month (-0.16%), and Incheon also saw its drop widen from -0.26% in July to -0.64% last month.

The Real Estate Board explained, "In Gyeonggi-do, the overall inventory backlog is intensifying, and in Incheon, the decline widened mainly in Yeonsu, Gyeyang, and Seo-gu due to the impact of new housing supply."

By housing type, apartments led the nationwide downward trend.

Last month, apartment prices nationwide fell by 0.51%, the largest drop since January 2009 (-0.68%).

Seoul apartment prices dropped 0.47% compared to July, deepening the decline from the previous month (-0.45%). This is the largest drop in 9 years and 1 month since August 2013 (-0.47%).

Apartment prices in Incheon and Gyeonggi fell by 0.96% and 0.71% respectively in August, more than doubling the declines from the previous month (-0.37%, -0.29%).

Apartment prices in the metropolitan area fell by 0.66%, marking the largest drop in 9 years and 7 months since January 2013 (-0.66%).

◆Jeonse Prices Fall at the Largest Rate in 3 Years and 4 Months... Monthly Rent Remains Strong

The jeonse (long-term lease) market is also deepening its slump.

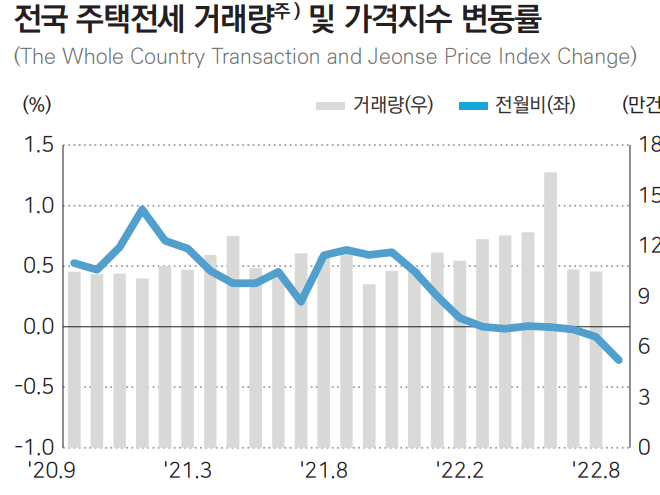

Nationwide housing jeonse prices fell by 0.28%, marking the largest drop in 3 years and 4 months since April 2019 (-0.29%).

Among these, nationwide apartment jeonse prices dropped 0.45%, and Seoul apartments fell 0.25%, both showing a significant increase in the rate of decline compared to the previous month.

The Real Estate Board analyzed, "In the metropolitan area, due to the shift to monthly rent and renewal contracts, new jeonse demand continues to decrease, while the burden of loan interest due to interest rate hikes is increasing, expanding the rate of decline."

On the other hand, monthly rent remains strong. Monthly rent prices for Seoul apartments rose by 0.12%, increasing from 0.10% in the previous month. This is due to increased demand for monthly rent as the interest rates on jeonse loans have become higher than the conversion rate from jeonse to monthly rent following interest rate hikes.

Nationwide apartment monthly rent prices rose by 0.20%, maintaining an upward trend, although the increase was slightly smaller than the previous month (0.22%).

The Real Estate Board analyzed, "Due to interest rate hikes and jeonse loan effects, demand for monthly rent is increasing," adding, "In Seoul (0.09%), the rise is centered around subway station areas with good transportation; in Gyeonggi (0.22%), areas with good proximity to workplaces; and in Incheon (0.18%), mainly in Gyeyang, Seo, and Bupyeong districts, monthly rent prices continue to rise."

As demand for monthly rent increases, the jeonse-to-monthly rent conversion rate has also risen. Seoul's comprehensive housing rate rose slightly from 4.8% in June to 4.9% in July, and Seoul apartments increased from 4.2% to 4.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.