Foreigners' Daily Net Purchases of 36.5 Billion and 800 Million Lead to Parallel Gains

US Inflation Reduction Act Impact Expected to Be Minimal

[Asia Economy Reporter Myunghwan Lee] The stock prices of Hyundai Motor and Kia, the leading domestic automakers, have turned 'red'. This is interpreted as expectations that the soaring won-dollar exchange rate will benefit these export-oriented companies. There is also an analysis that the negative impact of the Inflation Reduction Act (IRA), implemented in the United States last month, may be limited.

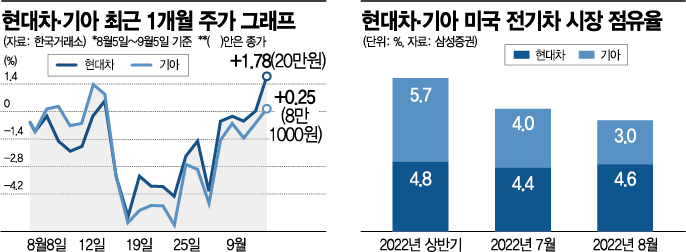

According to the Korea Exchange on the 6th, Hyundai Motor (1.78%) and Kia (0.25%) both closed higher the previous day. Considering that the KOSPI fell 0.25% and the KOSDAQ index dropped 1.84% due to the high exchange rate impact on the domestic stock market, this is a relatively good performance. On the 5th, the won-dollar exchange rate closed at 1,371.4 won per dollar, up 8.8 won from the previous day's closing price in the Seoul foreign exchange market. It is the first time in 13 years and 5 months since April 1, 2009, during the global financial crisis, that the won-dollar exchange rate has surpassed the 1,370 won level.

Expectations of benefiting from the strong dollar have attracted investment mainly from foreigners to Hyundai Motor and Kia, which are export-oriented. Foreign investors net bought about 36.5 billion won and 800 million won worth of Hyundai Motor and Kia stocks, respectively, on that day. Considering that foreign investors sold 69.3 billion won worth of stocks in the entire KOSPI market that day, this is a meaningful 'buying trend'. Hyundai Motor was the top stock in net foreign purchases that day.

The negative factor of the Inflation Reduction Act is also not exerting much influence. When the Inflation Reduction Act was passed, concerns arose that domestic automakers might suffer losses in the U.S. market because the law provides tax benefits only for electric vehicles produced in North America.

However, the securities industry views the damage from the Inflation Reduction Act as not significant in the short term. This is because the number of automakers that can fully receive the tax benefits is limited. Yongkwon Moon, a researcher at Shin Young Securities, said, "The U.S. Congressional Budget Office estimates that electric vehicles eligible for the $7,500 tax credit will account for only about 11,000 units, or 0.1% of the annual new car market in the U.S. in 2023," adding, "Even if domestic companies suffer some loss in price competitiveness, the short-term damage will not be significant."

Recently, there has also been analysis that the high exchange rate effect can be used to respond to the Inflation Reduction Act. Eunyoung Lim, a researcher at Samsung Securities, said, "Currently, the won-dollar exchange rate is depreciated by 15% compared to the 2021 average, resulting in a price difference of about $15,000 to $20,000 compared to Tesla vehicles, so subsidies do not affect price competitiveness," and evaluated, "The $3,750 subsidy gap for automakers is a level that can be sufficiently offset by the weak won."

As the strong dollar is expected to continue for the time being, it is also possible to expect continued benefits for the export-heavy automobile sector. Kyuyeon Jeon, a researcher at Hana Securities, said, "There is a high possibility that the strong dollar trend will continue in September," and diagnosed, "Although government intervention and response willingness are increasing, there is no proper resistance level at the current exchange rate, so the upper exchange rate level should be left open up to the 1,400 won mark."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.