[Asia Economy Reporter Jeong Dong-hoon] The biggest beneficiary of the U.S. Inflation Reduction Act (IRA) is 'renewable energy.' More than 40% of the support amount, totaling $160.3 billion, is allocated to tax credits for renewable energy. While the U.S. cites inflation and climate change response as the basis for the legislation, it is interpreted that the underlying intention is to attract new production bases to the U.S. in competition with China, the leader in renewable energy. So far, many global companies seem to be investing in the U.S. as intended by the U.S. government. In particular, there is growing interest in where the dominance of the solar panel industry, a representative of new renewable energy, will flow.

◆Korean Solar Industry Losing Supply Chain... Experts Say "Domestic Industrial Ecosystem Must Be Protected and Fostered"= On the 10th, experts emphasized that before overseas investment, it is important to protect and support the domestic industrial ecosystem.

Professor Yoo Seung-hoon of the Energy Policy Department at Seoul National University of Science and Technology expressed doubts about expectations that the domestic solar industry would benefit from the Inflation Reduction Act. Professor Yoo said, "(The Inflation Reduction Act) helps a limited number of companies that have production plants in the U.S. to some extent," but added, "Small and medium-sized enterprises that only have factories in Korea actually import Chinese components for assembly, so I think it will be difficult for them to benefit."

He continued, "The domestic solar industry has focused only on the distribution of solar panels and neglected the domestic industrial ecosystem such as materials, components, and equipment, and now the market is being encroached upon by Chinese companies," adding, "To protect the domestic industry, it is necessary to build an ecosystem where large and small-to-medium enterprises grow together." Professor Yoo also suggested establishing a renewable energy public corporation (tentative name) to steadily create demand for the domestic solar industry. He said, "The public corporation should be tasked with distributing renewable energy and restricted to using only domestic products to create a domestic industrial ecosystem," and added, "Only when companies that manufacture and research domestically exist will employment be created and the industrial ecosystem strengthened."

Professor Hong Jong-ho of Seoul National University Graduate School of Environmental Studies said, "The government must seriously consider the impact and ripple effects of the Inflation Reduction Act," and added, "In the complex political, economic, and geopolitical conflicts such as the Russia-Ukraine war and U.S.-China tensions, each country is trying to build a self-contained industrial system within its own borders." He continued, "Korean companies will benefit to some extent, but the Korean solar industry must carefully consider whether this is truly beneficial," and said, "If investment in the U.S. replaces domestic investment due to this law, we must consider the impact on the Korean industry within the next two to three years."

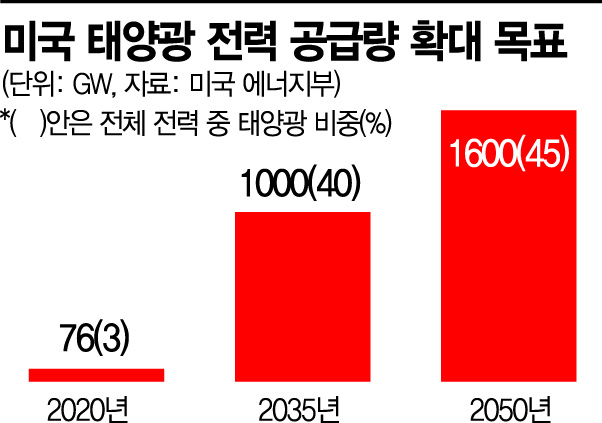

◆U.S. Solar Industry Lacks Justification for Sanctions on China... Will China Ultimately Reap the Benefits?= According to industry sources and the U.S. government, the Inflation Reduction Act aims to curb inflation by reducing the fiscal deficit by about $300 billion over the next 10 years. Key provisions include the introduction of a minimum corporate tax rate of 15% for large corporations, tax credits for purchasing eco-friendly vehicles such as electric cars, and tax credits to promote investment in renewable energy.

However, there are no detailed provisions regarding the renewable energy sector. This contrasts with guidelines requiring that parts and minerals used in electric vehicle manufacturing be produced in the U.S. or countries with which the U.S. has free trade agreements (FTAs) to qualify for electric vehicle subsidies. This is due to the unavoidable reality of the solar supply chain being dominated by China.

The U.S. government plans to finalize detailed guidelines by the end of the year, but there are criticisms that it is difficult to impose additional import restrictions or exclusion measures on Chinese solar equipment because the U.S. government has already imposed high tariffs on Chinese solar panels for the past four years.

The U.S. 'solar tariffs' began under the Trump administration in 2018 to curb Chinese panels dominating the global market by imposing a high tariff of 30% on imported panels. This was based on Section 201 of the U.S. Trade Act, invoking a 'safeguard' on the grounds that cheap Chinese products were harming the domestic industry. However, the tariff rate was gradually reduced to 15% over the four-year imposition period (until 2022). In particular, in February this year, the 15% tariff on imported solar panels and related equipment was extended until 2026, four years later. However, the import quota was doubled from the previous level, and key components such as 'bifacial panels' were excluded from tariff imposition, leading to criticism that 'the core has all been handed over to China.' Although the Chinese solar industry bears the tariff burden, the enactment of the Inflation Reduction Act creates conditions where the benefits of the growth of the U.S. solar industry could ultimately go to China.

China controls a significant portion of the global solar supply chain. As of last year, Asia leads with 57%, followed by Europe at 21%, and the U.S. at 16% in the solar industry. China leads in new installations with 54.9 GW. The Chinese solar industry is growing the fastest in the world, supported by strong government promotion and support, and a high share within the supply chain. The global solar supply chain's dependence on China remains very high, currently at 72% for polysilicon, 98% for ingots, 97% for wafers, 81% for cells, and 77% for modules.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.