KCCI Holds 2nd Industry-Specific ESG Working Group Meeting

Financial Sector Focuses on Climate Finance and Fintech Interests

Calls for Detailed Climate Risk Response Guidelines

Urges Expansion of Incentives for Model ESG Financial Firms

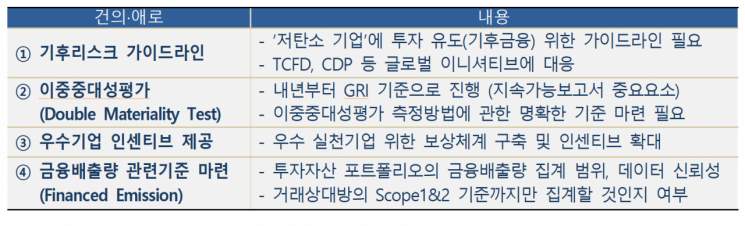

Financial Sector ESG-Related Suggestions and Difficulties. Table Provided by the Korea Chamber of Commerce and Industry

Financial Sector ESG-Related Suggestions and Difficulties. Table Provided by the Korea Chamber of Commerce and Industry

[Asia Economy Reporter Choi Seoyoon] It has been pointed out that the financial sector, including banks and insurance companies, should prepare for the global ESG (Environmental, Social, and Governance) trends such as financial emissions and climate scenarios, as they can also be classified as carbon industries.

On the 13th, the Korea Chamber of Commerce and Industry (KCCI) held the ‘2nd Industry-specific ESG Working Group Meeting’ at the Chamber of Commerce building in Jung-gu, Seoul, with key corporate officials from the banking and financial investment sectors attending to discuss ESG issues and response strategies in the financial sector.

The ESG Working Group is a practical consultative body created by KCCI in April, organizing the ESG agenda group launched mainly by Korea’s top 20 conglomerates and major financial holding companies into industry-specific groups. It serves as a forum to share information within the same industry and expand networking. The sectors are divided into five groups: ▲Food, Pharmaceuticals & Bio, Cosmetics, Distribution ▲Banking, Financial Investment ▲Energy, Petrochemicals, Heavy Industry ▲IT, Semiconductors ▲Automobiles, Steel.

A KCCI official said, “Reflecting the strong opinion that industry-specific practical channels are necessary to respond to global ESG issues, we held the 1st Working Group meeting in July. This time, we invited practitioners from the financial sector to hold the 2nd meeting.”

◆Financial Sector May Be Tied to Carbon Industry= Baek Tae-young, inaugural member of the International Sustainability Standards Board (ISSB) and professor of business administration at Sungkyunkwan University, who was invited as a keynote speaker, said about global ESG trends, “There is a movement to classify banks and insurance companies within the financial sector as carbon industries,” adding, “As the ISSB highlights issues related to measuring and disclosing financial emissions, the industry and financial authorities need to closely monitor global ESG standards and meticulously prepare guidelines related to climate finance.”

Choi Sun-young, senior research fellow at the Korea Capital Market Institute, emphasized, “As environmental and climate changes begin to significantly impact the financial system, the interest of central banks worldwide is increasing,” and stressed the importance of paying attention to the ‘climate scenarios’?climate change impact analysis data provided by the Green Finance Network. The Green Finance Network is a global organization established in December 2017 to respond to climate change and environmental risks by central banks and financial supervisory authorities. It has members from central banks and financial supervisory authorities of 116 countries worldwide.

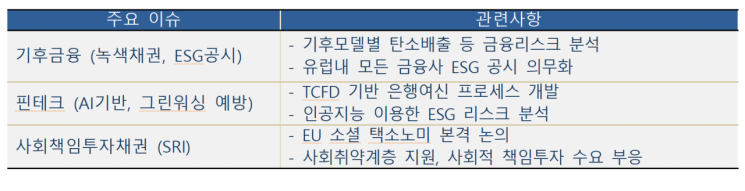

Key Keywords of ESG Management in the Financial Sector. Table provided by Korea Chamber of Commerce and Industry

Key Keywords of ESG Management in the Financial Sector. Table provided by Korea Chamber of Commerce and Industry

After the presentations, participants engaged in a free discussion addressing industry challenges such as ▲financial emissions ▲double materiality assessment ▲detailed guidelines on climate risk response and ESG finance management and supervision ▲providing incentives to financial companies excelling in ESG management, and proposed improvements to the system.

In particular, regarding ISSB’s ‘Scope 3,’ as the aggregation of financial emissions from investment asset portfolios gains attention, participants raised the need for clear standards on the reliability of greenhouse gas data from investment counterparties and comparability among companies in the same industry.

Scope 3 is the broadest concept among the carbon emission disclosure standards defined in the ISSB’s ESG disclosure draft. It includes not only carbon emissions generated during the product manufacturing process but also all external emissions occurring throughout the entire value chain, including all suppliers, logistics, and waste management within the company’s transaction network. Scope 1 refers to direct emissions generated during the product manufacturing stage, and Scope 2 refers to indirect emissions generated in the process of producing electricity and power used at business sites.

◆Climate Finance, Fintech, Socially Responsible Investment Bonds... Key ESG Management Keywords in the Financial Sector= Meanwhile, based on opinions from the banking and securities industries, KCCI identified key keywords related to ESG management in the financial sector, including climate finance implementation, fintech, and socially responsible investment bonds.

A banking official who attended the meeting said, “Until now, internal ESG was almost entirely entrusted to external consulting firms, so I was curious about how other companies in the same industry were preparing,” adding, “Through this Working Group meeting, we had the opportunity to share strategies and know-how for promoting ESG management in the financial sector and create synergy effects, which was very helpful.”

Woo Tae-hee, full-time vice chairman of KCCI, said, “From next year, global ESG regulations such as Germany’s Supply Chain Due Diligence Act and ISSB disclosure standards will be fully implemented, causing difficulties for domestic companies in responding,” and emphasized, “Recently, ESG finance for small and medium-sized enterprises and mid-sized companies has been active, and KCCI will continue to expand incentives such as sustainability-linked loans in cooperation with the financial sector.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.