KIPF Publishes Report on 'Inflation and Public Sector Finance'

"Domestic Consumer Prices Rise 1.6%P More When Including Owner-Occupied Housing Costs... Already Surpassed 8%"

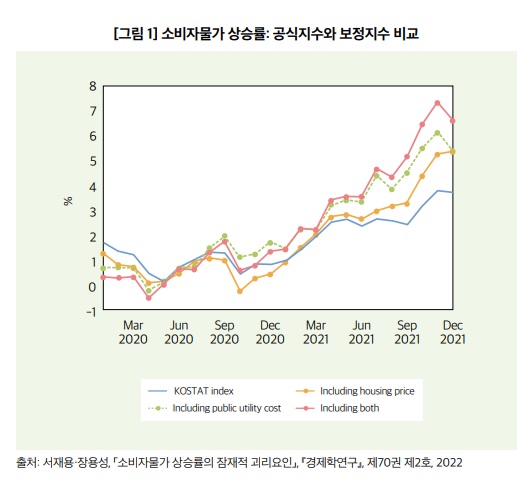

[Asia Economy Sejong=Reporter Kwon Haeyoung] An analysis has emerged that if owner-occupied housing costs are included in the domestic consumer price index, inflation would rise by an additional 1.7 percentage points, pushing the inflation rate in the first half of the year beyond the 7% range. When the cost increases of public utility charges such as electricity and gas fees are also reflected in consumer selling prices, the inflation rate is estimated to have already exceeded 8%.

On the 29th, the Korea Institute of Public Finance published the 'August 2022 Fiscal Forum' which included the report 'Inflation and Public Sector Finance' (Professor Jang Yongsung, Department of Economics, Seoul National University) containing these findings.

According to the report, the weight of housing costs in the price index is 9.8% in Korea, significantly lower than in the United States (32%). This is because owner-occupied housing costs, which represent the cost of living in a home after renting out the owned house, are not included. The report analyzes that this creates an optical illusion that Korea’s consumer price inflation rate of 5.4% as of May is relatively moderate compared to the United States (8.6%) and the Eurozone (8.1%). This contrasts with 20 out of 38 OECD member countries that publish price indices reflecting owner-occupied housing costs in some form.

Additionally, it is pointed out that the monthly rent price changes used in the consumer price index are smaller than actual market price fluctuations. It is suggested that the KB Kookmin Bank and Korea Real Estate Board’s Jeonse Price Index should be used instead.

Professor Jang Yongsung of Seoul National University stated, "If the consumer price index includes the weight of owner-occupied housing costs and reflects increases in house prices and monthly rent prices to recalculate the inflation rate, the inflation rate would rise by about 1.6 percentage points compared to the official indicator. Using the Jeonse Price Index, which reflects the monthly rent market situation and is frequently used in economic analysis, would further increase the consumer price inflation rate by 0.1 percentage points." He added, "The inflation rate reflecting these two housing-related factors is estimated to be about 1.7 percentage points higher than the official inflation rate, exceeding 7%."

The government's suppression of public utility charges such as electricity and gas also creates an optical illusion that the inflation rate appears relatively low. Assuming that electricity and city gas fees are raised enough to cover the operating losses of Korea Electric Power Corporation and Korea Gas Corporation, the inflation rate is analyzed to increase by an additional 1 percentage point. Suppressing public utility fee increases is criticized as shifting current inflation factors into the future.

Professor Jang said, "The hypothetical potential consumer price inflation rate calculated by considering all these factors reached 7% in December 2021 and is estimated to reach 8%, much higher than the official statistics now. Since the price index is an important indicator that serves as a reference for government policy-making and private sector economic activities, it is desirable to continuously improve it to better reflect market conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)