[New Interest Rate Nomad⑥]

As the term "King Dollar" has emerged due to the continued ultra-strong dollar phenomenon, foreign currency investments centered on the dollar are also active. The dollar deposit balances at major commercial banks have surged by about 1 trillion won in just over 40 days.

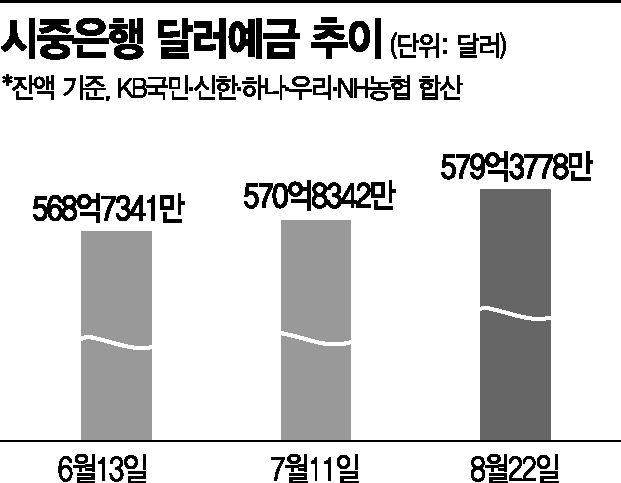

According to the financial sector on the 25th, the dollar deposit balance of the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) recorded approximately 57.93778 billion dollars (as of the 22nd). This is an increase of about 854.36 million dollars (approximately 1.1456 trillion won) compared to June 11 (about 57.08342 billion dollars), in just over 40 days.

The dollar deposits have shown an increasing trend for three consecutive months. In May, it was about 53.6 billion dollars, and in June, about 56.9 billion dollars. This is interpreted as investors holding onto dollars amid growing expectations that the exchange rate will continue to rise. The won-dollar exchange rate surpassed 1,340 won on the 22nd for the first time in 13 years and 4 months, and experts are also considering the possibility of it rising to 1,400 won. Regarding yen deposits at the five major banks, during the same period, it increased by 7.2 billion yen from about 603.1 billion yen to 610.3 billion yen. As the yen depreciation phenomenon prolongs, interest in forex investment (exchange rate + asset management) aiming for arbitrage gains has also increased. A Bank of Korea official said, "Expectations that the won-dollar exchange rate will rise delayed corporate spot foreign exchange sales, and overseas direct investment funds were temporarily deposited, leading to an increase in dollar deposits."

Commercial banks are also competing in foreign currency deposit products. NH Nonghyup Bank launched a corporate-only demand foreign currency deposit product called ‘NH Plus Foreign Currency MMDA’ last week. It is a product with free deposits and withdrawals, offering interest rates comparable to foreign currency time deposits even if deposited for just one day. The interest rate is 1.91% per annum (before tax) for deposits over 1 million dollars. KB Kookmin Bank offers a 90% preferential exchange rate benefit to corporate customers who open a ‘KB Export-Import Preferential Foreign Currency Account’ for the first time and then subscribe to a foreign currency time deposit until next month. SC First Bank also launched a special promotion offering up to 3.5% annual special interest rates to new customers subscribing to US dollar foreign currency time deposits. Foreign currency deposit interest rates are linked to foreign currency liquidity, and with increasing dollar demand, dollar deposit interest rates are relatively high. For example, KB Kookmin Bank’s dollar deposit interest rate is about 3.68% (for 12 months or more).

High-net-worth individuals are also flocking to dollar-denominated bonds, considering the possibility of interest rate cuts in the second half of next year. Private banking centers at each bank responsible for asset management have seen increased demand for foreign currency bonds. Jung Sung-jin, Deputy Head of KB Kookmin Gangnam Star PB Center, said, "There is also high interest in bonds issued by Korean companies in dollars in the US." Choi Jae-san, PB team leader at Shinhan PWM Yeouido Center, conveyed the atmosphere, saying, "Some customers are purchasing long-term bonds of 2 to 3 years or more because there is talk that interest rates may be cut next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.