Loan Adjustment Limit Reduced from 2.5 Billion to 1.5 Billion KRW

Principal Reduction Supported Only for Net Debt of Non-Performing Borrowers Overdue More Than 90 Days

Up to 10 Years Installment Repayment Available

Kwon Dae-young, Director General of Financial Policy Bureau at the Financial Services Commission, is briefing on the New Start Fund promotion plan on the morning of the 26th at the Government Seoul Office in Jongno-gu, Seoul.

Kwon Dae-young, Director General of Financial Policy Bureau at the Financial Services Commission, is briefing on the New Start Fund promotion plan on the morning of the 26th at the Government Seoul Office in Jongno-gu, Seoul.

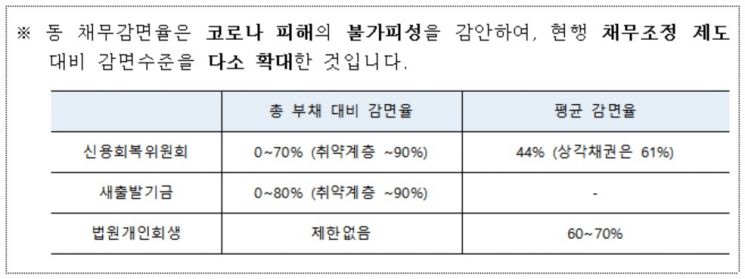

[Asia Economy Reporter Song Hwajeong] The debt adjustment program 'New Start Fund' for self-employed and small business owners affected by COVID-19 will be implemented in October. For delinquent borrowers with arrears over 90 days, principal adjustments of 60-80% will be supported on net debt limited by assets. Installment repayment is possible for up to 10 years, and high-interest loans will be adjusted to medium- and low-interest rates. The adjustment limit is 1.5 billion KRW. Financial authorities expect that up to 400,000 people will be able to receive support from the New Start Fund.

On the 28th, the Financial Services Commission announced detailed plans for the New Start Fund scheduled to be implemented from October.

The New Start Fund, created with a scale of 30 trillion KRW, is a program that adjusts loans held by contracted financial companies for self-employed and small business owners affected by COVID-19 according to the borrower's repayment ability recovery speed. Kwon Daeyoung, Director of the Financial Policy Bureau at the Financial Services Commission, said, "We have prepared a debt adjustment system to prevent the expansion of potential non-performing loans among self-employed and small business owners affected by COVID-19 and to provide opportunities for credit recovery and rehabilitation to borrowers with non-performing loans," adding, "We aim to alleviate excessive repayment burdens relative to repayment ability, provide sufficient time for business recovery, and offer rehabilitation opportunities by adjusting existing debts to match repayment ability through principal adjustments for non-performing borrowers."

Targeting vulnerable borrowers at high risk of default among self-employed or small business owners affected by COVID-19

The New Start Fund targets vulnerable borrowers who are self-employed or small business owners affected by COVID-19 who have been in long-term arrears of 90 days or more or are at high risk of falling into long-term arrears soon. All industries that complied with quarantine measures such as business restrictions are included in the support target, and borrowers who closed their businesses after the COVID-19 outbreak are also eligible.

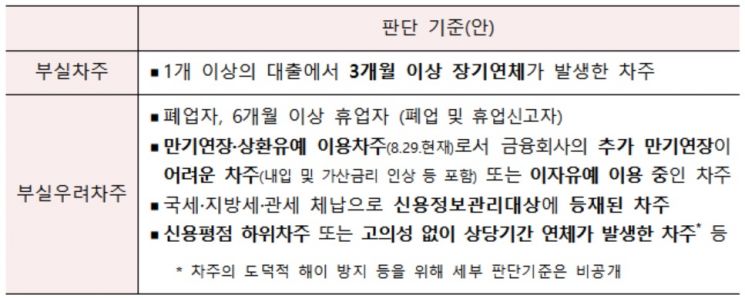

Vulnerable borrowers subject to debt adjustment include non-performing borrowers with long-term arrears of three months or more on one or more loans, ▲ closed businesses and those on leave for six months or more, ▲ borrowers who have used maturity extensions or repayment deferrals and for whom additional maturity extensions by financial companies are difficult, or borrowers currently using interest deferrals, ▲ borrowers registered in credit information management due to arrears in national tax, local tax, or customs duties, ▲ borrowers with low credit scores or those who have experienced significant arrears for a considerable period without intentional default, and other vulnerable borrowers at risk of default.

Industries not eligible for the Ministry of SMEs and Startups' loss compensation fund, such as real estate rental businesses, gambling machine and amusement equipment manufacturing, and professional occupations like legal, accounting, and tax services, are excluded from support. Additionally, borrowers who intentionally default to meet application qualifications or high-net-worth individuals applying for small debt reductions will be denied debt adjustment. The Financial Services Commission plans to establish reasonable rejection criteria to prevent moral hazard and conduct qualitative reviews during debt adjustment applications. If false documents or intentional defaults are discovered after debt adjustment, the adjustment will be immediately invalidated, and new applications will be prohibited.

Loans subject to debt adjustment include all loans held by contracted financial companies participating in the 'New Start Fund Agreement.' The Financial Services Commission aims to sign agreements with about 6,500 financial companies. Since self-employed and small business owners have a low proportion of unsecured loans (13%) and a high proportion of secured (75%) and guaranteed loans (12%), secured and guaranteed loans will also be supported. Due to the characteristics of self-employed individuals, household loans are included in the support target; however, for corporate small business owners where the corporation and representative are separate, the representative's household loans are excluded. Loans related to real estate rental and sales, household loans for personal asset formation such as home purchases, and jeonse deposit loans unrelated to COVID-19 damage are excluded. However, business loans secured by real estate, and loans for purchasing commercial vehicles such as trucks and heavy equipment are eligible for adjustment as they are for business operation. Discounted bills, trade finance, special purpose company (SPC) loans, deposit-secured loans, loans with disposal restrictions, and loans under court rehabilitation procedures are excluded. Private debts between individuals, tax arrears such as national tax, local tax, customs duties for non-contracted borrowers, and new loans taken less than six months ago by vulnerable borrowers are also excluded. Non-performing borrowers cannot receive support if new loans within six months exceed 30% of total debt.

To limit intentional and repetitive debt adjustment applications, only one application per applicant is allowed during the application period. However, if a vulnerable borrower fails to comply with the debt adjustment plan for 90 days or more during the use of the New Start Fund, it is possible to transfer from the vulnerable borrower track to the non-performing borrower track for adjustment.

The adjustment limit is 1 billion KRW for secured loans and 500 million KRW for unsecured loans, totaling 1.5 billion KRW. Director Kwon explained, "We set the adjustment limit the same as the Credit Recovery Committee's debt adjustment limit, and since the average debt of self-employed people in Korea is about 120 million KRW, 1.5 billion KRW will cover most cases," adding, "We accepted public opinion that the initial limit of 2.5 billion KRW needed to be lowered and adjusted accordingly."

Support divided into two tracks for non-performing and vulnerable borrowers... Principal reduction for non-performing borrowers, interest reduction for vulnerable borrowers

Debt adjustment is customized into two types according to the borrower's credit status and loan type. For Track 1, where non-performing borrowers apply for guaranteed and unsecured loans, strict screening procedures are conducted, and principal adjustment is supported for 60-80% of the debt exceeding the borrower's asset value (net debt), not the total debt. Since the reduction rate of 60-80% is applied to net debt (debt minus asset value), the reduction rate relative to total debt varies from 0 to 80% depending on asset holdings. If asset value exceeds total debt, principal adjustment is not supported. The reduction rate is determined considering the ratio of net debt to income, expected economic activity period, and repayment period. Director Kwon said, "If you earn 500,000 KRW but have to repay 1 million KRW, it's impossible. So, we deduct 500,000 KRW and then reduce 60-80% of the remaining part," adding, "If the borrower is expected to work longer, the reduction rate is lower; if older with a shorter economic activity period, the reduction rate is higher. We plan to operate a program that allows fine-tuning of the reduction rate based on repayment willingness."

In Track 1, interest and overdue interest are reduced, and regardless of whether the loan is a lump-sum or installment repayment, it is converted into an installment repayment loan to be repaid steadily. Borrowers directly select the grace period and repayment period according to their financial situation and repay the loan according to that schedule. The grace period during which installment payments can be deferred is supported for up to 0-12 months, and the installment repayment period is supported for 1-10 years.

After debt adjustment, if hidden assets are discovered through regular asset investigations, the existing debt adjustment, including principal adjustment, will be invalidated immediately.

Non-performing borrowers under Track 1 will have their long-term delinquency information lifted upon contract conclusion, but information on the use of the debt adjustment program (public information) will be registered with the Credit Information Center and shared with all financial institutions and credit bureaus for two years, imposing a credit penalty. During this period, borrowers will find it practically difficult to obtain new loans or use/issue credit cards. However, after two years, the public information is lifted, allowing credit improvement depending on the borrower's efforts.

Track 2 applies to ▲ vulnerable borrowers applying for secured, guaranteed, or unsecured debt adjustments, and ▲ non-performing borrowers applying for secured debt adjustments. The loan structure is converted into long-term, low-interest, installment repayment loans to allow borrowers to repay according to their business recovery speed. Principal adjustment is not supported.

Interest rate reductions are provided differentially according to the borrower's delinquency period. Before 30 days of delinquency, the existing contracted interest rate is maintained, but any portion exceeding 9% high interest is adjusted to 9%. After 30 days of delinquency, as the borrower's credit score begins to decline significantly, a single interest rate is applied within the repayment period. For repayment periods of 3 years or less, the rate is in the high 3% range; for 3-5 years, mid-4%; and for over 5 years, high 4%. Specific interest rates will be decided later reflecting bank loan rates and the New Start Fund's funding rates. In Track 2, all loans are converted into installment repayment loans regardless of the original loan type. The grace period allowing interest-only payments is supported for 0-12 months (0-36 months for real estate secured loans), and the installment repayment period is supported for 1-10 years (1-20 years for real estate secured loans). Interest deferral is also possible within a one-year limit during the grace period. Vulnerable borrowers are not registered in public information but may face credit restrictions due to short-term delinquency history.

Debt adjustment applications can be submitted through an online platform opening in October or offline service counters. After application, a debt adjustment plan is prepared within about two weeks, and the debt adjustment agreement is concluded within two months after debt purchase, etc.

The New Start Fund will begin accepting debt adjustment applications in October after preparation procedures such as legal amendments, signing agreements with financial institutions (about 6,500), and building IT systems (taking 1-2 months). Applications will be accepted primarily for one year from October, but depending on COVID-19 resurgence, economic conditions, and trends in potential non-performing loans among self-employed and small business owners, the operation period may be extended up to three years if necessary.

The Financial Services Commission expects that up to 400,000 people will be able to receive support from the New Start Fund. Director Kwon said, "Considering the average debt size of self-employed people (120 million KRW), 30 trillion KRW in debt adjustment can support about 250,000 self-employed and small business owners," adding, "However, since applicants usually have small assets and income and thus lower debt levels, the support scale is expected to expand to about 400,000 people."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)