Major Shareholders Including Broadcasters and Pay TV Channel Operators 'Worry' About Declining Broadcast Advertising

[Asia Economy Reporter Lim Hye-seon] Domestic OTT platforms are closely watching Netflix's move to introduce an ad-supported subscription plan. Netflix plans to launch an ad-supported tier as early as November to respond to subscriber declines and differentiated strategies by country. If Netflix's pricing plan is introduced domestically, it is expected that local OTT platforms will also readjust their management strategies.

According to Bloomberg and industry sources on the 1st, the Netflix plan under preparation is a $7?8 monthly subscription that includes ads. This is about half the price of the standard plan ($15.49 per month). The ad time will be shorter than that of cable channels, which run 10?20 minutes of ads per hour. Netflix plans to insert about 4 minutes of ads per hour of video for subscribers using this plan, with ads placed before and during the video. To enter the advertising market, Netflix has recruited two former Snap employees to Microsoft, its technology support partner.

Greg Peters, Netflix Chief Operating Officer (COO), said, "Jeremy Goezen has joined Netflix as the globally recognized head of advertising, and Peter Taylor has joined as Vice President of Advertising Sales," adding, "In Netflix's efforts to provide members with more choices through an ad-supported plan, Jeremy Goezen's extensive experience in ad operations and Peter Taylor's background leading ad sales teams will be very important."

According to foreign media, Netflix has proposed an advertising fee of $65 (approximately 87,600 KRW) per 1,000 viewers. Netflix is reportedly planning to limit advertising contracts per company to $20 million annually (about 26.9 billion KRW) to prevent excessive ad exposure from a single advertiser. Media market analysis firm Ampere Analysis expects Netflix to generate an additional $8.5 billion (about 11.4 trillion KRW) annually by 2027 through subscription fees and advertising revenue after launching the new ad-supported plan.

Since the subscription economy market is already saturated, especially centered on OTT, this move is analyzed as a strategy to overcome subscriber decline and increase additional revenue through advertising. Netflix's subscriber count decreased by 200,000 in the first quarter of this year, marking the first decline in 11 years. In the second quarter, it dropped by 970,000, losing the global OTT No. 1 spot to Walt Disney for the first time.

If Netflix's ad-supported plan is introduced domestically, it is expected to bring changes to the media and advertising market environment. The industry atmosphere suggests that Netflix could absorb not only platform advertising demand from companies like Naver but also broadcast advertising.

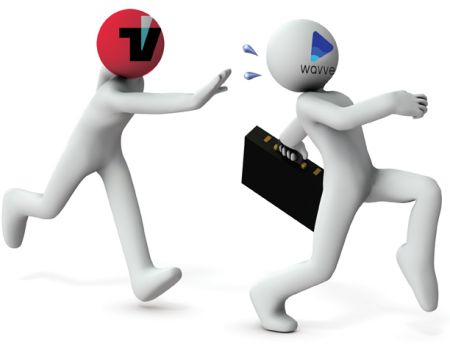

Domestic OTT platforms such as TVING and WAVVE are also considering whether to follow Netflix's path. With subscriber numbers still less than half of Netflix's, advertising sales are not easy, and there is a risk of cannibalizing their parent companies' advertising revenue. According to Mobile Index, the monthly active users (MAU) of domestic OTT platforms in July were Netflix (12.12 million), Coupang Play (4.81 million), WAVVE (4.24 million), TVING (4.12 million), Disney Plus (1.65 million), and Watcha (1.05 million), in that order. Even if the same ads are placed, the exposure effect is greater on Netflix. The advertising industry observes that ad sales are not as easy as expected.

A senior official in the broadcasting industry said, "Netflix, which has secured households with viewership, will be able to convert the ad-supported plan into revenue, but domestic OTT platforms still have a long way to go," adding, "There is even a possibility of losing subscribers." He also mentioned, "We are discussing diversifying pricing plans according to each country at the time of overseas expansion."

Furthermore, the major shareholders of TVING and WAVVE consist of terrestrial broadcasters (KBS, MBC, SBS) and pay-TV operators (CJ ENM, JTBC). If advertisers place ads on OTT programs, the ads inserted into live broadcasts are likely to decrease. Ultimately, there are concerns that the reduction of ads on broadcast channels and their insertion into OTT programs could cause more harm than good.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)