Possibility of Delayed Inflation Peak Due to Soaring Exchange Rates

Rising Import Prices Push Inflation Up as Exchange Rates Surge

Geopolitical Risks Persist in the US, China, and Others

Wage-Driven Inflation Expectations Also Cause Concern

The won-dollar exchange rate continues its high-altitude march, and geopolitical tensions among major countries such as the United States and China are increasing, expanding the uncertainty surrounding our economy. Regarding inflation, there were initial forecasts that the peak might come earlier, but recently the exchange rate has risen more steeply than expected, and inflation expectations have shown instability, leading to analyses that inflation pain may persist for a long time.

According to the Bank of Korea and financial markets on the 10th, inflation is expected to peak in the second half of this year when considering international oil prices and base effects, but there are considerable upside risks, so the peak may be delayed.

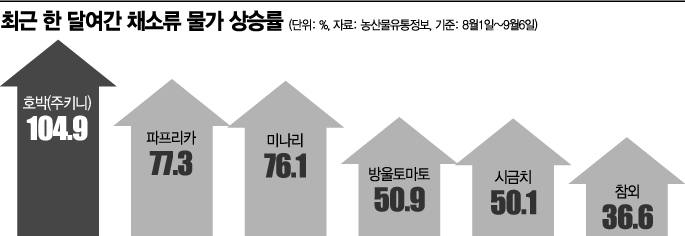

Domestic consumer price inflation has shown an unstable pattern, surpassing 4% in March and entering the 6% range for the first time since the foreign exchange crisis in June. This is due to the instability of raw material supply chains caused by the Ukraine crisis and the sharp rise in international oil prices.

Previously, the Bank of Korea viewed the inflation peak as occurring from the end of the third quarter to the beginning of the fourth quarter but explained that it might be brought forward slightly. On the 25th of last month, Lee Chang-yong, Governor of the Bank of Korea, said at a press conference following the Monetary Policy Committee regular meeting, "International oil prices have fallen sharply over the past two months, so the consumer price inflation rate in August is expected to be lower than in July," adding, "the peak could be earlier than the July forecast."

However, as the won-dollar exchange rate recently surpassed 1,380 won, reaching the highest level since the financial crisis, the view that the inflation peak could be delayed is gaining traction. When the exchange rate rises, import prices increase, raising the domestic inflation burden.

In the 'Monetary and Credit Policy Report' recently submitted to the National Assembly, the Bank of Korea diagnosed that "(inflation) upside risks are not small, so there is a possibility that the peak will be delayed or that a high inflation situation will persist." The Bank of Korea estimated that the rise in the won-dollar exchange rate in the first half of this year raised the consumer price inflation rate by 0.4 percentage points out of 4.6%.

Although international raw material prices have recently stabilized somewhat, geopolitical risks such as the Ukraine crisis remain, so if the situation worsens, supply-side inflationary pressures could expand again. On the demand side, the moderate recovery of private consumption since COVID-19 is continuing, so inflationary pressures are likely to persist.

Members of the Korean Teachers and Education Workers Union (JeonGyoJo) held a press conference near the Presidential Office in Yongsan, Seoul, on the 1st, condemning the Yoon Seok-yeol administration for effectively forcing wage cuts. They rejected the 1.7% increase in public servant salaries and urged a 7.4% raise reflecting the inflation rate. Photo by Kim Hyun-min kimhyun81@

Members of the Korean Teachers and Education Workers Union (JeonGyoJo) held a press conference near the Presidential Office in Yongsan, Seoul, on the 1st, condemning the Yoon Seok-yeol administration for effectively forcing wage cuts. They rejected the 1.7% increase in public servant salaries and urged a 7.4% raise reflecting the inflation rate. Photo by Kim Hyun-min kimhyun81@

It is also problematic that inflation expectations, which greatly influence inflation, are becoming unstable. Inflation expectations, which correspond to economic agents' forecasts of future prices, have steadily risen since last year, reaching the 4% range.

If inflation expectations become unstable, the expectation formation behavior of economic agents changes, increasing the likelihood of persistent inflation. Jerome Powell, Chair of the U.S. Federal Reserve, also said at the monetary policy conference hosted by the Cato Institute in Washington DC on the 8th (local time), "It is important to anchor inflation expectations."

In particular, in Korea, the interaction between inflation and wages is also strengthening. According to the Bank of Korea, when inflation expectations are unstable and wage growth rates rise, it has a larger and more persistent impact on inflation trends. This is because when inflation expectations become unstable, companies tend to pass on the cost burden from wage increases to consumers.

The Bank of Korea explained, "If the steep rise in prices continues and the short-term inflation expectations continue to rise, long-term inflation expectations are also likely to increase significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)