Total IT Personnel in Financial Companies 11,541

IT Budget 7.9748 Trillion KRW... Continuous Growth Trend

As of the end of last year, the average number of information and communication technology (IT) personnel in domestic financial companies was 74.5, showing a significant annual increase in proportion. The IT budget averaged 51.5 billion KRW, growing by more than 10% in one year.

The Financial Informatization Promotion Council published the "2021 Financial Informatization Promotion Status" on the 31st, containing these details. This booklet includes IT operation status surveyed from 155 financial companies, including 20 domestic banks, 86 financial investment firms, 41 insurance companies, and 8 credit card companies.

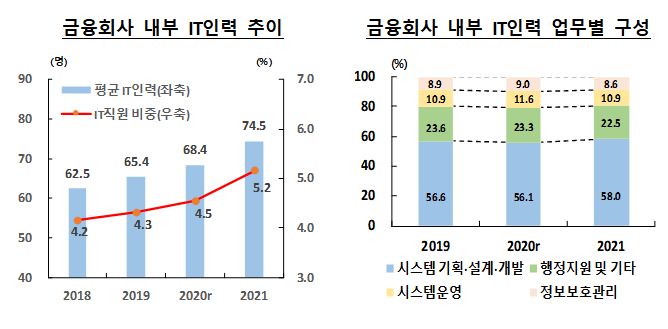

At the end of last year, the total IT personnel in 155 domestic financial companies amounted to 11,541. The average per company was 74.5, an 8.8% increase compared to the previous year, showing an expanding growth trend.

Although the total number of employees in financial companies showed a declining trend, the proportion of internal IT personnel increased significantly from 4.5% to 5.2% year-on-year due to expanded new hiring. The average number of outsourced IT personnel, including external contractors, was 92.8, a 1.0% decrease from the previous year.

Among the 155 financial companies, 122 institutions were found to have appointed Chief Information Security Officers (CISO) as executives.

Last year, the total IT budget of domestic financial companies reached 7.9748 trillion KRW. The average was 51.5 billion KRW, a 10.6% increase from the previous year, and the proportion of the total budget also rose from 8.8% to 9.8% within one year.

The usage scale of major customer-facing electronic financial services such as internet banking and trading showed an increasing trend.

The number of internet banking service uses and transaction amounts at domestic banks and postal financial institutions increased by 18.0% (17.32 million transactions per day) and 19.6% (70.5541 trillion KRW), respectively, compared to the previous year.

Additionally, the share of mobile banking steadily rose, accounting for 82.9% of usage frequency and 18.2% of transaction amounts last year. The relatively lower proportion of transaction amounts compared to usage frequency is because mobile banking is mainly used for relatively small fund transfers.

Internet banking was mostly used for fund transfer services. The usage share of loan application services was only 0.2% in transaction frequency and 1.1% in transaction amount.

According to a survey of IT personnel in financial companies and related institutions, key issues in the financial IT sector included 'increased utilization of big data in financial services' (68.7%), 'activation of cloud environment use in the financial sector' (65.4%), and 'introduction and activation of MyData services in the financial sector' (60.8%).

Regarding the technology fields expected to grow the fastest over the next three years, responses ranked 'cloud environment utilization technology' (59.4%), 'big data processing technology' (57.6%), and 'artificial intelligence technologies such as robo-advisors and chatbots' (39.6%) in order.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.