[Asia Economy Reporter Myunghwan Lee] The KOSPI closed lower in the early 2400s on the 5th. The won-dollar exchange rate surpassed 1,370 won for the first time in over 13 years, seemingly negatively impacting foreign investors' sentiment. The KOSDAQ index also fell to the low 770s, breaking below the 780 level for the first time in five trading days.

On this day, the KOSPI closed at 2,403.68, down 0.24% (5.73 points) from the previous trading day. The KOSPI opened at 2,410.07, up 0.03% (0.66 points) from the previous day, and moved within a slightly positive range, briefly extending its gains. As noon approached, the upward momentum waned and the index turned downward. During the afternoon session, the KOSPI briefly dropped to the low 2,390s.

Foreign investors, who were net buyers during the morning session in the securities market, switched to net selling in the afternoon, offloading stocks worth 67.3 billion won. Individual investors also sold a net 66.4 billion won. Only institutional investors were net buyers, purchasing stocks worth 134.1 billion won.

The shift to net selling by foreign investors is presumed to be influenced by the high exchange rate. At 11:13 a.m. in the Seoul foreign exchange market, the won-dollar exchange rate rose to 1,370.1 won. The won-dollar rate surpassing the 1,370 won level is the first time in 13 years and 5 months since April 1, 2009, during the financial crisis, when it reached 1,392 won (high price basis).

Seokhwan Kim, a researcher at Mirae Asset Securities, diagnosed the domestic stock market on this day, stating, "The dollar index surpassed 110 during the session, and the won-dollar exchange rate broke through 1,370 won, maintaining the burden of a strong dollar."

Looking at the top market capitalization stocks in the securities market, Samsung Electronics closed at 57,100 won, down 0.70% (400 won) from the previous day. Samsung Biologics (-2.74%), Samsung SDI (-1.74%), and Samsung Electronics Preferred (-1.51%) also declined significantly.

On the other hand, LG Energy Solution (0.21%) continued its upward trend amid expectations of benefits from the Inflation Reduction Act (IRA). Automakers such as Hyundai Motor (1.78%) and Kia (0.25%) also rose. Regarding this, researcher Kim noted, "The strength in automobile stocks is due to expectations of regulatory improvements for the government's expansion of electric and hydrogen vehicle charging infrastructure," adding, "There is also a reflection of forecasts that export values will be enhanced due to the strong dollar."

By sector indices, steel and metals (1.34%), transportation equipment (1.14%), and securities (0.74%) closed higher. Conversely, medical precision (-2.73%), pharmaceuticals (-2.32%), and transportation and warehousing (-2.20%) sectors declined.

The KOSDAQ index closed at 771.43, down 1.84% (14.45 points) from the previous day. The KOSDAQ opened at 784.83, down 0.13% (1.05 points) from the previous day, and the decline accelerated in the afternoon session.

In the KOSDAQ market, individual investors were the sole net buyers, purchasing 52.8 billion won worth of stocks. In contrast, institutional and foreign investors sold 23.2 billion won and 3.5 billion won, respectively.

Most of the top market capitalization stocks in the KOSDAQ declined. HLB (-4.87%), L&F (-3.11%), and EcoPro BM (-3.02%) experienced significant drops. Entertainment-related stocks such as Pearl Abyss (1.85%) and Studio Dragon (0.41%) rose.

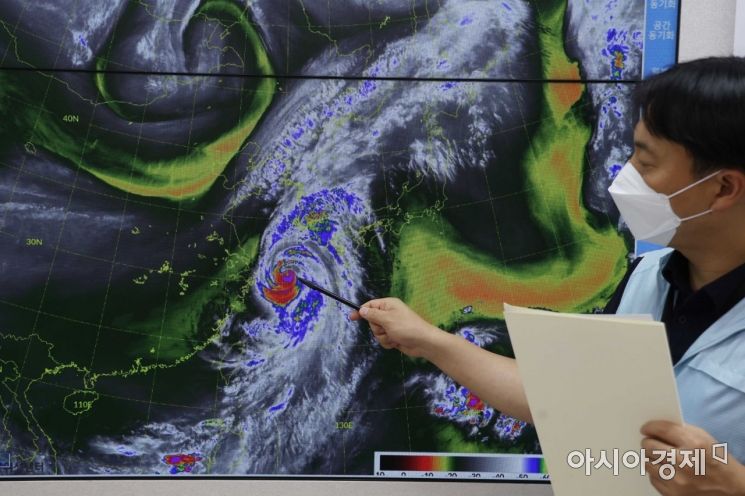

On the 5th, as the 11th typhoon 'Hinnamnor' moves northward, a notification officer is monitoring the typhoon's status at the Korea Meteorological Administration Policy Briefing Room in Dongjak-gu, Seoul. Photo by Moon Honam munonam@

On the 5th, as the 11th typhoon 'Hinnamnor' moves northward, a notification officer is monitoring the typhoon's status at the Korea Meteorological Administration Policy Briefing Room in Dongjak-gu, Seoul. Photo by Moon Honam munonam@

In the KOSDAQ market, disaster recovery-related stocks showed strength. This appears to be due to the Korean Peninsula entering the influence zone of Typhoon Hinnamnor. Korea SE closed at 5,990 won, up 29.79% (1,375 won) from the previous day, nearing the price limit. Samho Development (15.97%) and Woowon Development (9.85%) also rose sharply.

By KOSDAQ sector, telecommunications services (1.81%) and broadcasting services (0.84%) rose. Other manufacturing (-3.15%), pharmaceuticals (-3.06%), and IT components (-3.01%) closed lower.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.