[Asia Economy Reporter Minji Lee] Despite negative outlooks for semiconductor companies, positive forecasts continue for Broadcom.

On the 12th, Broadcom's stock price stood at $522.40. Since the beginning of this month, Broadcom's stock price has risen over 6%, positively reflecting the earnings guidance that exceeded market expectations announced earlier this month.

Broadcom operates in various communication-related fields, including chip design for telecommunications, server storage, wireless equipment, IoT, and software businesses. The core segment of its business belongs to the networking sector within the semiconductor solutions division.

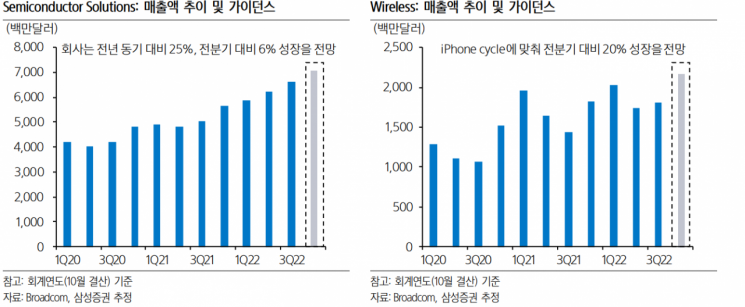

For the third quarter of the 2022 fiscal year, revenue was $8.46 billion, a 24.9% increase compared to the same period last year. EPS was $9.73, surpassing market expectations. Strong cloud demand continued, and enterprise sales showed year-over-year growth for six consecutive quarters. Semiconductor division revenue was $6.6 billion, up 32% year-over-year and 6% quarter-over-quarter.

Networking revenue reached $2.3 billion, a 30% increase year-over-year. Server storage recorded $1.1 billion, up 17%, and broadband reached $1.1 billion, a 20% increase, driven by rapid deployment of Wi-Fi 6. Wireless revenue rose 25% to $1.6 billion due to strong demand from Apple. Except for industrial sales, which declined 2% due to sluggish business in China, all semiconductor solutions business units posted solid results.

Ji-yong Lim, a researcher at NH Investment & Securities, said, “Contrary to concerns about an overall semiconductor demand slowdown, demand remained strong in the semiconductor end distribution market, with the B2B segment showing strength. The B2C segment, which accounts for 20% of total sales, is mostly Apple-related, so it was less affected by demand slowdown.”

The fourth-quarter earnings guidance projects revenue of $8.9 billion. Adjusted EBITDA margin is estimated at 63%. Semiconductor division revenue is expected to increase 25% year-over-year and 6% quarter-over-quarter. This is primarily because both cloud and enterprise demand are rising. Although market concerns about the cloud segment persist, the company expects networking chip growth to accelerate in the fourth quarter. In fact, the backlog expanded from $29 billion at the end of the second quarter to $31 billion at the end of the third quarter.

The growth rate of major operators is also expected to continue. The company's core product is the Tomahawk Ethernet switching chip for data centers based on a 4nm process, which applies technology that can replace the InfiniBand network-based data center solutions provided by competitor Nvidia. Beomjun Hwang, a researcher at Yuanta Securities, analyzed, “Market penetration is expected to expand among customers who need diversification of data center solutions.”

Additionally, the launch of new iPhone models is positive. Junho Moon, a researcher at Samsung Securities, explained, “The wireless business accounts for 25-40%, most of which is for iPhone, so it is expected to be relatively resilient compared to other companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.