Trade Balance from 1st to 10th

Deficit of $2.443 Billion

Accumulated $27.6 Billion This Year

Soaring Oil and Gas Energy Prices

High Exchange Rate Negatively Impacts Trade Balance

Deficit Expected to Continue in Second Half

South Korea's trade balance is on the verge of recording a deficit for six consecutive months for the first time in 25 years since the 1997 Asian financial crisis. As of the 10th of this month, the cumulative trade deficit this year has reached $27.5 billion, marking an annual record high. This is due to a significant increase in Korea's gas imports amid growing concerns over energy supply instability caused by the prolonged Russia-Ukraine war. The won-dollar exchange rate is approaching the 1,400-won level, negatively impacting the trade balance.

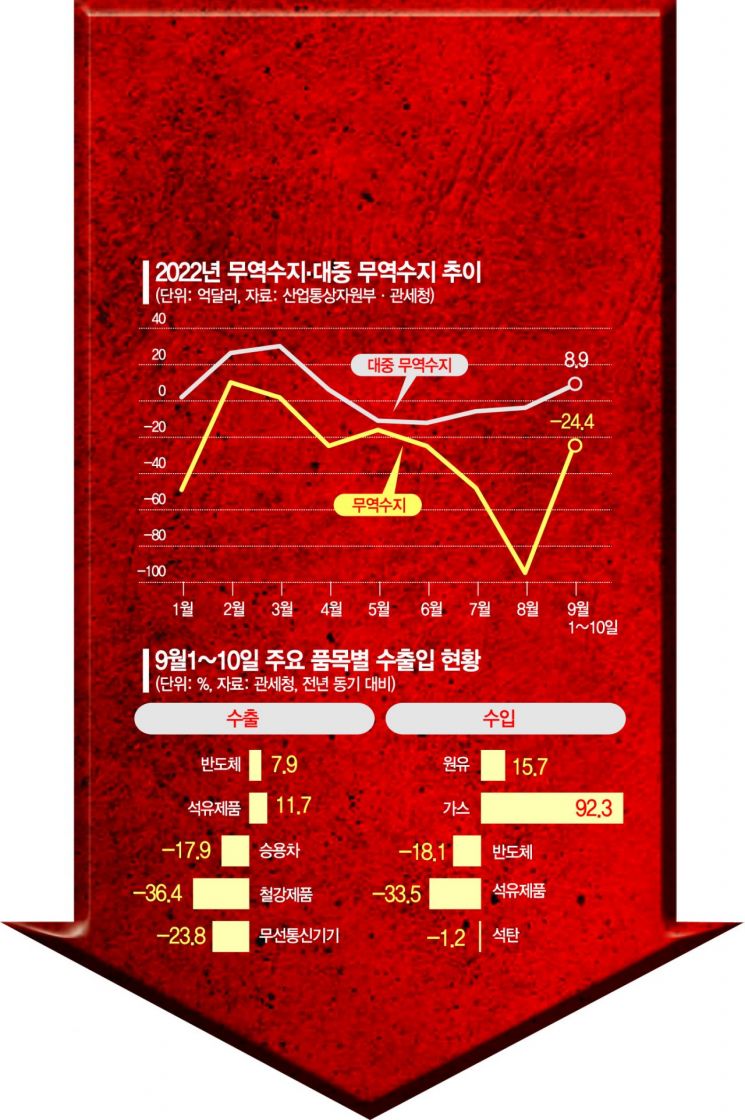

According to the export-import status announced by the Korea Customs Service on the 13th for the period from the 1st to the 10th of this month, the trade balance recorded a deficit of $2.443 billion. This continued the deficit following August's record monthly deficit of $9.47 billion. A six-month consecutive trade deficit from April to the end of this month is the first occurrence in 25 years since the Asian financial crisis (January 1995 to May 1997). This year, the monthly trade balance recorded deficits of -$2.476 billion in April, -$1.6 billion in May, -$2.487 billion in June, -$4.85 billion in July, and -$9.474 billion in August, marking the first time in 14 years that a deficit was recorded for five consecutive months.

As of the 10th of this month, the cumulative trade deficit stands at $27.55 billion, raising concerns about surpassing a $30 billion deficit for the year. The previous record was $20.6 billion in 1996, just before the International Monetary Fund (IMF) financial crisis.

The six-month consecutive trade deficit is due to soaring energy prices such as crude oil and gas following the international community's intensified sanctions against Russia amid the Russia-Ukraine war. Due to the impact of working days during the Chuseok holiday, exports (provisional customs clearance basis) from the 1st to the 10th of this month amounted to $16.246 billion, and imports were $18.688 billion, down 16.6% and 10.9% respectively compared to the same period last year. However, energy imports such as crude oil (15.7%) and gas (92.3%) continued to increase.

In particular, during this period, the combined import value of the three major energy sources?crude oil ($3.286 billion), gas ($2.155 billion), and coal ($668 million)?was $6.109 billion. This is a 31.7% increase compared to the same period last year ($4.638 billion). According to investing.com, the Japan-Korea Marker (JKM) futures price, an LNG price indicator for the Northeast Asia region, was $53.950 per million BTU at the end of last month, a 196.1% increase from $18.220 a year ago.

The monthly trade deficit with China, which has continued since May, is also a negative factor for South Korea. Although the trade balance with China turned to a surplus of $89 million as of the 10th of this month, both exports (-20.9%) and imports (-24.2%) decreased compared to the same period last year. The trade deficit with China is due to China's zero-COVID policy and ongoing city lockdowns, which caused the second-quarter economic growth rate to fall to 0.4%. Consequently, South Korea recorded a deficit for four consecutive months (May to August) for the first time in 30 years since establishing diplomatic relations with China in August 1992. The high exchange rate adds insult to injury for the trade balance. Typically, a weak won raises the won-dollar exchange rate, inevitably increasing the cost of imports, including raw materials.

To address concerns over the prolonged trade deficit, the government recently announced a strategy to strengthen export competitiveness and began supporting export companies to enhance their competitiveness. First, the trade insurance support limit will be expanded from the current 230 trillion won to 260 trillion won, and export growth financing of 50 billion won will be supplied by the end of the year for beginner export companies. However, the problem is that the fundamental improvement of the trade balance in the second half of this year is unlikely. Professor Jeong In-gyo of Inha University's Department of International Trade said, "The sharp rise in energy prices, the main cause of the current trade deficit, is unlikely to be resolved due to the prolonged Russia-Ukraine war."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)