Cheapest Core Battery Mineral Lithium on the Rise

LFP Battery Dominance and Abnormal Climate Make It the Most Expensive Mineral

Korean Batteries Mainly Use NCM Batteries with Relatively Low Lithium Usage

LFP Batteries May Lose Price Competitiveness

[Asia Economy Reporter Donghoon Jeong] The price of lithium, a key mineral for batteries, has continued its solo surge, breaking historical records once again. This contrasts with other mineral prices, which have gradually stabilized downward after fluctuating together following the Russia-Ukraine war. Despite being a core mineral, this trend could present another opportunity for the domestic battery industry, which mainly produces ternary batteries that use less lithium than lithium iron phosphate (LFP) batteries.

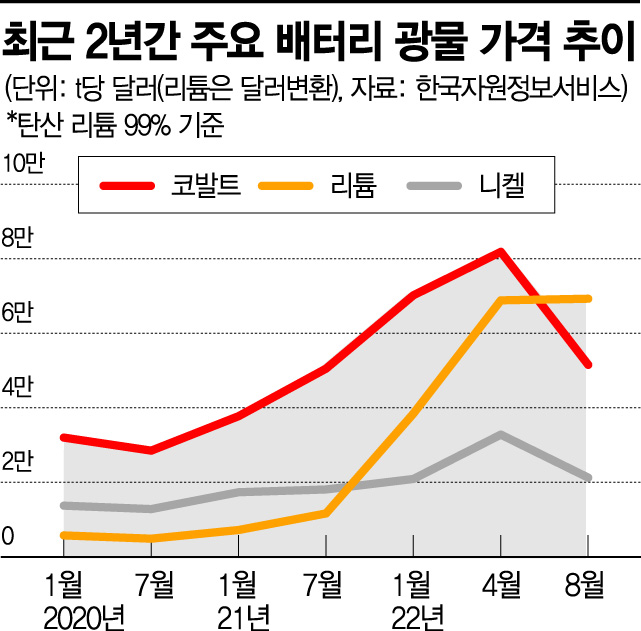

According to the Korea Resource Information Service on the 28th, the price of lithium carbonate reached $69,259 per ton (approximately 92.47 million KRW) as of that day, surpassing the previous record of $68,822 per ton (approximately 91.89 million KRW) set in April this year. In July last year, lithium prices were around $11,652 per ton (approximately 15.55 million KRW), making it the cheapest among other key battery minerals such as cobalt ($50,500 per ton, approximately 67.42 million KRW) and nickel ($18,082 per ton, approximately 24.14 million KRW), but it has since experienced the largest increase. Currently, it is the most expensive mineral used in batteries.

The recent rise in lithium prices is analyzed to be driven by the U.S. Inflation Reduction Act (IRA) and the resulting supply chain restructuring issues. The surge in electric vehicle demand and power usage restrictions in Sichuan Province, the world’s lithium production hub, are also considered contributing factors. Sichuan Province, which accounts for about 28% of global lithium carbonate production, is experiencing a heatwave not seen in 60 years. Consequently, power usage restrictions within Sichuan have led to the closure of some production plants.

This lithium price surge could actually be an opportunity for Korean batteries. This is because the lithium price spike significantly impacts LFP (lithium iron phosphate) batteries, which are mainly produced by Chinese companies, compared to NCM (nickel-cobalt-manganese) batteries, the main product of Korean battery manufacturers.

LFP batteries have been advantageous for distribution due to their lower cost despite lower energy density. They reduce production costs by using iron instead of rare metals like cobalt or nickel. However, the lithium price surge is seen to be diminishing this price competitiveness. While lithium is used in the electrolyte of NCM batteries, LFP batteries contain lithium in both the cathode material and electrolyte, making the lithium proportion higher.

According to market research firm SNE Research, in November last year, the prices of NCM811 (ternary battery with over 81% nickel content) and LFP batteries were $63 and $50 per kWh, respectively?a 26% gap. As of March this year, the prices rose to $80.3 and $70.6, respectively, increasing by 27% and 41%, narrowing the gap to 14%.

When limited to cathode materials, which determine battery types, the difference is even more noticeable. For NCM811, cathode material costs rose from $33 to $42.9 during the same period, while for LFP, they increased from $22 to $38.5. The price gap between the two battery cathode materials significantly narrowed to 11%, reflecting the full impact of lithium prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)