KOSPI closes at 2450.93, up 24.04P (0.99%↑)

KOSDAQ closes at 797.02, up 17.13P (2.20%↑)

The KOSPI opened at 2,441.21, up 14.32 points (0.59%) from the previous trading day, on the 30th at the Hana Bank dealing room in Jung-gu, Seoul. In the Seoul foreign exchange market, the won-dollar exchange rate started at 1,346.0 won, down 4.4 won. Photo by Hyunmin Kim kimhyun81@

The KOSPI opened at 2,441.21, up 14.32 points (0.59%) from the previous trading day, on the 30th at the Hana Bank dealing room in Jung-gu, Seoul. In the Seoul foreign exchange market, the won-dollar exchange rate started at 1,346.0 won, down 4.4 won. Photo by Hyunmin Kim kimhyun81@

[Asia Economy Reporter Ji Yeon-jin] The domestic stock market closed higher on the 30th. Unlike the U.S. stock market, which fell for two consecutive days due to the 'Jackson Hole shock,' the domestic market rebounded in just one day. With the exchange rate, which hit its highest point in 20 years, calming somewhat, foreigners are actively buying in the futures market, driving the market.

The KOSPI index closed at 2450.93, up 24.04 points (0.99%) on the day. The index, which had dropped to 2426 due to the hawkish Jackson Hole shock the previous day, recovered the 2440 level (2441.21) from the opening and expanded its gains to reclaim the 2450 level.

Individuals net bought about 140.2 billion KRW worth of KOSPI cash stocks, while foreigners and institutions net sold about 32.7 billion KRW and 127.4 billion KRW respectively. Foreigners initially net sold about 170 billion KRW in the early session but reduced their selling volume as the market calmed in the afternoon. Notably, foreigners net bought about 369.1 billion KRW worth in the KOSPI futures market, leading the stock price rise. Large-scale foreign futures purchases tend to stimulate buying in the cash market's program arbitrage, effectively pushing the index higher.

Lee Jin-woo, a researcher at Meritz Securities, said, "Since the drop after Jackson Hole was excessive, the market sentiment was good due to foreign futures buying," adding, "Because Fed Chair Powell's Jackson Hole remarks did not change the market's previously expected direction, the sharp drop followed by a rebound seems to be a result of repeated interpretation and reinterpretation."

Among the top market capitalization stocks, Hyundai Motor closed up 3.71%, supported by simultaneous buying from foreigners and institutions, and Kia also rose 3.35%. Foreigners have been buying Hyundai Motor for nine consecutive trading days since the 18th. Except for the 17th, they have been buying Hyundai Motor on every trading day this month.

Samsung Electronics showed weakness immediately after the opening but managed to rebound during the session, closing up 0.34% (200 KRW) at 58,800 KRW. LG Energy Solution rose 1.31% as its intraday gains slowed, while SK Hynix (0.76%), Samsung Biologics (0.84%), and LG Chem (1.16%) recorded gains around 1%. NAVER and Kakao closed up 1.71% and 1.39%, respectively. Celltrion rose 1.62% on news that it will announce clinical results for two biosimilars at a European conference next month, and POSCO Holdings closed up 4.10%.

On the other hand, Hanjin KAL plunged over 8% on news that LX Pantos, a logistics affiliate of LX Group, will acquire a 3.83% stake.

The KOSDAQ index closed at 797.02, up 17.13 points (2.20%) from the previous day. The KOSDAQ index had fallen 22.56 points (2.81%) the day before, breaking below the 800 level, but rebounded in just one day, recovering close to the 800 mark. Foreigners and institutions net bought about 62.2 billion KRW and 82.8 billion KRW respectively, driving the index rebound. Individuals showed buying dominance in the early session but ended with net selling of 133 billion KRW.

Kim Seok-hwan, a researcher at Mirae Asset Securities, said, "Both KOSPI and KOSDAQ rose due to rebound buying," adding, "With large-cap stocks overall on the rise, especially strong performances in automobile, secondary battery, and gaming-related stocks, combined with concentrated foreign buying, the KOSDAQ index rose more than 2% intraday." He also noted that the intraday drop in U.S. Treasury yields and the rebound in Nasdaq futures were positive factors for the stock market.

All top market capitalization stocks on the KOSDAQ closed higher. Celltrion Healthcare jumped 3.03% benefiting from Celltrion's strong performance, and Celltrion Pharm also closed up 3.60%. HLB (1.98%) and Alteogen (2.40%) also rose together. Nature Cell, ranked 18th in KOSDAQ market cap, surged 15.96%, highlighting the strength of bio-related stocks. Additionally, Pearl Abyss (3.60%) and Kakao Games (2.54%) closed higher.

Appclon soared to the daily limit at 21,700 KRW on positive reviews of its drug under development.

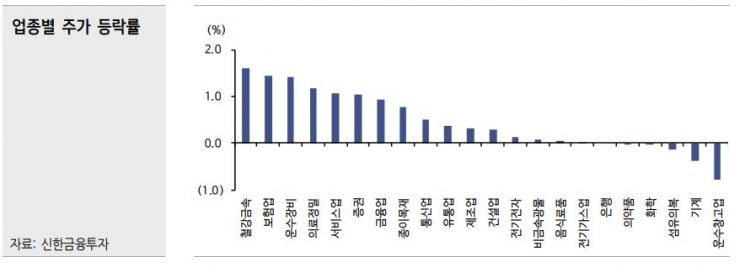

Choi Yoon-ah, a researcher at Shinhan Investment Corp., said, "After digesting the Jackson Hole meeting, there was a slight rebound due to the perception of excessive previous declines, and the dollar weakened, showing a trend contrasting with the U.S. stock market," adding, "Foreigners are leading the rise mainly through futures buying, while in the cash market, strong U.S. Treasury yields and downward pressure on the semiconductor sector are causing selling."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)