Korea Federation of SMEs Announces September SME Business Outlook Survey

Business Outlook Index Rises 4.7p Compared to Previous Month

[Asia Economy Reporter Kwak Min-jae] The Small and Medium Business Outlook Index (SBHI) rebounded for the first time in four months. Despite the resurgence of COVID-19 and the global economic slowdown, this is analyzed as a result reflecting expectations for domestic demand improvement due to the government's second supplementary budget and the Chuseok holiday.

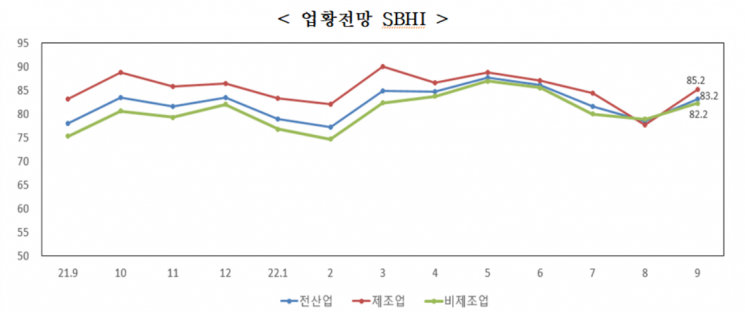

The Korea Federation of SMEs announced on the 28th that it conducted the "September 2022 Small and Medium Business Outlook Survey" targeting 3,150 SMEs from the 16th to the 23rd, and the business outlook index for September rose 4.7 points from the previous month to 83.2.

This marks a rebound after four months since May (87.6). Expectations for domestic demand improvement, including the government's second supplementary budget, the new school term in September, and the Chuseok holiday, are reflected, and the decline in SMEs' perceived business conditions is expected to ease somewhat.

The manufacturing sector's business outlook for September rose 7.6 points from the previous month to 85.2, while the non-manufacturing sector increased 3.3 points to 82.2. Construction rose 0.9 points to 79.6, and services increased 3.8 points to 82.7 compared to the previous month.

Among 22 manufacturing industries, 16 sectors showed an increase compared to the previous month, centered on metal fabricated products (up 17.2 points) and printing and recorded media reproduction (up 16.9 points). Notable declines were seen in beverages (down 4.8 points) and apparel, clothing accessories, and fur products (down 4.6 points).

In the non-manufacturing sector, expectations improved due to the end of the summer off-season and the Chuseok holiday special demand. Construction rose 0.9 points from 78.7 to 79.6, and services increased 3.8 points from 78.9 to 82.7 compared to the previous month.

Within services, the largest increases were in arts, sports, and leisure-related services (up 20.1 points), transportation (up 8.7 points), and wholesale and retail trade (up 4.7 points). The largest declines were in education services (down 6.2 points) and accommodation and food services (down 4.2 points).

Exports are expected to worsen slightly, dropping from 85.7 to 85.1 compared to the previous month. However, domestic sales (79.3 to 83.0), operating profits (76.2 to 79.3), financial conditions (79.1 to 80.3), and employment (93.5 to 92.5), which is a counter-trend, are expected to improve compared to the previous month.

Comparing September's SBHI with the average SBHI for the same month over the past three years by category, manufacturing is expected to improve in all areas except raw material outlook, including overall business conditions, production, domestic demand, exports, operating profits, and financial conditions, as well as counter-trend areas such as facilities, inventory, and employment outlook. Non-manufacturing is expected to improve in all categories.

The main difficulties faced by SMEs were dominated by sluggish domestic demand (60.0%), followed by rising raw material prices (48.8%), increased labor costs (48.1%), excessive competition among companies (35.3%), and rising logistics costs and transportation difficulties (27.3%).

The proportion of responses citing sluggish domestic demand (59.0 to 60.0), rising labor costs (47.3 to 48.1), excessive competition among companies (32.0 to 35.3), and delayed payment collection (15.4 to 16.2) increased compared to the previous month, while the proportion citing rising raw material prices (49.5 to 48.8) decreased.

The average operating rate of small and medium manufacturing in July was 72.2%, down 0.3 percentage points from the previous month but up 1.3 percentage points compared to the same month last year.

By company size, small enterprises recorded 68.9%, down 0.2 percentage points from the previous month, and medium enterprises recorded 75.3%, down 0.6 percentage points from the previous month.

By company type, general manufacturing fell 0.5 percentage points from the previous month to 71.1%, while innovative manufacturing rose 0.3 percentage points to 75.1% compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.