Internet Banks Offer Average Interest Rates 3 Times Higher Than Commercial Banks

"Many High-Interest Loans for Low-Credit Borrowers"

Claiming Simple Comparisons Are Unfair

Reluctant to Raise Deposit Interest Rates

Market banks also show discomfort with the disclosure of the interest rate spread between deposits and loans, often referred to as the "interest profiteering" report card. Internet-only banks, which have built a good image so far, have also found themselves in a difficult position as they cannot avoid criticism of "interest profiteering." The deposit-loan interest rate spread of internet-only banks is on average nearly three times higher than that of market banks, with Toss Bank in the 5% range showing up to five times the difference.

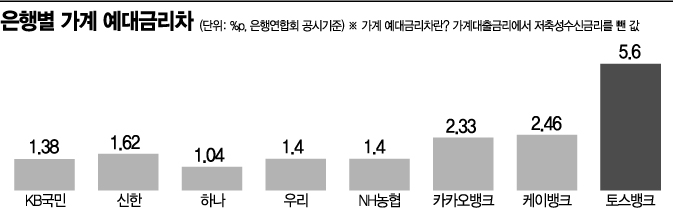

According to the Bankers Association on the 23rd, the household loan deposit-loan interest rate spread of the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) was 1.37 percentage points, while internet banks (Kakao Bank, K Bank, Toss Bank) had 3.46 percentage points. The average loan deposit-loan interest rate spread for the five major banks was 1.21 percentage points, and for internet banks, it was 3.48 percentage points.

The household loan deposit-loan interest rate spread is the value obtained by subtracting the interest rate on savings deposits from the household loan interest rate. The average loan deposit-loan interest rate spread is calculated by adding corporate loans to household loans. The larger these figures are, the lower the deposit interest rates and the higher the loan interest rates, which is interpreted as the banks' "interest profiteering" report card.

Among the five major banks, Shinhan Bank had the largest household deposit-loan interest rate spread at 1.62 percentage points, followed by Woori Bank (1.4 p.p.), NH Nonghyup Bank (1.4 p.p.), KB Kookmin Bank (1.38 p.p.), and Hana Bank (1.04 p.p.).

Looking at the overall deposit-loan interest rate spread including corporate loans, NH Nonghyup Bank had the largest spread at 1.36 percentage points among the five major banks. Woori Bank (1.29 p.p.), KB Kookmin Bank (1.18 p.p.), Shinhan Bank (1.14 p.p.), and Hana Bank (1.1 p.p.) followed.

For internet-only banks' household deposit-loan interest rate spread, Toss Bank had the largest at 5.6 percentage points, followed by K Bank at 2.46 percentage points and Kakao Bank at 2.33 percentage points. The average loan deposit-loan interest rate spread was 5.65% for Toss Bank, 2.45% for K Bank, and 2.33 percentage points for Kakao Bank.

Internet-only banks, which have a high proportion of high-interest loans to medium- and low-credit borrowers, argue that simple numerical comparisons are unfair. Toss Bank, which recorded nearly five times the figure of market banks, even issued an explanatory document to clarify the situation.

A Toss Bank official explained, "These figures resulted from focusing on medium- and low-interest loans in line with the regulatory intent of establishing internet banks as inclusive finance." He added, "The popular '2% parking account' was classified as a demand deposit account and thus not reflected, which made the deposit-loan interest rate spread appear larger." In fact, Toss Bank's proportion of loans to medium- and low-credit borrowers was about 38% at the end of last month, the highest among all banks. As of the end of Q2, Kakao Bank was at 22.2%, and K Bank at 24%. However, when comparing achievement rates against their respective targets for this year?42% for Toss Bank and 25% for Kakao Bank and K Bank?K Bank has the highest achievement rate.

Internet banks have hurried to increase the proportion of loans to medium- and low-credit borrowers because they were criticized by regulators for failing to meet their self-set targets last year. However, even considering this, there are criticisms that the gap with market banks is too large. Internet-only banks, which reduce fixed costs such as branch maintenance and labor costs, should have provided better benefits to customers.

In fact, while market banks raised deposit interest rates one after another last month, internet-only banks showed a somewhat passive attitude. Market banks raised deposit interest rates by nearly 1% on average. In response, Kakao Bank raised savings and deposit interest rates by up to 0.8 percentage points earlier this month, and K Bank raised them by 0.6 percentage points, but Toss Bank showed no particular movement.

Shinhan Bank, which recorded the highest deposit-loan interest rate spread among the five major market banks, also expressed some disappointment. It explained that the proportion of loans to medium- and low-credit borrowers increased as a result of actively supporting loans for low-income households such as the Sunshine Loan and New Hope Loan. In fact, as of the end of last year, Shinhan Bank had the largest amount of low-income household support loans at 975.1 billion KRW, followed by Woori Bank (666 billion KRW), KB Kookmin Bank (594.6 billion KRW), and Hana Bank (548.5 billion KRW).

A financial industry official said, "The intention to provide transparent information to financial consumers is good, but if public opinion continues to focus only on criticism of 'interest profiteering,' banks will inevitably become hesitant," adding, "As a result, unexpected side effects may occur, such as reducing loans to medium- and low-credit borrowers or increasing the deposit-loan margin on corporate loans to reduce the household loan deposit-loan interest rate spread due to excessive 'watching each other's moves'."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)