Accelerated the Bill Proposal... But the Aftermath Is the Problem

[Asia Economy Reporters Sunmi Park, Chaeseok Moon] There is a growing crisis theory that the ‘K-Chips Act,’ an ambitious initiative by the Yoon Suk-yeol administration to foster South Korea’s semiconductor industry, may miss its ‘last golden time’ due to political complacency and partisan conflicts. Despite the urgent need for legislation amid a global hegemony battle over technological supremacy, the backward behavior of the political sphere is holding back progress. With the U.S. Chips Act and the European Union’s Chips Act already enacted, Korean semiconductor companies are concerned about a decline in competitiveness.

◆A flashy start but... an ‘insufficient’ strategy for a semiconductor superpower= The Yoon Suk-yeol administration announced a ‘Semiconductor Superpower Achievement Strategy’ to boost South Korea’s representative competitive industry, the semiconductor sector, and subsequently introduced supplementary measures. However, caught in a tug-of-war between ruling and opposition parties, the semiconductor bill, where speed is crucial, has failed to accelerate in implementation. A prime example is the ‘K-Chips Act,’ which bundles the partial amendment bills of the Special Act on Strengthening and Protecting National Advanced Strategic Industries and the Restriction of Special Taxation Act, proposed by the Semiconductor Industry Competitiveness Enhancement Special Committee (Semiconductor Special Committee).

Led by Representative Hyang-ja Yang (People Power Party, Chair of the Semiconductor Special Committee), the committee concluded its first season of activities on June 4 and proposed the K-Chips Act. After five meetings since its launch on June 28, the bill was completed and quickly submitted.

Given the importance of semiconductor competitiveness among countries amid the ‘Chip 4’ alliance issue, it was urgent to ease regulations and supplement various government supports to at least keep pace with the support measures of the U.S. and Europe. Notably, this bill was bipartisan, containing provisions not included in the previous Democratic Party special committee’s bill, which gave it significance. Therefore, there was an expectation that Season 2 would be elevated to a National Assembly-level special committee to continue discussions after Season 1 ended.

However, the atmosphere has completely changed. Even three weeks after the conclusion of the committee’s activities, there has been no discussion about forming Season 2. A semiconductor industry insider explained, “While budget discussions are necessary to implement the K-Chips Act, everything seems to be at a standstill.” Many local government heads are stepping up to create semiconductor clusters and specialized semiconductor complexes in line with corporate investment trends, but limited resources make resolving this impossible.

With continuous opposition from the political sphere, passing the proposed bill through the National Assembly is not easy. According to the National Assembly, the Industrial, Trade, Small and Medium Venture Resources and Energy Committee’s Industrial, Trade and Energy Patent Subcommittee, which oversees the K-Chips Act, will meet on the 5th of next month. However, for the K-Chips Act agenda to be included, the opposition party’s floor leader (Representative Han-jung Kim of the Democratic Party) must reach an agreement with the ruling party’s floor leader (Representative Cheol-gyu Lee of the People Power Party) and obtain the consent of the committee chair (Representative Kwan-seok Yoon of the Democratic Party). If the opposition blocks it, even discussion could be restricted.

It is also notable that the Ministry of Economy and Finance, which must balance ‘regulatory reform’ with ‘protecting the national treasury,’ has expressed reluctance rather than ‘active support.’ While preparing next year’s budget, the government set the fiscal management deficit limit to within 3.0% of the gross domestic product (GDP), signaling a belt-tightening stance.

◆Companies say “Semiconductors = Timing,” anxiously waiting= Among the K-Chips Act provisions, semiconductor companies most anticipated tax benefits, workforce development, and easing of facility permits and regulations. Especially, mid-sized and small companies, as well as large corporations, had high expectations for tax benefits.

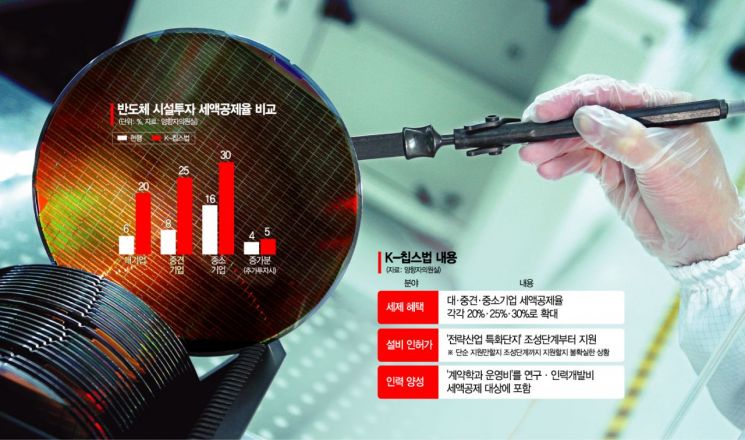

The partial amendment bill to the Restriction of Special Taxation Act bundled in the K-Chips Act aims to increase the semiconductor facility investment tax credit rate up to 30%. It extends the tax credit period for semiconductor facility investments to 2030 and raises the current 6?16% tax credit rate to ▲20% for large corporations ▲25% for mid-sized companies ▲30% for small companies. This means that Samsung Electronics and SK Hynix, which have the greatest capacity for semiconductor investment, could receive a dramatically increased tax credit from the current 6% level to 20%.

The semiconductor industry notes that it is difficult for fiscal authorities to easily approve doubling the tax credit rate from the current 6?16% to 20?30%. Compared to the U.S. (25%), the credit rate is insufficient, and more radical tax support is needed to empower companies to expand facility investments.

A representative from a major semiconductor company said, “It is important that the government shows a strong will to quickly follow the trend of increasing semiconductor tax support seen in major countries like the U.S. The K-Chips Act centers on tax credits, and if that part is delayed, medium- to long-term investments such as workforce development and easing of facility permits may not have significant effects. Now is the time when corporate investment and government support must create synergy.”

With gloomy forecasts that memory semiconductors, South Korea’s core export product, will grow by only ‘0%’ next year, there are growing concerns that if the government’s semiconductor deregulation and tax support do not accelerate, corporate semiconductor investment expenditures will decrease.

Samsung Electronics stated in last month’s conference call that it would flexibly review its short-term semiconductor facility investment plans according to market conditions, and in fact, its facility investment in the first half of this year was KRW 21.7341 trillion, down 13.5% from KRW 25.1149 trillion last year. SK Hynix has put on hold its plan to expand a new semiconductor plant in Cheongju.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.