Ecopro Soars 9% on Electric Vehicle Battery Supply Contract News

Only Secondary Battery Sector Rises... Samsung Electronics Falls to 56,100 Won

On the 7th, when the won-dollar exchange rate surpassed 1,380 won for the first time in 13 years and 5 months, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. Photo by Moon Honam munonam@

On the 7th, when the won-dollar exchange rate surpassed 1,380 won for the first time in 13 years and 5 months, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. Photo by Moon Honam munonam@

[Asia Economy Reporter Ji Yeon-jin] The KOSPI index fell to the 2360 level on the afternoon of the 7th as foreign investors expanded their selling pressure. The won-dollar exchange rate, which surpassed 1380 won earlier that day, showed an increase of over 1% within half a day, threatening to reach 1890 won.

As of 1:30 PM that day, the index was at 2365.48, down 44.54 points (1.85%) from the previous day. The KOSPI started the day slightly down (-0.6%), but the decline widened as foreign selling volume accumulated during the session. Foreign investors sold about 413.4 billion won worth, marking the largest selling pressure since June. Institutions also net sold about 268.3 billion won, while individuals bought approximately 660.3 billion won.

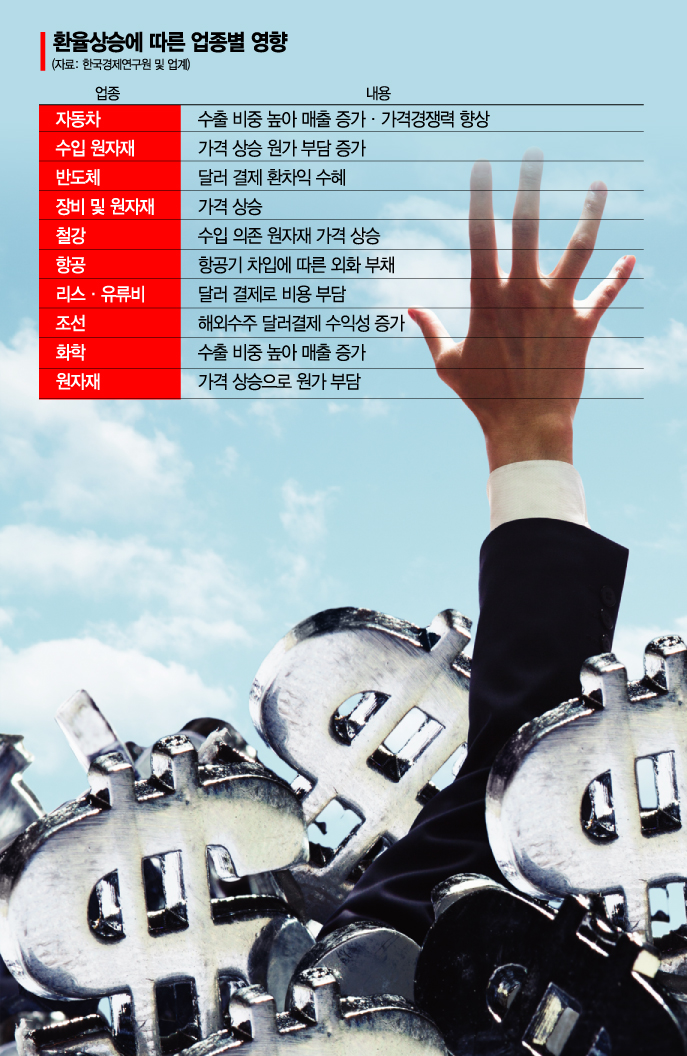

The foreign selling appears to have been influenced by rising U.S. Treasury yields and a sharp increase in the exchange rate. At the same time, in the Seoul foreign exchange market, the won-dollar exchange rate traded at 1387.6 won, up 15.9 won (1.16%).

Oh Chang-seop, a researcher at Hyundai Motor Securities, said, "Currently, the U.S. dollar strength is synchronized with the rise in U.S. bond yields, and with Federal Reserve Chairman Powell's remarks on continued rate hikes, the rise in U.S. bond yields and dollar strength is likely to last longer than expected." He added, "Global recession concerns, the impact on Korea's export economy, and U.S. quantitative tightening are also dominant factors driving the won-dollar exchange rate upward."

Among the top market capitalization stocks in KOSPI, only LG Energy Solution (0.52%) and Kia (0.25%) showed slight gains, while all others declined. In particular, Samsung Electronics fell 1.75% to 56,100 won, hitting its lowest point in two months. SK Hynix and Samsung SDI also recorded declines exceeding 1%, and Kakao dropped by 3.44%. Additionally, Samsung Biologics, Hyundai Motor, and LG Chem showed slight declines.

At the same time, the KOSDAQ index traded at 765.30, down 14.16 points (1.82%). Individuals bought 138.6 billion won worth, but foreign investors and institutions net sold 89.2 billion won and 49.4 billion won, respectively.

EcoPro surged 9.55% as foreign and institutional investors jointly bought shares following news of a supply contract for lithium hydroxide for electric vehicle batteries with AMG Lithium the previous day. EcoPro BM and L&F also showed slight gains. On the other hand, Kakao Games fell more than 4%, and Pearl Abyss dropped nearly 4%. Biotech stocks such as Celltrion Healthcare (-0.72%), HLB (-1.83%), Celltrion Pharm (-2.02%), and Alteogen (-2.36%) were weak.

On this day, Korea Information & Communication, Gold & S, and Yesun Tech hit the daily upper limit during trading. Boryung surged 20% in the KOSPI market on news that its topical hair loss treatment received product approval from the Ministry of Food and Drug Safety.

On the previous day’s New York Stock Exchange, concerns over Federal Reserve tightening persisted, and the influx of corporate bond issuance into the bond market triggered a rise in yields. The 10-year U.S. Treasury yield rose sharply by 16 basis points to close at 3.35%, and the 2-year yield, sensitive to policy rate outlooks, increased by 11.6 basis points to settle around 3.5%. The dollar index surpassed 110 points due to the impact of yields.

Kim Yu-mi, a researcher at Kiwoom Securities, pointed out, "As caution surrounding major events such as the August U.S. Consumer Price Index (CPI) and the September Federal Open Market Committee (FOMC) meeting accumulates over time, the negative factors emerging in the bond and foreign exchange markets are also adversely affecting the stock market at this point."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.